DeFi Lending Rate Calculator

Borrowing Rate Result

Utilization Visualization

Key Takeaways

- DeFi lending rates are set by algorithmic models that react to utilization, not by central banks.

- Three model families exist: linear, nonlinear and the widely used kinked (piece‑wise) model.

- Aave, Compound and MakerDAO each implement the kinked model but differ in optimal utilization, slope steepness and risk parameters.

- Understanding utilization curves helps you predict rate spikes, avoid liquidations and spot arbitrage opportunities.

- New versions (Aave V4, Compound V3) are adding volatility‑smoothing and dynamic kink adjustments.

When you hear the phrase Interest Rate Models algorithmic frameworks that set borrowing and lending rates in decentralized finance (DeFi) lending protocols, you might picture a complex math textbook. In reality, the core idea is simple: the protocol watches how much of its capital is being used and automatically adjusts the price of borrowing or supplying assets. No bankers, no policy committees-just code, supply, and demand.

DeFi lending, represented by platforms like Aave, Compound and MakerDAO, has exploded to roughly $50billion TVL by October2025. That growth is largely powered by these transparent, on‑chain rate mechanisms that let anyone earn or borrow with a few clicks. Below we unpack how the models work, what makes each protocol unique, and how you can use that knowledge to protect your capital or earn higher yields.

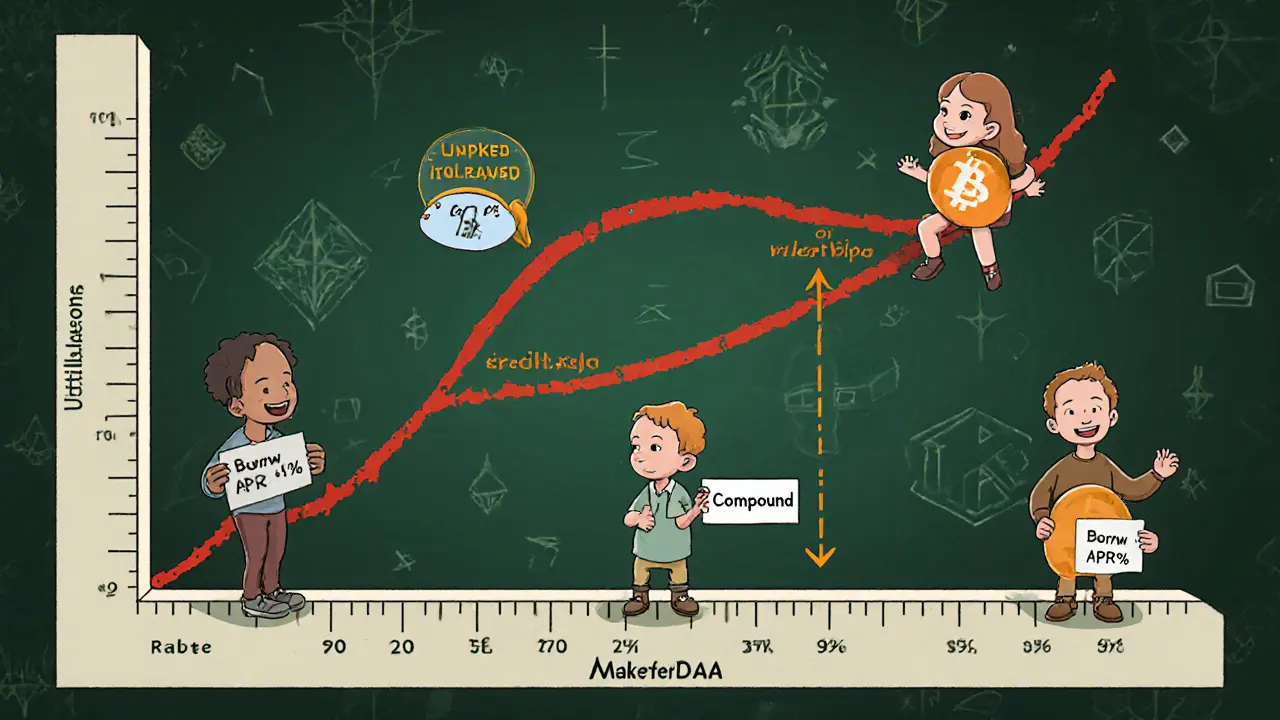

How Utilization Drives Every Rate

At the heart of every model lies utilization the ratio of assets currently loaned out to the total assets supplied to a pool. If a pool has 100ETH supplied and borrowers have taken out 70ETH, utilization (U) is 70%.

Most protocols calculate the borrowing rate (Rborrow) as a function of U and a set of governance‑controlled parameters:

Rborrow = BaseRate + Slope1 × U (U ≤ kink point) Rborrow = BaseRate + Slope1 × kink + Slope2 × (U - kink) (U > kink)

This piece‑wise linear equation creates a DeFi lending interest rates curve that rises gently until the “kink”-often around 80‑95%-then shoots up sharply. The steep second slope discourages borrowers from pushing utilization to 100%, which would lock lenders out of their funds and trigger a liquidity crisis.

Types of Rate Models

While the kinked curve dominates, three broad families exist:

- Linear models: A single slope from 0% to 100% utilization. Simple but prone to extreme spikes when demand surges.

- Nonlinear models: Use exponential or polynomial functions for smoother transitions, often seen in experimental protocols.

- Kinked (piece‑wise) models: Two slopes with a defined kink point; the sweet spot for most major platforms.

Choosing a model is a governance decision. It reflects how a community balances capital efficiency (higher rates for lenders) against borrower accessibility (lower rates for users).

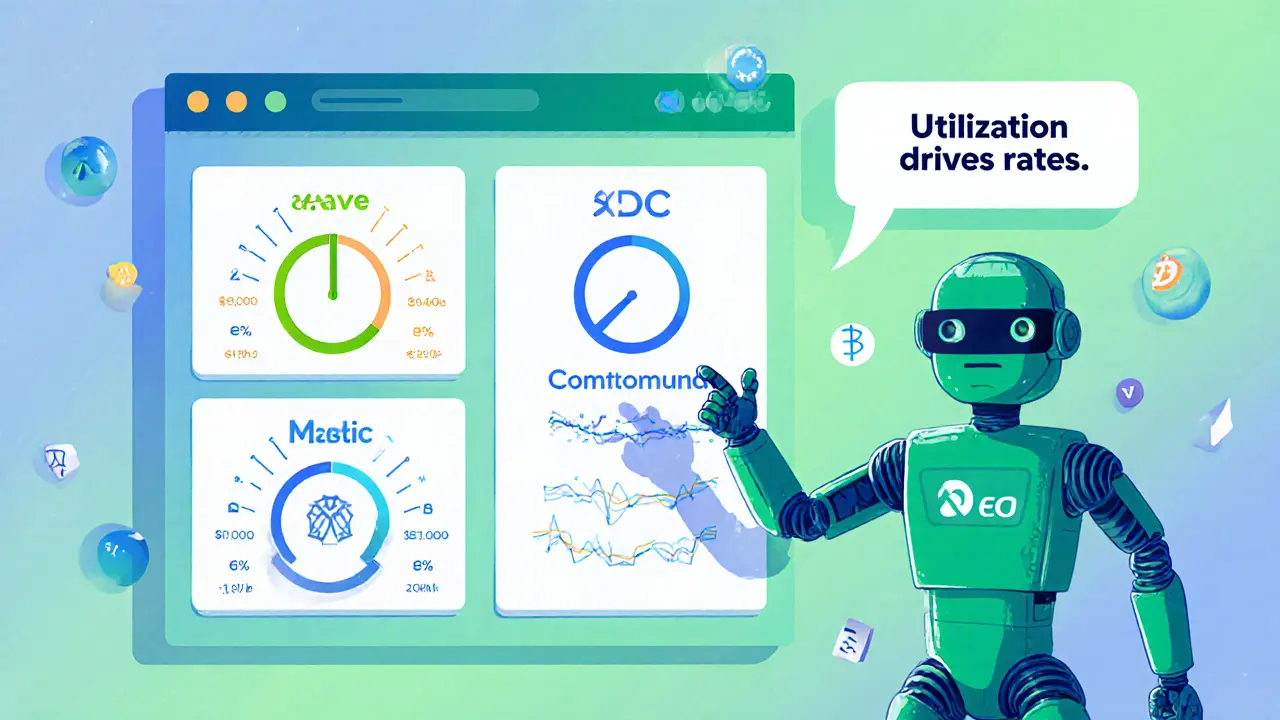

Major Protocol Implementations

Let’s see how the three market leaders apply the kinked formula.

Aave

Aave introduced the first on‑chain piece‑wise model back in 2017. Its “optimal utilization” sits at 80% for stablecoins like USDC and 95% for volatile assets such as ETH. The first slope (Slope1) is modest (≈0.04% per %U), while the second slope (Slope2) can exceed 1% per %U, creating rates that can jump from 8% APR to over 50% APR during market stress.

Aave also offers a stable rate option where borrowers lock in a rate for up to 30 days, shielding them from sudden spikes. This stability comes at a slight premium compared to the variable rate.

Compound

Compound’s version uses a similar kink at 80% utilization but with a flatter second slope (≈0.6% per %U). This makes rate spikes less dramatic but can leave lenders with lower yields during high demand. Compound’s governance frequently tweaks the BaseRate and slopes to keep the market competitive.

Borrowing an asset like USDC on Compound currently shows APRs around 4% while suppliers earn roughly 8% APY, reflecting a healthy spread.

MakerDAO

MakerDAO operates differently through its Dai Savings Rate (DSR) and a collateral‑specific borrow rate. The DSR, at 11.5% (as of Oct2025), acts like a deposit rate for DAI holders. Borrowers pay a stability fee that translates to about 12.5% APR on Dai loans. Utilization isn’t calculated per‑asset in the same way, but the protocol enforces strict LTV caps (66‑75%) to keep the system safe.

Side‑by‑Side Comparison

| Protocol | Optimal Utilization (Kink) | Supply APY (USDC) | Borrow APR (USDC) | Max LTV (Core Assets) | Rate Model Type |

|---|---|---|---|---|---|

| Aave | 80% (stablecoins), 95% (volatile) | 7.47% | 8.94% | 80% | Kinked (piece‑wise) |

| Compound | 80% | 8.30% | 4.10% | 75% | Kinked (piece‑wise) |

| MakerDAO | N/A (DSR model) | 11.5% (DSR) | 12.5% (stability fee) | 66‑75% | Fixed DSR & stability fee |

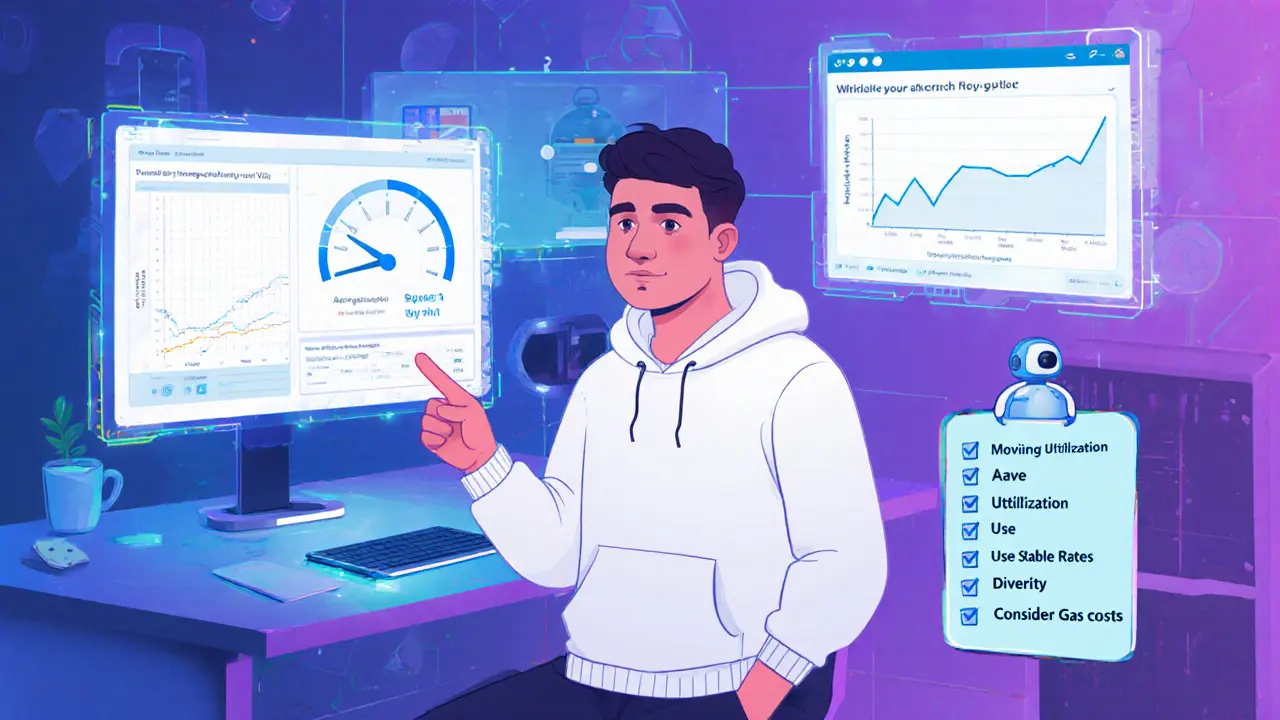

Why Rate Volatility Happens (and How to Tame It)

During market crashes, utilization can skyrocket as borrowers rush to liquidate positions while lenders pull out funds. Because the second slope is steep, rates can briefly exceed 50% APR-exactly what Reddit users reported in March2020 on Aave.

Here are three practical tricks:

- Monitor the utilization gauge. All major UIs display a real‑time %U. If it creeps past the kink, consider withdrawing or swapping to a lower‑utilization pool.

- Use stable‑rate options. Aave’s stable rate locks you in for up to 30days, protecting you from sudden spikes.

- Diversify across protocols. If one pool spikes, the same asset on another platform may stay below the kink, letting you earn a steadier yield.

Advanced users also employ “rate‑chasing” bots that automatically move capital when utilization drops, but be mindful of gas costs (often $50‑$200 during congestion).

Emerging Trends & The Future of Rate Models

Both Aave V4 (launched Q22025) and Compound V3 introduce volatility‑smoothing algorithms. Instead of a hard kink, they now apply a weighted moving average of utilization over the past hour, reducing sudden jumps.

Machine‑learning‑augmented models are also in early testing. They adjust the kink point dynamically based on historical volatility, aiming for a sweet spot where lenders earn ~10% APY while borrowers see rates under 6% APR.

Regulators, especially the EU’s MiCA framework, are beginning to require clearer disclosure of algorithmic parameters. Expect future dashboards to show not just utilization but also the exact slope values governing rates.

Practical Tips for New Users

- Start small. Allocate 2‑4weeks of capital to a single pool, track utilization, and get comfortable reading on‑chain metrics.

- Use native analytics. Aave and Compound both expose APIs; tools like DeFi Pulse and Dune Analytics aggregate utilization data in real time.

- Mind the health factor. Aave liquidates when your factor falls below 1. Keep a buffer of 10‑15% extra collateral during volatile periods.

- Factor gas. On Ethereum L2s (Arbitrum, Optimism) you can chase rates at a fraction of the cost compared to mainnet.

- Stay informed. Follow protocol governance forums; a parameter tweak (e.g., adjusting the kink point) can instantly reshape yields.

Next‑Step Checklist

- Identify the asset you want to supply (USDC, DAI, ETH).

- Check current utilization on your chosen protocol’s UI.

- Decide between variable vs. stable rate (if available).

- Deposit the amount, set a modest collateral buffer, and enable notifications for utilization spikes.

- Periodically rebalance: if utilization crosses the kink, move funds to a lower‑utilization pool or switch protocols.

Frequently Asked Questions

What exactly is utilization and why does it matter?

Utilization (U) is the percentage of supplied assets that are currently borrowed. It matters because every protocol’s borrowing rate is a direct function of U. When U is low, rates stay low; as U approaches the kink point, rates rise sharply to attract more lenders.

How do I avoid being liquidated during a rate spike?

Keep your health factor above 1 by over‑collateralizing (10‑15% buffer) and monitor utilization gauges. Switching to a stable‑rate option on Aave or moving assets to a lower‑utilization pool can also protect you.

Which protocol currently offers the highest stable‑rate APY for USDC?

As of October2025, Aave’s stable‑rate USDC supply sits around 7.5% APY, slightly lower than Compound’s variable supply but with the benefit of rate certainty.

Can I earn more by moving funds between protocols?

Yes, arbitrage opportunities arise when utilization (and thus rates) diverge. Advanced users run bots to shift capital from a high‑utilization pool (low supply APY) to a low‑utilization one (higher APY). Remember to factor in gas fees.

What’s new in Aave V4’s rate model?

Aave V4 adds a “rate smoothing” algorithm that calculates a moving average of utilization over the past hour. This softens abrupt jumps at the kink, keeping rates more predictable during volatile market moves.

- Poplular Tags

- DeFi lending interest rates

- interest rate models

- Aave

- Compound

- MakerDAO

People Comments

Wow the rate curves feel like a roller‑coaster for a DeFi fan who loves drama

Every time utilization hits that spooky kink the numbers just explode

It’s like watching a thriller where the hero’s heart rate spikes just as the plot twists

Sure, the protocols hide the real agenda behind “utilization” – it’s a secret control lever for the shadow elite

They want us to chase the variable APRs while the system quietly siphons fees

Everything’s a simulation and we’re just NPCs in their algorithmic game

The piece‑wise model makes sense because lenders need higher returns as the pool fills up

Keeping the explanation simple helps newcomers see why rates jump after the kink

It also shows the balance between capital efficiency and borrower cost

Love the aggressive push to use the stable‑rate option – it’s the safest play when the market gets wild

Don’t sit on the sidelines, move your funds before the utilization spikes

Take control and watch your yields climb

cool guide lol 😂

Dear readers, the nuances of DeFi lending models merit a thorough exposition; understanding the kink point is pivotal for both lenders and borrowers.

First, the base rate establishes a floor for returns, ensuring liquidity providers receive compensation even at minimal utilization.

Second, the slope parameters dictate how rapidly rates ascend once the pool’s utilization surpasses the optimal threshold, thereby incentivizing further capital inflow.

Third, protocol governance can adjust these parameters in response to market dynamics, a flexibility that distinguishes on‑chain finance from traditional banking.

Consequently, diligent monitoring of utilization gauges, combined with strategic allocation across platforms, can significantly enhance portfolio performance.

Building upon the previous analysis, could we explore how the moving‑average utilization smoothing in Aave V4 mathematically influences the second slope?

Specifically, does the weighted average reduce the abruptness of rate spikes, and what are the implications for borrower risk assessments?

It is incumbent upon us, as participants in decentralized finance, to recognize that unchecked rate volatility can erode trust in the ecosystem.

Therefore, we must advocate for transparent governance and responsible parameter setting, lest we invite systemic fragility.

Rate models are simply piecewise linear functions with a kink that adjusts the slope after a certain utilization threshold.

The community benefits when we share clear visualizations of utilization so users can make informed decisions without getting overwhelmed.

In the ever‑evolving landscape of DeFi, grasping the intricacies of rate models is as essential as packing your parachute before a sky‑diving jump.

When a pool’s utilization creeps toward the kink, lenders see their APY climb, while borrowers feel the pinch of rising APRs.

Aave’s implementation, for example, sets the kink at 80 % for stablecoins, meaning that up to that point the increase is gentle, but beyond it the slope rockets.

Compound, on the other hand, chooses a flatter second slope, which smooths the transition but may leave lenders with slightly lower returns during heavy demand.

MakerDAO eschews the traditional kink entirely, opting instead for a fixed stability fee that decouples utilization from the borrow rate.

This design choice reflects Maker’s emphasis on predictability for DAI users, albeit at the cost of less dynamic yield adjustments.

When you watch the utilization gauge in real time, you’ll notice the visual cue-a red line marking the kink-acting like a warning sign on a highway.

Crossing that line triggers the second slope, and if you’re not prepared, your borrowing cost can explode from single digits to double‑digit percentages within minutes.

Smart users mitigate this risk by diversifying across protocols, moving capital to pools where utilization remains comfortably below the kink.

They also set health‑factor buffers, typically maintaining a collateral surplus of 10‑15 % to survive sudden spikes.

Gas costs, especially on Ethereum mainnet, can blow up during congestion, so many seasoned yield‑chasers have migrated to Layer‑2 solutions like Arbitrum or Optimism.

These L2s preserve the core rate‑model logic while slashing transaction fees, making frequent rebalancing economically viable.

Looking ahead, the upcoming volatility‑smoothing algorithms in Aave V4 and Compound V3 aim to replace the hard kink with a moving average of utilization over the past hour.

Early simulations suggest this could temper abrupt rate jumps, offering borrowers more predictability without sacrificing lender incentives.

In practice, keeping an eye on the dashboard, setting alerts for utilization thresholds, and periodically reviewing governance proposals will keep you ahead of the curve.

Thank you for the comprehensive breakdown; the analogy of a warning sign makes the kink concept much clearer for newcomers.

I’ll definitely set up utilization alerts on my dashboard to avoid surprise spikes.

Great insights! 😊 Keeping an eye on those utilization gauges really does save you from nasty rate shocks.

Feel free to ping me if you need help setting up alerts.

Listen, you cant just hop between pools without thinking about the overall risk to the ecosystem.

Every time someone jumps out at the kink it hurts the stability for everyone else.

Our platform clearly outperforms the rest – the rates here are unbeatable and the community is the strongest.

Anyone still using other protocols is just wasting time.

Man, I totally get the fear of those sudden APR spikes, it’s like the market just flips a switch and you’re left scrambling.

What helped me was setting up a simple spreadsheet that tracks utilization percentages across Aave, Compound, and MakerDAO in real time.

Whenever the gauge nudges past the kink, the sheet flashes a reminder and I quickly reallocate a slice of my supply to a lower‑utilization pool.

This habit not only smooths out my earnings but also keeps my health factor comfortably above 1, so I never get liquidated.

Don’t forget to factor in gas fees; on L2s the moves are cheap enough to do daily.

Stay chill and keep the data flowing – the more you watch, the less surprise you’ll have.

The sheer power behind our nation's DeFi adoption is undeniable – we are leading the charge, forging new frontiers in financial freedom!

Every protocol that adopts our standards instantly gains robustness, and the rest simply follow.

Oh sure, because everyone totally reads the fine print on utilization curves before they jump in.

If you miss the kink you’re just another clueless retail trader swarmed by the pros.

Nice summary – keep an eye on the kink and adjust accordingly.

Honestly the guide feels half‑baked, like someone threw together a wiki page after a single coffee.

It needs more depth, especially on the new smoothing algorithms.

I appreciate the effort put into this guide; it really breaks down the core concepts.

If you’re new, start with stablecoins on Aave and watch the utilization gauge before moving to more volatile assets.

I understand how intimidating those rate spikes can seem, especially when you’re protecting a sizable portfolio.

By maintaining a healthy collateral buffer and regularly checking the utilization gauge, you can mitigate most of the stress.

Remember that the community is here to share tools and tips, so don’t hesitate to ask for help.

Staying proactive will keep your assets safe and your yields steady.

Keep learning and you’ll gain confidence over time.

The dance of rates and utilization mirrors the chaotic nature of our financial world, a reminder that control is often an illusion.

Yet, within that chaos, we find patterns that guide our decisions, like the ever‑present kink.

Embrace the uncertainty, but let data be your compass.

Stay active, monitor utilization, and rebalance when needed – that’s the recipe for steady DeFi yields.