China Bitcoin mining: How regulations, energy, and policy shape the global hash rate

When you think about China Bitcoin mining, the centralized, energy-heavy operation that once controlled over 70% of the world’s Bitcoin hash rate. Also known as Chinese crypto mining, it was the backbone of Bitcoin’s security until 2021, when a sudden policy shift turned it into a cautionary tale. This wasn’t just about shutting down machines—it was a full rethinking of energy use, financial control, and digital sovereignty.

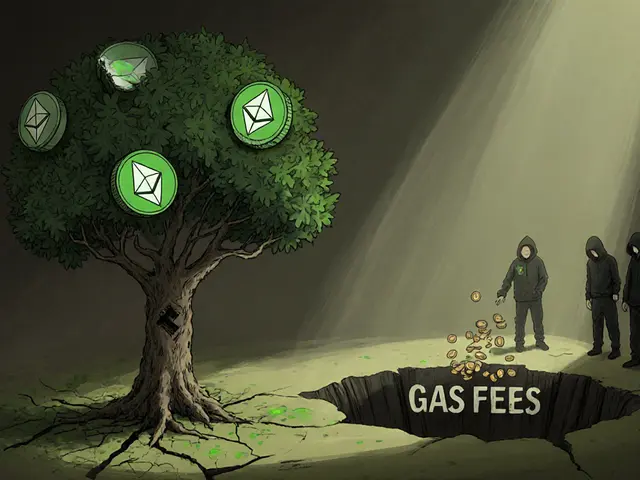

The Chinese government didn’t ban Bitcoin. It banned crypto mining, the process of using powerful computers to validate transactions and earn new Bitcoin. Also known as proof-of-work mining, it requires massive electricity—something China’s grid couldn’t afford to waste on speculative tech. In 2021, provinces like Sichuan and Xinjiang, where cheap hydropower and coal made mining profitable, were ordered to shut down operations overnight. Thousands of machines were abandoned. Miners fled to Kazakhstan, the U.S., and even Sweden, where energy rules are strict but not outright bans. This wasn’t a market correction—it was a geopolitical reset.

What happened after? The global hash rate didn’t collapse—it redistributed. New mining hubs popped up where electricity was cheap and regulations were clear. But China’s move did something deeper: it proved that crypto mining regulation, government control over energy access and digital asset activity. Also known as national crypto policy, it can override market forces in seconds. Countries watching China saw the risks: too much mining concentration, too much reliance on fossil fuels, too little transparency. That’s why Sweden now demands detailed energy reports. Why the UAE offers tax-free mining but requires licenses. Why Bitcoin’s energy use is no longer ignored—it’s scrutinized.

Today, China’s role in Bitcoin mining is nearly zero. But its impact is everywhere. If you’re wondering why mining hardware prices dropped, why mining farms moved to Texas, or why energy efficiency is now a top priority for new projects—it all traces back to Beijing’s decision in 2021. The machines are gone, but the lesson isn’t.

Below, you’ll find real breakdowns of how countries are handling mining today—from Sweden’s strict energy limits to the UAE’s tax-free zone. You’ll see how regulators react, how miners adapt, and what happens when a single country decides to pull the plug on an entire industry. No fluff. Just what happened, why it matters, and how it’s changing Bitcoin’s future.