Meme Coin Value Calculator

Calculate Meme Coin Value

See how market cap relates to actual trading volume for meme coins like OmniCat (OMNI). High market cap with low volume often means fake value.

Note: Market cap is calculated as price × total supply. Volume/MCap ratio shows how much actual trading activity exists relative to market cap.

High market cap with very low volume (e.g. less than 1% of market cap) indicates potentially fake value.

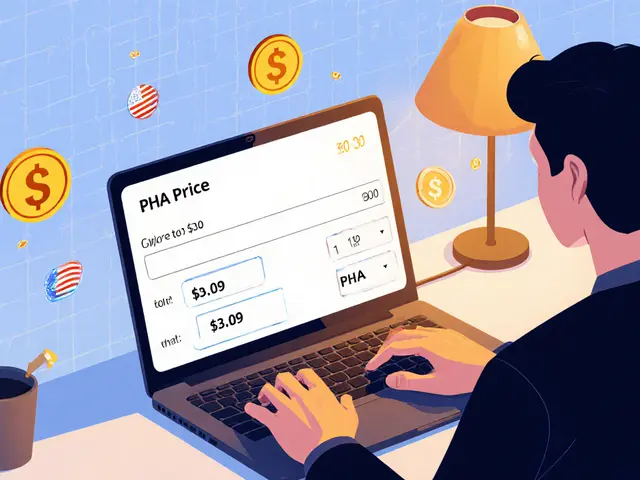

Price: $0.00001068, Supply: 45.82 billion, Volume: $0

This creates a market cap of ~$500,000 but with $0 volume, the value is completely meaningless.

OmniCat (OMNI) isn’t your average meme coin. While Dogecoin and Shiba Inu ride the wave of internet humor on a single blockchain, OmniCat claims to be the first omnichain meme coin - meaning it’s designed to live and move freely across eight different blockchains at once. That sounds impressive. But behind the flashy tech talk, there’s a lot of risk, confusion, and questionable data.

What makes OmniCat different?

Most crypto tokens stick to one chain. Shiba Inu runs on Ethereum. Dogecoin has its own network. OmniCat says it’s built to work everywhere. It uses LayerZero’s omnichain technology to let users send OMNI tokens directly from Ethereum to BNB Chain, Polygon, Avalanche, Arbitrum, Optimism, Base, and even Solana - without needing bridges, wrapped tokens, or complex swaps. The idea is simple: move your cat coin across chains with one click and pay only native gas fees. This isn’t just marketing. The token uses OFT (Omnichain Fungible Token) standards, which let the same token exist natively on each chain instead of being copied or locked up. That’s technically clever. But clever tech doesn’t mean it’s valuable.The numbers don’t add up

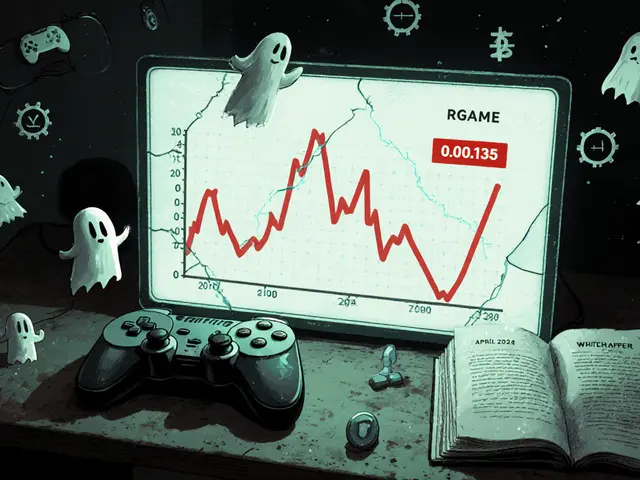

Here’s where things get messy. CoinMarketCap lists OmniCat’s total supply at 45.82 billion tokens. CoinGecko says it’s 42 billion. The price? Around $0.00001068 as of November 2024. That gives it a market cap of roughly $500,000 - less than the cost of a modest apartment in Wellington. But here’s the red flag: trading volume. CoinMarketCap shows $0 in 24-hour volume. CoinGecko says $707. BeInCrypto claims $5,050. That’s not just a discrepancy - it’s a sign of zero real trading activity. If nobody’s buying or selling, the price is just a number on a screen. Worse, the all-time high listed on CoinMarketCap is $2,591.82 - dated October 30, 2025. That’s a date in the future. That’s not a glitch. That’s either a data error or someone manually faking numbers to create hype.Who owns it?

OmniCat has around 39,610 wallet holders. Sounds like a community? Not really. Over 85% of all tokens are held in the top 100 wallets. That means a handful of people control almost the entire supply. If they decide to dump their holdings, the price crashes. Fast. There’s no team name. No public founders. No GitHub activity in the last 90 days. No updates to the roadmap. The official website? Barely exists. The main presence is a Twitter/X account with 12K followers and a Telegram group with under 5,000 members. No whitepaper. No development blog. No community calls.

Is anyone using it?

DappRadar shows only 127 unique active wallets across all chains in the past 30 days. Compare that to Shiba Inu’s 1.2 million. That’s not a startup. That’s a ghost town. Users on Reddit and Trustpilot report failed transactions, insane slippage (buying 100 OMNI and getting 2 back), and wallets showing wrong balances. One user said they spent 4.7 hours just learning how to send OMNI from BSC to Polygon. That’s not user-friendly - it’s a barrier. The few positive stories? A handful of people who successfully transferred tokens between chains with low gas fees. But those are rare exceptions. Most feedback is frustration.How does it compare to other meme coins?

Dogecoin: Owns its blockchain. Millions of users. Real-world merchant acceptance. Shiba Inu: Built on Ethereum, has its own ecosystem (Shibarium), NFTs, staking, and a massive community. Pepe: Pure meme, but trades on major exchanges like Coinbase and Binance with real volume. OmniCat has none of that. No exchange listings. No utility. No roadmap execution. No team. Just a token that claims to be everywhere - but no one’s actually using it anywhere.

Why does it even exist?

It’s part of a bigger trend. In Q3 2024, nearly 13% of all new crypto tokens launched were meme coins. Most die within weeks. A few go viral. OmniCat is trying to ride the wave of omnichain hype - the idea that cross-chain tech is the future. LayerZero, the protocol it uses, is real. But using it for a meme coin with no purpose? That’s like putting a Formula 1 engine in a toy car. The SEC and other regulators are starting to look at multi-chain tokens more closely. If a token operates on multiple jurisdictions at once, who regulates it? That legal gray area makes it riskier for exchanges and investors.Should you buy it?

If you’re looking for a long-term investment? No. There’s no utility, no team, no growth, no adoption. If you’re gambling on pure hype? Maybe. But treat it like a lottery ticket. The price could spike tomorrow because someone posts a viral meme. Or it could vanish next week when the last holder gives up. The only real value OmniCat has right now is as a cautionary tale. It shows how easy it is to build a crypto project that looks technical but has no substance. The omnichain tech is real. The token? Not so much.What’s the bottom line?

OmniCat (OMNI) is a meme coin with a fancy tech label. It’s not a scam in the traditional sense - there’s no fake app or phishing site. But it’s also not a legitimate project. It’s a speculative experiment with no foundation, no community, and no future roadmap. The price is meaningless. The volume is nonexistent. The holders are concentrated. The team is invisible. If you’re curious, you can buy a few tokens on PancakeSwap or 1inch. But don’t expect returns. Don’t expect support. Don’t expect it to last. It’s a digital cat that runs across chains - but no one’s home to feed it.Is OmniCat (OMNI) a scam?

It’s not a classic scam like a fake exchange or phishing site. But it has all the warning signs of a low-effort, high-risk project: no team, no roadmap updates, zero developer activity, fake price data, and extreme centralization. Most experts classify it as a speculative meme coin with little chance of long-term survival.

Can I trade OmniCat on Coinbase or Binance?

No. OmniCat is not listed on any major centralized exchanges like Coinbase, Binance, Kraken, or Bybit. It’s only available on decentralized platforms like PancakeSwap, 1inch, and other DEX aggregators. That means higher fees, more risk, and no customer support if something goes wrong.

How do I buy OmniCat (OMNI)?

You need a wallet that supports multiple chains - like MetaMask or Trust Wallet - and enough ETH, BNB, or MATIC to pay gas fees on the chain you’re using. Then go to a DEX like PancakeSwap, connect your wallet, search for OMNI, and swap. Be aware: liquidity is extremely low. You might not get your full trade filled, or you could get stuck with tokens you can’t sell.

Why does OmniCat have such a high market cap if it’s worth so little?

Market cap is calculated by multiplying the token price by the total supply. With 45 billion tokens and a tiny price, the math gives you a number like $500K. But since almost no one is trading it, that number is meaningless. It’s like saying your toy car is worth $1 million because you printed a million stickers for it.

Is OmniCat built on Ethereum?

It’s built on multiple chains, including Ethereum, but not just Ethereum. It’s an omnichain token using LayerZero, so it has native versions on Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, Optimism, Base, and Solana. You can hold OMNI on any of them, but you need to manage each chain’s wallet separately.

Will OmniCat’s price go up?

Maybe - if there’s a sudden meme surge or someone dumps a large amount to create fake volume. But without real adoption, team updates, or exchange listings, there’s no reason to believe it will sustainably rise. Most analysts believe it will fade into obscurity within months.

Is OmniCat related to the Omni Network?

No. CoinMarketCap explicitly warns that OmniCat (OMNI) has no connection to the legitimate Omni Network project, which is a separate blockchain protocol focused on asset issuance. This is a common tactic in crypto - using similar names to confuse investors. Always check the contract address before buying.

What’s the safest way to store OmniCat?

Store it in a non-custodial wallet like MetaMask or Trust Wallet, and only on the chain you plan to use. Don’t send it to a wallet that doesn’t support the chain it’s on - you could lose it forever. Never store large amounts. Treat it like cash you’re willing to lose.

- Poplular Tags

- OmniCat

- OMNI coin

- omnichain crypto

- meme coin

- LayerZero

People Comments

So let me get this straight - we’ve got a digital cat running across eight blockchains like it’s in a Pixar movie, but no one’s home to feed it? I’m not even mad. I’m impressed. This is the most poetic waste of blockchain tech since that guy tried to tokenize his toaster.

OMNI? More like OMEGA-MISS. 😂 This isn’t crypto - it’s a TikTok trend with a whitepaper written by a bot that got lost in a crypto Discord. 45B supply? That’s not a token - it’s a digital inflation bomb waiting to detonate. And that ‘future date’ on CoinMarketCap? Someone’s either drunk or running a Ponzi with a PowerPoint.

Let’s be clear: if you’re buying this because you think it’s ‘omnichain tech,’ you’re being sold a fantasy. LayerZero is real. This token? It’s a glitter bomb in a library. The fact that trading volume is near zero means the only people holding it are either delusional or holding it for the meme. Don’t be either.

I’ve seen a lot of meme coins come and go. This one’s different. It’s not even trying to be fun. It’s trying to be ‘innovative’ - and failing at both. The real story here isn’t the coin - it’s how easy it is to fool people with buzzwords. ‘Omnichain’ sounds smart. But if no one’s using it, it’s just a fancy name for vaporware.

Okay but… why? I mean, I get memes. I get crypto. But this feels like someone took a cat meme, threw it into a blockchain workshop, and said ‘make it sound smart.’ Now it’s just… a ghost. I tried to buy some. The slippage was 87%. I lost 30% just clicking ‘swap.’

Let’s not sugarcoat this: OmniCat is a regulatory nightmare waiting to happen. Multi-chain tokens operating across jurisdictions without a legal entity? That’s not innovation - it’s evasion. The SEC is already watching. When they come for this, the ‘community’ will vanish faster than a NFT monkey in a bear market.

It’s funny how we romanticize ‘decentralization’ while ignoring that 85% of this token is held by 100 wallets. That’s not Web3. That’s Wall Street with a cat logo. The tech is cool, sure - but the governance? It’s a cult with a Discord server.

They’re lying about the price. They’re lying about the volume. They’re lying about the future date. And you think this is a coincidence? No. This is a coordinated pump. Someone’s laundering money through meme coins. The ‘community’? Bot accounts. The ‘traders’? Shell wallets. This isn’t crypto - it’s a digital casino run by ghosts.

Man I bought 500k OMNI last week… thought I was smart. Turned out my wallet showed 2M because of a glitch. Then I tried to send it to Polygon and lost half of it. Now I just stare at it like a weird pet. It’s alive… but not really. I think I’m emotionally attached to a glitch.

What’s interesting is how this mirrors the broader crypto culture: spectacle over substance. The fact that people are still buying this, despite all the red flags, says more about us than about the token. We’re not investing in tech - we’re investing in hope. And hope doesn’t pay gas fees.

There’s something almost tragic about OmniCat. It’s not malicious - it’s just… empty. Like a theater with a perfect stage, no actors, and no audience. The omnichain tech could’ve revolutionized asset movement. Instead, it’s being used to sell a meme that doesn’t even have a punchline. We’re not just losing money - we’re losing meaning.

This is the future of crypto. Not Bitcoin. Not Ethereum. Not even Dogecoin. It’s this. A glittering, chaotic, beautifully nonsensical digital ghost that floats across chains, ignored by everyone except the desperate and the delusional. And maybe… that’s beautiful in its own way. 🌌

Oh wow. Another ‘omnichain’ token. Let me guess - the dev team is ‘anonymous,’ the website looks like it was made in 2017, and the Twitter account has 12K followers who all bought in at the peak. Classic American crypto hustle. You people are so gullible it’s embarrassing. At least Shiba Inu had memes. This? This is a PowerPoint presentation with a wallet.

If you’re thinking of buying OMNI, please do me a favor: write down why you’re buying it. Then ask yourself - is it because you believe in the tech? Or because you saw a guy on YouTube say ‘1000x’? If it’s the latter - walk away. This isn’t investing. It’s emotional gambling with extra steps.

Just don’t.

It’s hard to believe that in 2024, we still have projects like this. The real tragedy isn’t the lost money - it’s the erosion of trust. Every time a project like OmniCat gets traction, it makes it harder for legitimate builders to be taken seriously. This isn’t innovation. It’s entropy dressed up in blockchain jargon.

Let me tell you something about American crypto. We don’t build. We hype. We don’t innovate. We rebrand. OmniCat isn’t a project - it’s a marketing stunt. And the fact that people are falling for it proves we’re not ready for real decentralization. We want the glitter, not the groundwork. Shameful.

As someone who’s watched crypto for a decade - this is the most predictable pattern. New tech → hype → fake volume → rug pull → ghost chain. The only surprise is how long it takes people to learn. The answer isn’t more education. It’s less greed.

Interesting how this mirrors the Indian startup scene - flashy names, no product, investors cheering. But here, at least the cat has some charm. Maybe it’s not dead… just sleeping. 😊

Think about it - why would a legitimate team use LayerZero for a meme coin? It’s like putting a nuclear reactor in a toy car. The only explanation? This is a front for something darker. Maybe laundering. Maybe state-sponsored manipulation. The lack of team? The fake price? The zero volume? This isn’t a coin - it’s a cover.

They’re not even trying anymore. The future date on CoinMarketCap? That’s not a glitch - it’s a middle finger to every rational investor. The entire project is a joke. And the worst part? People are still buying it. We’re not just investing in crypto - we’re investing in delusion.

Maybe it’s not about whether this is smart or dumb. Maybe it’s about what we’re willing to believe. We want to think the future is here - so we cling to anything that sounds like it. Even if it’s a cat that runs on invisible tracks. Maybe that’s the real crypto: not the tech - but the dream.

As someone from India where meme coins are often used as social currency - this feels familiar. The hype is loud, the utility is quiet. But I’ve seen projects like this rise and vanish in weeks. The only difference here is the scale of the delusion. And the fact that it’s trying to be ‘technical’ makes it more dangerous.

Let’s not forget: the SEC doesn’t care about your ‘omnichain’ dreams. They care about unregistered securities. This token is a clear violation. When the enforcement action comes - and it will - the only people who lose are the ones who didn’t read the fine print. Or worse - didn’t care to.