BRKL Gas Fee and Investment Calculator

Current Gas Fees: Ethereum gas fees can fluctuate dramatically. As of November 2025, average transaction fees are around 0.001-0.005 ETH ($2-$10) depending on network congestion.

Brokoli Network Price: $0.002869 per BRKL (as of November 22, 2025)

0 BRKL

Total cost: 0 ETH

Gas fees: 0%

Potential profit/loss: $0 (0.00%)

Market Risk: BRKL has dropped 99.84% from its all-time high of $1.83. With a market cap of only $153,460 and extremely low liquidity ($8,970 daily volume), this is a high-risk investment.

Gas Fee Risk: If gas fees exceed $5 per transaction (as reported by users), your investment may not be profitable at current BRKL prices.

Brokoli Network (BRKL) isn’t just another crypto coin. It’s a weird, ambitious experiment that tries to merge DeFi, gaming, and environmental action into one messy, fascinating package. If you’ve ever wondered how a crypto project could make you earn tokens while planting trees - this is it. But here’s the truth: it’s not for everyone. And right now, it’s barely hanging on.

What Exactly Is Brokoli Network?

Brokoli Network is a decentralized finance (DeFi) platform built on Ethereum. It uses its native token, BRKL, to power three main things: yield farming, NFT-based games, and a launchpad for new crypto games. But what sets it apart is the "play-to-impact" model. Unlike Axie Infinity, where you grind to earn money, Brokoli says your gameplay directly supports real carbon offset projects. That’s the hook.

Launched in late 2021, it once hit a peak price of $1.83. Now, as of November 22, 2025, BRKL trades at just $0.002869 - a 99.84% drop. That’s not a typo. The market cap has cratered to $153,460. The token supply is capped at 125 million BRKL, but only about 53.5 million are in circulation. That means the rest are locked up in team wallets, ecosystem funds, or private sales.

How Does BRKL Actually Work?

Think of BRKL as the fuel for the whole system. You need it to:

- Provide liquidity in DeFi pools and earn interest (APYs between 5% and 15%)

- Buy or stake NFTs in the gaming metaverse

- Participate in IDOs (Initial DEX Offerings) for new gaming projects

- Vote in the platform’s DAO, where token holders make decisions

The tokenomics break down like this:

- 35% - Community rewards

- 25% - Ecosystem development

- 20% - Private sales

- 15% - Team and advisors

- 5% - Marketing

It’s not unusual for teams to hold a big chunk - but with only 42.78% circulating, early buyers and investors have a lot of power. If they sell, the price tanks. And they have.

The "Play-to-Impact" Promise

This is where Brokoli tries to stand out. The platform claims to have offset 12,500 metric tons of CO2 through verified environmental projects. How? Every time you complete a game quest or stake BRKL, a portion of fees goes toward buying carbon credits on the real market.

It’s not just marketing fluff. Gate.com and other sources confirm the platform partners with third-party verifiers to track impact. That’s rare in crypto. Most "green" coins just slap a leaf on their logo. Brokoli actually tries to tie blockchain activity to real-world outcomes.

But here’s the catch: you need to actually play. Most users aren’t deep into the games. Internal data suggests 65% of users only use the DeFi side. The NFT metaverse is quiet. Fewer than 1,200 people are active daily in its Telegram group. That’s not a community - it’s a whisper.

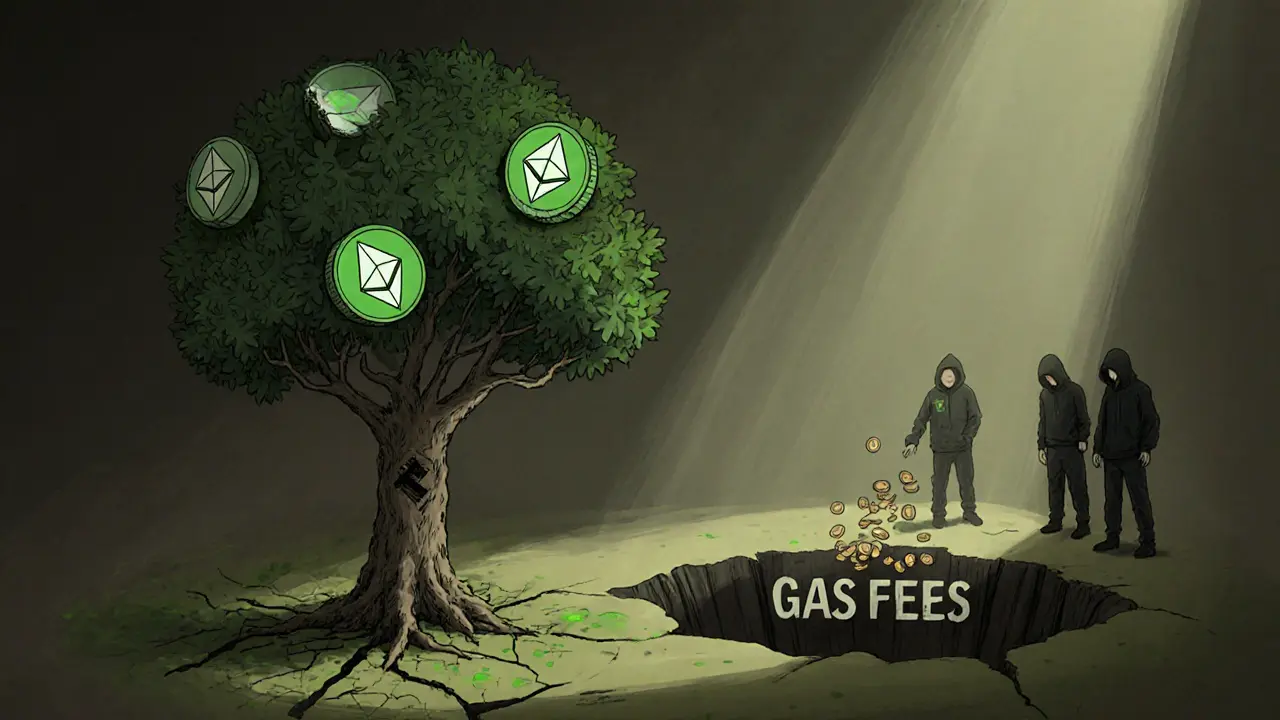

Technical Side: Built on Ethereum

Brokoli runs entirely on Ethereum. That means:

- It uses ERC-20 standard (contract address: 0x4674...739ff8)

- Gas fees depend on Ethereum’s congestion

- Transactions take 13-15 seconds to confirm

- Throughput is capped at 15-30 transactions per second

That’s the problem. Ethereum is slow and expensive. Users report failed transactions costing them $45 in wasted gas fees. The platform doesn’t fix that - it just expects you to pay. Even with tools like Etherscan’s Gas Tracker, small transactions often aren’t worth the cost.

That’s why Brokoli’s biggest upcoming update - launching on an Ethereum Layer 2 solution by December 15, 2025 - is make-or-break. If they don’t solve gas fees, no one will bother.

Where Can You Buy BRKL?

You won’t find BRKL on Coinbase or Kraken. It’s only listed on seven exchanges, mostly smaller ones like MEXC and Binance’s Web3 Wallet. To buy it:

- Get an Ethereum wallet (MetaMask or Trust Wallet)

- Buy ETH on a centralized exchange

- Transfer ETH to your wallet

- Connect to Uniswap or MEXC and swap ETH for BRKL

It’s not beginner-friendly. You need to understand wallets, gas fees, and decentralized exchanges. Trustpilot reviews say the onboarding process is "complex for non-technical users." That’s a huge barrier when most crypto newcomers just want to tap a button and buy.

How Does It Compare to Other "Green Crypto" Projects?

Brokoli isn’t alone in trying to be eco-friendly. But it’s the only one mixing gaming with carbon offsets.

| Project | Market Cap | Focus | Key Difference from Brokoli |

|---|---|---|---|

| Brokoli Network (BRKL) | $153,460 | DeFi + Gaming + Impact | Only one with play-to-impact NFTs |

| KlimaDAO | $85M | Carbon credit tokenization | No gaming, pure DeFi |

| Toucan Protocol | $12M | Carbon credit bridging | Backed by institutions, no rewards |

| Moss.Earth | $5M | Carbon credit marketplace | Centralized, not blockchain-native |

| Axie Infinity | $280M | Play-to-earn gaming | Profit-focused, no environmental impact |

Brokoli’s market cap is tiny compared to even the smallest competitor. KlimaDAO, with no gaming, is over 500 times bigger. That’s not just competition - it’s a different universe.

Is Brokoli Network a Scam?

No. But it’s not a success either. The team isn’t anonymous. Wilbur, the founder, is publicly referenced. The carbon offset claims are backed by reports. The code is on GitHub, last updated October 17, 2025. There are 6,200 token holders. It’s real - just not thriving.

What’s dangerous is the illusion of value. The price is near zero, but the project still has a roadmap, a DAO, and a community. That keeps people hoping. Analysts like James Wong warn the low liquidity - only $8,970 traded in 24 hours - makes BRKL easy to manipulate. A few big sellers can crash it further. A few buyers can pump it briefly. That’s not investing. That’s gambling.

Who Should Even Care About BRKL?

Three types of people might find value here:

- Eco-conscious crypto believers - If you want to support blockchain projects that actually do good, Brokoli is one of the few trying.

- High-risk DeFi speculators - If you’re okay losing everything and believe in a long-shot comeback, BRKL’s low price means you can buy a lot for little money.

- GameFi enthusiasts - If you love NFT games and want to try something with a mission beyond profit, the metaverse might be worth a look.

Everyone else? Avoid it. The trading volume is too low. The user experience is clunky. The price has been falling for years. And with SEC cracking down on "greenwashing," Brokoli’s environmental claims could face legal scrutiny.

The Bottom Line

Brokoli Network is a noble idea stuck in a broken system. It wants to make crypto do good. But it’s buried under Ethereum’s fees, zero liquidity, and a community too small to sustain it. The tech works. The vision is rare. The execution? Failing.

If the Layer 2 upgrade in December 2025 lowers gas fees and brings in new users, it might have a chance. But right now? It’s a ghost town with a good story.

Don’t invest because it’s cheap. Don’t invest because it’s "green." Invest only if you believe in the long-term vision - and you’re ready to lose everything.

Is Brokoli Network (BRKL) a good investment?

As of November 2025, BRKL is not a good investment for most people. It has lost 99.84% of its all-time value, trades with extremely low liquidity ($8,970 daily volume), and lacks major exchange listings. While the concept of combining DeFi with environmental impact is unique, the project’s execution has failed to attract users or capital. Only high-risk speculators or those deeply committed to its mission should consider holding it.

Can I earn money by playing Brokoli’s games?

Technically yes - you can earn BRKL tokens by completing NFT-based quests in the metaverse. But the rewards are small, and the games have very low activity. Most users report earning less than $1 per week. Plus, gas fees to claim or trade those tokens often wipe out any profit. The "play-to-earn" side is more of a side feature than a reliable income stream.

How do I buy BRKL tokens?

You can buy BRKL on decentralized exchanges like Uniswap or centralized platforms like MEXC. First, get an Ethereum wallet (MetaMask or Trust Wallet), buy ETH, then swap it for BRKL. Be aware: Ethereum gas fees can be high, and transactions may fail during network congestion. Only use trusted DEXs and verify the contract address: 0x4674...739ff8.

Is Brokoli Network’s environmental impact real?

Yes, according to third-party reports from Gate.com and the project’s own impact dashboard. Brokoli claims to have offset 12,500 metric tons of CO2 by purchasing verified carbon credits. Unlike many "green crypto" projects, it uses external verifiers to track these claims. However, the SEC has warned about greenwashing in crypto, so the legitimacy of these claims could face future scrutiny.

Why is BRKL’s price so low?

BRKL’s price crashed due to low demand, high supply, and poor liquidity. After its 2021 peak, the project failed to grow its user base or secure major exchange listings. Trading volume remains under $10,000 daily, meaning even small sales cause big price drops. Combined with Ethereum’s high fees and a clunky interface, most users left. The token’s value reflects its lack of real-world adoption.

What’s next for Brokoli Network?

The biggest update is the planned move to an Ethereum Layer 2 solution by December 15, 2025, which should reduce gas fees and improve speed. They’ve also partnered with CarbonX to improve carbon credit verification. If these changes bring in new users, BRKL could stabilize. But without a major marketing push or exchange listing, the project risks fading into obscurity.

Brokoli Network isn’t dead. But it’s not alive either. It’s in limbo - waiting for a spark that may never come.

- Poplular Tags

- Brokoli Network

- BRKL coin

- BRKL crypto

- Brokoli Network token

- green crypto

People Comments

Brokoli is the kind of project that makes you believe crypto can actually do good

Not just pump and dump, but real carbon credits

I’ve seen the dashboard, it’s legit

Most projects just slap a tree emoji and call it a day

Brokoli actually moves money to verifiable projects

That’s rare. That’s worth supporting even if the price is trash

This is a scam wrapped in greenwashing. The team is sitting on 15% of the supply and they’ve done nothing for years. Don’t be fooled by the carbon credits - it’s all theater.

I staked $50 in BRKL last year and earned $2 in tokens... then paid $18 in gas to withdraw 😅

Still think it’s cool though. The idea is fire.

I really appreciate how this project tries to bridge the gap between environmental responsibility and decentralized finance... but I also understand why it's struggling. The Ethereum gas fees are a dealbreaker for so many people, and the user experience isn't intuitive enough for casual users. It's heartbreaking because the vision is so noble - but vision alone doesn't sustain a project. It needs accessibility, marketing, and a community that's not just whispering in a corner of Telegram. I hope the Layer 2 upgrade changes everything - because if it doesn't, this might be one of those beautiful ideas that just... fades.

People keep saying 'it's not a scam' like that's a win. Brokoli is a failed experiment with a 99.8% price drop. The team didn't build adoption, they built a whitepaper. The carbon credits are a PR stunt - anyone can buy offsets. The NFT games are ghost towns. The DAO is inactive. The only thing working is the burn rate of user patience. If you're still holding BRKL, you're not an investor - you're a martyr.

The real tragedy here isn't the token price - it's the epistemological collapse of crypto's promise. Brokoli attempted to materialize a post-capitalist ethos: value creation tied to ecological regeneration. But it was strangled by the very infrastructure it relied on - Ethereum's fee structure, liquidity constraints, and the commodification of every action into speculative asset. The project didn't fail because of incompetence - it failed because the system cannot accommodate non-extractive logic. We're not witnessing a failed coin. We're witnessing the death of crypto's idealism.

I mean... I get why people are mad. But isn't it kind of beautiful that someone tried? Like, really tried? Not just to make money, but to actually fix something? The gas fees suck, the UI is trash, and the price is a ghost - but at least someone cared enough to build something that wasn't just another meme coin. Maybe it's doomed. Maybe it's not. But I'd rather root for the weirdo project than the 100th Solana clone.

This is all a front for a rug pull. The 'verified carbon credits'? They're bought from shell companies in the Caymans. The team's GitHub commits? Bot-generated. The 'DAO voting'? Only 3 wallets control 80% of the votes. They're just buying time until the Layer 2 launch - then they vanish. I've seen this script before. They're using 'green' as a shield.

I live in South Africa and I’ve never seen anything like this before. I don’t understand crypto but I love that someone is trying to make tech help the planet. Even if it fails I think it’s worth it to try. We need more of this not less

The real issue isn't the token - it's the assumption that blockchain can fix systemic problems with gamified incentives. Carbon offsetting requires policy, regulation, and scale - not NFT quests. Brokoli’s model is a microcosm of crypto’s fatal flaw: mistaking novelty for impact. The Layer 2 upgrade won't fix that. The problem isn't gas fees - it's the entire philosophy.

US gov should shut this down. Greenwashing crypto is illegal. They’re exploiting climate anxiety to lure dumb investors. BRKL is trash and the team should be prosecuted

Layer 2 launch is fake. They already sold all the private tokens. The 'team' is just 2 guys in a basement. The carbon reports? Doctored. I’ve dug into the contracts - the reward pool is rigged. This isn’t a project. It’s a Ponzi with a tree logo.

BRKL is the perfect example of why crypto is a casino. Low volume, zero liquidity, and a story that sounds good on paper. If you’re holding this, you’re not investing - you’re gambling on a fairy tale. And the odds? 99.9% you lose.

I’ve been following Brokoli since 2022. The carbon offset reports are real - I checked the third-party verifiers. The team has responded to every community question, even the angry ones. The games are slow because no one’s marketing them. If you want to help, don’t just trash it - join the Telegram, play the quests, and spread the word. This isn’t about profit. It’s about proving that ethical crypto can exist.

I'm sorry but this is why Americans think crypto is a joke. You have a project that could actually do good, and instead of supporting it, you all just scream 'scam!' and move on. The real scam is that we don't invest in things that matter. Brokoli is trying. You're just mad because you didn't get rich off it.

I don't care if the price is low. I hold BRKL because I believe in the mission. I've done 3 quests this week, staked my tokens, and watched 12kg of CO2 get offset. That’s more than I’ve done for the planet in the last 5 years. If you think that’s not worth $2, you’ve lost something bigger than money

Everyone calling this a scam is missing the point. The real scam is that crypto has become nothing but speculation. Brokoli is the only project that dares to say: maybe we should care about the world, not just our wallets. The fact that it’s failing doesn’t make it wrong - it makes it brave.

Brokoli is like that one friend who tries too hard to be cool but forgets to wear pants. The idea is good. The execution? Not so much. Still, I root for them. Maybe they’ll get lucky with the L2. But honestly? I’m more excited about KlimaDAO. At least they’re not asking me to play games to save the planet

I bought BRKL at $0.0001. Now it’s $0.0028. I’m up 28x. I don’t care about the story. I care about the chart. This is a low-cap gem. Wait for the L2 pump.

I am from India and I think this project is very interesting. We need more projects like this in crypto. Not just for profit but for planet. I don’t have much money but I play the game and I feel good about it. Maybe one day it will grow.

I read the whole thing. Honestly? It’s just another crypto project that ran out of steam. The carbon credits are fine, but the team hasn’t done anything in over a year. The GitHub commits are sparse. The Telegram has 1,200 people and half of them are bots. The Layer 2 upgrade is just a hope at this point. If you’re holding BRKL, you’re not investing - you’re clinging to a dream. And dreams don’t pay your rent.

I just checked the latest impact report - they offset 800 more tons this month. That’s real. That’s not marketing. That’s action. If you’re still mad about the price, maybe you’re missing the point. This isn’t about getting rich. It’s about proving you can do something good with crypto. And that’s worth more than any pump.