Meme Coin – Trends, Risks & Airdrop Guides

When talking about Meme Coin, a cryptocurrency created mainly for humor, community hype, or viral marketing. Also known as meme token, it often rides social media buzz and can shift market sentiment in minutes. Meme Coin isn’t just a joke; it’s a real asset class that forces traders to balance fun and finance. BRC-20 a Bitcoin‑based token standard that enables meme projects to launch quickly on the Bitcoin network and ERC-20 Ethereum’s token standard that powers the majority of meme tokens on the smart‑contract chain form the technical backbone of today’s viral launches. Another driver is the Airdrop a free distribution of tokens to early supporters or community members, which can instantly inflate a meme coin’s user base and price. These three entities—Meme Coin, BRC‑20/ERC‑20 standards, and Airdrops—create a loop where hype fuels distribution, distribution fuels hype, and the cycle repeats.

Why meme coins explode and how to read the signal

At its core, a meme coin encompasses community‑driven token launches; the community decides the narrative, the name, and often the mascot. Because the narrative is the product, viral marketing becomes a requirement for success—memes, TikTok videos, Reddit threads, and Discord shout‑outs act as the sales force. The tokenomics are usually simple: low supply, high volatility, and a portion set aside for future airdrops or burn events. When a token uses the BRC‑20 standard, it benefits from Bitcoin’s robust security but suffers from higher transaction fees and slower confirmation times. ERC‑20 tokens, on the other hand, enjoy fast swaps and a mature DeFi ecosystem, making them the favorite choice for developers who want to attach games, NFTs, or staking mechanisms to their meme.

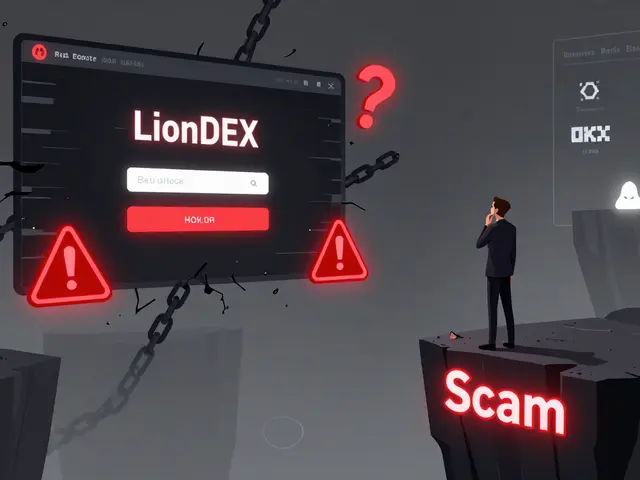

From a risk perspective, meme coins inherit two main threats. First, the hype‑driven price can plummet as quickly as it rose once the community’s attention shifts. Second, the same open‑access nature that fuels creativity also invites scams—forked copies, rug pulls, and fake airdrops are common. To protect yourself, look for clear token contracts, transparent roadmaps, and evidence of real development activity. A genuine airdrop will usually require on‑chain actions like holding a specific token or completing a simple task, not sending money to an unknown address. Remember the semantic link: Airdrop influences meme coin popularity by expanding the holder base, but only legitimate airdrops add lasting value.

When you scan the collection of articles below, you’ll see how these ideas play out in real life. One piece breaks down Ratscoin, a meme token that exists as both a BRC‑20 Bitcoin meme and an ERC‑20 reflection token, showing the split‑standard challenge. Another guide walks you through the Shambala airdrop, highlighting why some drops disappear from tracking sites like CoinMarketCap. There’s also a deep dive into tokenomics for over‑collateralized stablecoins, which, while not a meme, shares the same community‑driven launch model. Together, these posts give you a practical toolbox: how to spot a genuine meme launch, evaluate the token’s technical foundation, and decide whether an airdrop is worth your time. Use the insights here to navigate the meme coin space with confidence, and let the articles guide you from curiosity to actionable strategy.