China Crypto Policy Impact Simulator

China's crypto regulations significantly impact Bitcoin prices. This simulator shows how potential policy changes could affect market volatility based on historical patterns.

Market Impact Analysis

Volatility Impact:

Estimated Price Movement:

Market Reaction Time:

China doesn’t just regulate cryptocurrency-it bans it. Fully. Completely. Since 2021, the Chinese government has shut down every legal pathway for trading, mining, or even promoting Bitcoin within its borders. If you hold Bitcoin and live in China, you’re playing by rules that make it illegal to cash out, trade, or even openly talk about your holdings through official channels. And yet, millions still do.

How China’s Crypto Ban Works in Practice

China’s ban isn’t one law. It’s a web of rules layered over years. In 2013, Bitcoin was labeled a "virtual commodity," not money. That meant banks couldn’t touch it. In 2017, all domestic crypto exchanges were shut down. By 2021, the government went further: Bitcoin mining was declared illegal, and any business helping people buy or sell crypto became a criminal activity. The rules now say:- No exchanges can operate in China-even if they’re based overseas, they can’t serve Chinese users.

- Banks and payment apps like Alipay and WeChat Pay must block any transaction linked to crypto.

- Internet companies must delete crypto-related content and report users who promote it.

- Financial institutions must monitor all transfers for signs of crypto trading using AI and manual checks.

What Happens to Bitcoin You Already Own?

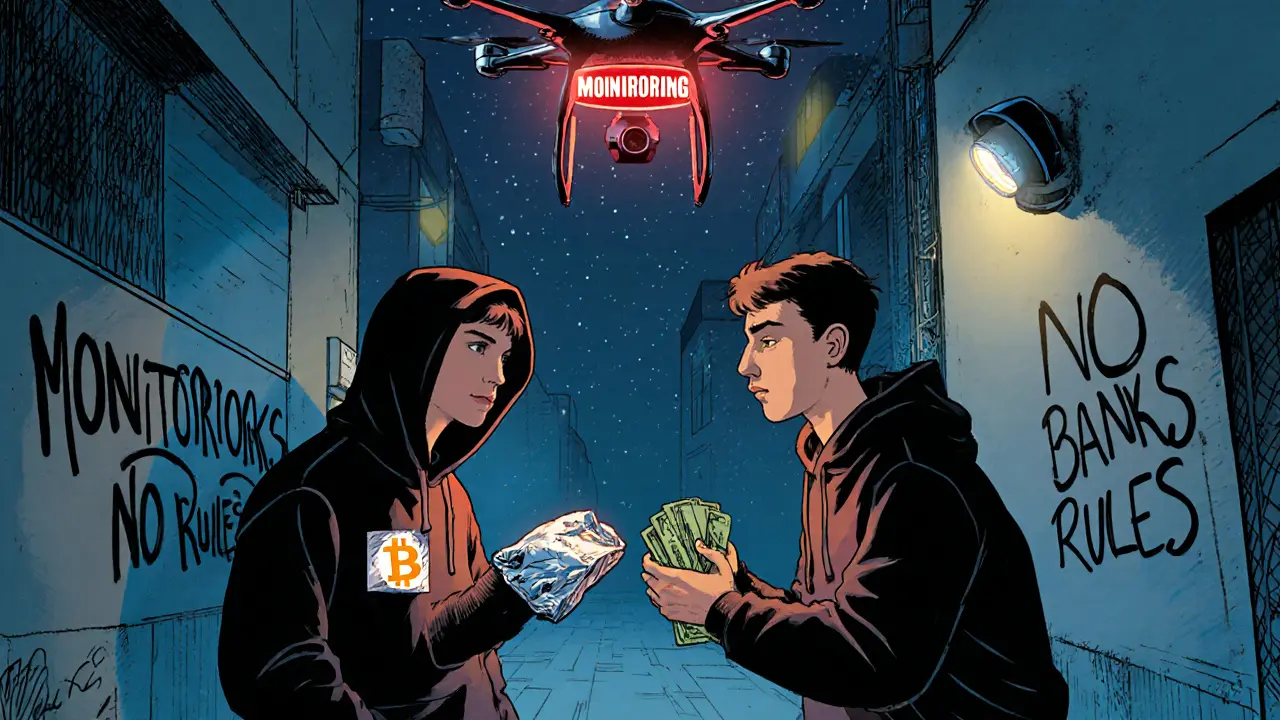

Owning Bitcoin isn’t technically illegal. But holding it is risky. You can’t legally sell it. You can’t use it to pay for goods. You can’t get it converted into yuan through any official channel. If you bought Bitcoin in 2020 and still hold it today, you’re sitting on an asset that’s effectively locked. Some people keep their Bitcoin in cold wallets-hardware devices stored offline. Others use peer-to-peer (P2P) platforms like LocalBitcoins or Telegram groups to trade privately. But these aren’t safe. In 2023, a man in Guangzhou was fined over $80,000 for selling Bitcoin through a P2P app. The court ruled he violated financial regulations, even though he didn’t use a bank. There’s no legal recourse if you get scammed. If someone steals your Bitcoin or runs off with your cash in a P2P deal, you can’t go to court. Chinese law doesn’t recognize cryptocurrency as property. You’re on your own.Why Did China Ban Bitcoin?

The official reason? Financial stability. The government says Bitcoin’s price swings are too wild. If regular people lose money, it could trigger panic. If banks accidentally get involved, it could destabilize the whole system. But there’s another reason: control. China doesn’t want decentralized money. It wants its own digital currency-the digital yuan. Launched in 2020, the digital yuan is fully trackable. The government knows who sent what, when, and where. Bitcoin? No one knows. That’s the problem. By banning Bitcoin, China clears the path for its own system. No competition. No uncertainty. Just a state-controlled digital dollar that can be turned off if someone steps out of line.

Is the Ban Working?

On paper, yes. China used to mine over 70% of the world’s Bitcoin. By 2023, that number dropped to under 1%. Mining farms were shut down. Power grids were reconnected. The country’s energy use from crypto mining fell by 90%. But here’s the catch: people still trade. A 2024 report from Chainalysis found that China still ranks in the top 10 countries for peer-to-peer Bitcoin trading volume. How? People use cash, gift cards, or offshore wallets. They meet in person. They use VPNs to access foreign exchanges. Some even use fake IDs to open overseas accounts. The government knows this. That’s why they’ve built a massive surveillance system. Banks now scan every transaction for keywords like "BTC," "USDT," or "crypto wallet." If your account shows patterns linked to crypto, you get flagged. You might get a call from the bank. Or worse-a visit from local authorities.What About Foreign Bitcoin Holders?

If you live outside China, the ban doesn’t directly affect you. But it still matters. China’s market was huge. When Chinese traders were forced out, Bitcoin prices dipped. When rumors of a "relaxation" spread, prices spiked. That’s still true today. In 2025, false rumors about China lifting its ban spread across social media. Elon Musk’s X account shared one. So did financial news bots. The story went viral. Bitcoin jumped 12% in 24 hours-then crashed when no official announcement came. These rumors happen every year. And they’re profitable for traders who know how to exploit them. China’s ban creates volatility. It makes Bitcoin’s price more sensitive to noise. If you’re a global investor, you’re not just watching Fed meetings or inflation data-you’re watching for whispers from Beijing.

What’s the Future?

Will China ever lift the ban? Most experts say no. The digital yuan is too important. Letting Bitcoin back in would mean giving up control. It would mean accepting a currency the government can’t track, freeze, or tax. But there’s a twist. Some analysts believe China might allow institutional crypto trading under strict rules-like letting state-owned funds invest in Bitcoin through licensed, monitored platforms. That’s not a full reversal. It’s a controlled leak. For now, the ban stands. And it’s tighter than ever.What Should Bitcoin Holders Do?

If you’re a Chinese citizen with Bitcoin:- Don’t try to cash out through banks or payment apps. It’s a direct path to trouble.

- Don’t advertise your holdings. Even a post on WeChat could get you flagged.

- Keep your Bitcoin in a hardware wallet. Never leave it on an exchange, even overseas.

- If you must trade, use P2P with extreme caution. Only deal with trusted contacts. Never use your real name.

- Understand that China’s ban still shapes global markets. Watch for rumor cycles.

- Don’t assume policy changes are real until they’re announced by the People’s Bank of China or the State Council.

- Remember: China’s move to digital yuan isn’t just about crypto. It’s about the future of money-and you’re watching it happen.

Frequently Asked Questions

Is it illegal to own Bitcoin in China?

No, owning Bitcoin isn’t illegal. But using it, trading it, or converting it to yuan through official channels is. You can hold it in a wallet, but you can’t legally spend it, sell it, or use it to pay for anything within China’s financial system.

Can I use a VPN to access Binance or Coinbase from China?

Technically, yes-but it’s risky. The government blocks many VPNs, and using one to access crypto exchanges violates rules. If detected, your internet provider may be fined, and you could be investigated. Many users still do it, but there’s no legal protection if something goes wrong.

Why doesn’t China just tax Bitcoin instead of banning it?

Because taxing Bitcoin means recognizing it as a financial asset. That gives it legitimacy. China doesn’t want to legitimize a decentralized currency. It wants to replace it with its own digital yuan, which it can fully control. Taxing Bitcoin would be admitting defeat on that goal.

Are Chinese citizens still mining Bitcoin?

Almost none. The government shut down 99% of mining operations by 2022. Any remaining activity is underground and extremely risky. Miners who are caught face heavy fines, equipment seizures, and even criminal charges. The energy crackdown was one of the most effective parts of the ban.

What happens if I send Bitcoin to someone in China?

The transaction itself isn’t illegal, but the recipient can’t legally cash it out. If they try to convert it to yuan through a bank, the system will flag it. They could face investigation. Sending Bitcoin to someone in China doesn’t make it usable-it just moves the risk.

Could China’s ban on crypto change in 2026?

It’s unlikely. The government has invested billions into the digital yuan and built a surveillance infrastructure to enforce the ban. Reversing course would mean giving up control over financial flows. The political cost is too high. Any change would be a small, controlled opening-not a full reversal.

People Comments

Okay but imagine living in a country where your money is a surveillance tool. The digital yuan isn't just currency-it's a leash. Every transaction tracked, every purchase monitored, every whisper of dissent frozen by algorithm. Bitcoin represents freedom in a world that wants you silent. I don't care what they say about volatility-this isn't about finance, it's about the soul of autonomy. 🌍💔

China’s approach is rational. Decentralized currencies undermine monetary sovereignty. The digital yuan enables targeted stimulus, anti-corruption tracking, and financial inclusion without the chaos of speculative assets. Bitcoin is an anachronism in the age of algorithmic governance.

They’re not banning Bitcoin because of stability-they’re banning it because they know the West is watching. Every time someone in Shanghai buys BTC, it’s a middle finger to the surveillance state. The government’s terrified that if people realize they can opt out of their system… the whole thing collapses. This isn’t economics. It’s psychological warfare.

If you're holding Bitcoin in China, please use a hardware wallet. Never keep it on an exchange. And if you're doing P2P-use cash meetups in public places, never your real name. I’ve seen too many people get fined because they thought Telegram was safe. You’re not anonymous just because you’re not using your bank. Stay sharp.

So China bans Bitcoin but lets AI surveillance drones monitor every citizen’s bank account? Classic authoritarian hypocrisy. The U.S. doesn’t ban crypto, but we let Big Tech track your every click and sell your soul to advertisers. Who’s really the villain here?

Imagine being told you can’t own a piece of the future… just because it’s not controlled by the state. Bitcoin isn’t just money-it’s a rebellion written in code. And China? They’re trying to delete a movement with firewalls and fines. But you can’t ban hope. 💪✨ #BitcoinIsFreedom

Why does everyone assume China’s ban is permanent? They banned private schools too. Then they didn’t. They banned private tutoring. Then they regulated it. This isn’t ideology-it’s control. And control evolves. Watch for the quiet rollout of licensed BTC ETFs for state funds. That’s the real signal.

People forget that mining shutdown wasn’t just about control-it was about power grid stability. China’s grid is overloaded. Crypto mining was siphoning electricity from hospitals and factories. The ban saved lives. Maybe not the outcome we wanted, but the logic is sound.

Let’s be brutally honest: the average Chinese citizen holding Bitcoin is either a reckless speculator or a naive idealist. The state has built a financial infrastructure that is efficient, stable, and utterly controllable. Why would any rational actor choose a volatile, unregulated, legally unrecognized asset over a sovereign digital currency backed by the world’s second-largest economy? The answer isn’t ideology-it’s ignorance.

I’ve lived in Beijing and Shanghai. People still trade BTC. Not on apps. Not online. In alleyways. With cash. In back rooms. They use fake IDs, burner phones, and meet at 2 AM in Starbucks parking lots. The government knows. They just don’t have the manpower to stop it all. This isn’t a ban-it’s a game of cat and mouse. And the mice are winning.

For those outside China: this isn’t just about Bitcoin. It’s about the future of money. The digital yuan isn’t just a currency-it’s a blueprint. Other nations will follow. The U.S. is already testing CBDCs. We’re not fighting for Bitcoin. We’re fighting for the right to have money that doesn’t answer to a government.

China’s ban works because it’s not just law-it’s culture. No one talks about crypto anymore. Not on WeChat. Not at work. Not even with friends. The silence is the real victory. People stopped thinking it was worth the risk. That’s more powerful than any arrest.

If you own Bitcoin and live under a regime that denies you financial freedom-you’re not holding an asset. You’re holding a protest. Every satoshi is a silent scream against control. And that’s why they fear it more than any hacker or speculator ever could

Don’t be fooled. This isn’t about control-it’s about fear. The Chinese Communist Party knows their legitimacy is built on economic growth. If people realize they can bypass the state’s financial system entirely, the whole myth of state superiority collapses. Bitcoin isn’t a threat to their economy-it’s a threat to their narrative.

I have family in Guangzhou. They keep their BTC in a cold wallet under their mattress. They never talk about it. They don’t even tell each other. But they still check the price every night. It’s their quiet rebellion. I don’t judge. I just hope they stay safe.

To anyone holding Bitcoin in China: you’re not alone. I know it feels like you’re carrying a secret that could destroy you. But millions are doing the same thing. You’re part of a quiet global movement. Keep your keys safe. Stay low. And remember-this too shall pass. The world is watching. And it’s rooting for you.

China banned crypto because they know the truth-Bitcoin makes the party look weak. They can’t print it. They can’t track it. They can’t tax it. And that’s why they’d rather burn their own economy than let people be free. This isn’t economics. It’s ego. And it’s pathetic

Wow so much drama. Honestly? Bitcoin’s just a meme. The real story is the digital yuan. That’s the future. Everyone else is just yelling into the void.

Look-I’ve been in crypto since 2014. I’ve seen governments panic. I’ve seen bans. I’ve seen crackdowns. And guess what? Bitcoin always comes back. China’s ban is the most extreme example yet. But here’s the thing-they can shut down exchanges. They can arrest miners. They can block websites. But they can’t stop people from sending value peer-to-peer. That’s the beauty of open code. No one owns it. No one controls it. And that’s why it lasts.

So if you’re holding BTC in China? You’re not a criminal. You’re a pioneer. And when the world finally catches up? You’ll be the ones who kept the flame alive.