Staking Rewards Calculator

Calculate Your Potential Earnings

Enter your staking amount and select a network to see estimated annual rewards.

Estimated Annual Return

Annual Rate

Monthly

30-Day Total

Important Note: Staking rewards are paid in the network's native cryptocurrency. Your total value depends on both your earnings and the cryptocurrency's market price. If the price drops, your earnings may not offset the loss.

Imagine earning interest on your cryptocurrency without selling it. No trading. No guessing market trends. Just locking your coins in a digital wallet and watching your balance grow slowly over time. That’s cryptocurrency staking - and it’s not a gimmick. It’s how blockchains like Ethereum, Solana, and Cardano keep themselves running securely while rewarding people who help keep them honest.

How Staking Keeps Blockchains Alive

Before staking became popular, most blockchains relied on mining. Bitcoin and early Ethereum used proof-of-work, where computers raced to solve crazy-hard math puzzles. That process used more electricity than entire countries. It was slow. Expensive. Environmentally heavy. Proof-of-stake changed all that. Instead of using brute force, blockchains now pick validators based on how much cryptocurrency they’re willing to lock up - or "stake." Think of it like putting money in a savings account, but instead of earning interest from a bank, you’re earning it by helping verify transactions on the blockchain. When you stake, you’re basically saying: "I believe in this network. I’ll lock my coins here, and I’ll help check that everyone’s transactions are real." The network then randomly selects validators from everyone who’s staked. The more coins you stake, the higher your chance of being chosen. But even small stakers get a shot - many networks use randomness to keep things fair. Once chosen, you create a new block of transactions. Other validators check your work. If you’re correct, you get rewarded. If you try to cheat - like approving a fake transaction - you lose part of your stake. That’s called slashing. It’s the blockchain’s way of saying: "Don’t mess with us. We’ve got skin in the game too."How Much Can You Earn?

Staking rewards vary by network. On Ethereum, you might earn between 3% and 5% annually. Solana offers around 6% to 8%. Cardano hovers near 4%. These aren’t guaranteed - they can shift slightly depending on how many people are staking and how much total value is locked up. Here’s a real example: If you stake 100 ETH at a 4% annual rate, you’ll earn about 4 ETH after a year. That’s not bad - especially since you still own your original 100 ETH. The rewards are paid out in the same cryptocurrency you staked, so you’re not converting or selling anything. You’re just growing what you already have. Rewards come from two places: newly minted coins (the network creates them as payment) and transaction fees collected from users. Unlike lending crypto to a third party, staking doesn’t involve giving your coins to someone else. The protocol itself pays you. That’s why it’s considered lower risk than DeFi lending platforms.How to Stake - No Tech Skills Needed

You don’t need to run your own server or understand blockchain code to stake. Most people do it through exchanges like Coinbase, Kraken, or Binance. You just log in, find the staking section, click "Stake," and confirm. The platform handles everything: choosing validators, managing your stake, paying out rewards. It’s as easy as depositing money into a savings account. But there’s another way: staking pools. These are groups of people who combine their coins to increase their chances of being selected as validators. If you only have 5 ETH, your individual chance of being chosen on Ethereum is tiny. But in a pool with 10,000 ETH total, you still earn a fair share of the rewards based on your contribution. Pools often charge a small fee - maybe 5% to 10% of your rewards - but they make staking accessible to everyone. Some networks, like Solana, let you delegate your stake directly through a wallet like Phantom or Solflare. You pick a validator, click "Delegate," and you’re in. No middleman. No exchange. Just you and the blockchain.What You Lose When You Stake

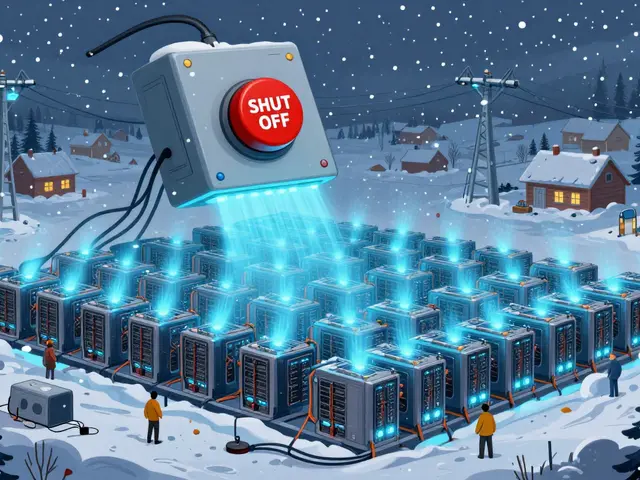

Staking isn’t free money. There are trade-offs. First, your coins are locked. You can’t sell them during the staking period. On Ethereum, unstaking can take days or even weeks. On Solana, it’s faster - sometimes just a few hours. But you can’t react to market drops or sudden price spikes. If ETH crashes 30% while you’re staking, you still earn your 4% - but your overall value is down. Second, there’s slashing risk. If you’re running your own validator and your server goes offline, or if you accidentally sign two conflicting blocks, you could lose a portion of your stake. Most retail users avoid this by using exchanges or pools, where the platform takes responsibility for uptime and accuracy. Third, there’s opportunity cost. That money you staked could’ve been used to buy another coin, pay off debt, or invest elsewhere. If you lock up your crypto and then Bitcoin surges 200%, you’re not part of that gain.Is Staking Safe?

Compared to lending on DeFi platforms or using centralized finance apps, staking is one of the safer ways to earn yield in crypto. Why? Because you’re not giving your coins to a company that might go bankrupt or get hacked. You’re locking them directly into the blockchain’s protocol. Still, not all platforms are equal. Exchanges like Coinbase and Kraken offer insurance on staked assets and have strong security practices. Smaller platforms? Not always. Always check: Do they have a track record? Have they been audited? Do they offer withdrawal guarantees? Also, remember: staking doesn’t protect you from crypto’s biggest risk - volatility. Your rewards might be 5%, but if your coin loses 20% in value, you’re still down. Staking gives you passive income, not price protection.

Which Coins Can You Stake?

Not every cryptocurrency supports staking. Only those using proof-of-stake (PoS) or its variations do. Here are the big ones:- Ethereum (ETH) - After its 2022 upgrade, Ethereum fully switched to PoS. Now over 30% of all ETH is staked. Minimum: 32 ETH to run your own validator. Most people stake less through exchanges.

- Solana (SOL) - Fast, cheap, energy-efficient. Rewards are high. Unstaking is quick. Great for beginners.

- Cardano (ADA) - Designed with sustainability in mind. Rewards are modest but steady. Easy to stake via wallets like Daedalus or Yoroi.

- Polygon (MATIC) - Used for scaling Ethereum apps. Low entry barrier. Good for small stakers.

- Polkadot (DOT) - Lets you nominate validators. Rewards are split among nominators and validators.

What’s Next for Staking?

The future of staking is getting even simpler. Liquid staking is the next big thing. It lets you stake your ETH and get a token in return - like stETH - that represents your staked coins. You can trade stETH, use it in DeFi, or even borrow against it - all while still earning staking rewards. It’s like having your cake and eating it too. Regulation is the wild card. In the U.S., the IRS treats staking rewards as taxable income. In the EU, rules are still being shaped. If governments start treating staking like a financial product, it could change how platforms offer it - or even ban it in some places. For now, staking is growing fast. More than $100 billion worth of crypto is locked in staking across major networks. Institutions are getting involved. Retail investors are too. It’s not just a way to earn. It’s becoming a core part of how blockchains survive and scale.Can you lose money by staking cryptocurrency?

Yes, but not in the way most people think. You won’t lose your staked coins just for holding them. But you can lose part of them if you’re a validator and make a serious mistake - like approving a fake transaction. This is called slashing. Most people avoid this by staking through exchanges or pools, where the platform handles the technical side. The bigger risk is price drops. If your coin falls 30% while you’re staking, you’re still earning rewards - but your overall portfolio value may be lower.

Is staking better than mining?

For most people, yes. Mining requires expensive hardware, high electricity bills, and technical know-how. Staking just needs a wallet and some crypto. It’s also far more energy-efficient. Ethereum saved over 99% of its energy use after switching from mining to staking. Staking is accessible, cheaper, and environmentally friendly - making it the clear winner for everyday users.

Do you need to stake 32 ETH to earn rewards on Ethereum?

No. That’s only if you want to run your own validator. Most people stake smaller amounts - even $10 or $50 - through exchanges like Coinbase or Kraken, or through staking pools. These platforms combine many small stakes into one large validator, so you still earn your fair share of rewards without needing 32 ETH.

How often are staking rewards paid out?

It depends on the network. Ethereum pays rewards roughly every 6 to 8 minutes, but you won’t see them in your wallet until they’re finalized - which can take hours or days. Solana pays daily. Cardano pays every 5 days. Exchanges usually pay out weekly or monthly, depending on their system. Always check the payout schedule before you stake.

Are staking rewards taxed?

In most countries, yes. The IRS treats staking rewards as taxable income at the fair market value when you receive them. So if you earn 0.5 ETH worth $1,000, you owe income tax on that $1,000. Later, if you sell the ETH for more, you may owe capital gains tax too. Always keep records of when you earned and sold your rewards. Tax rules vary by country - check your local regulations.

People Comments

Staking is literally the easiest way to make crypto work for you. No mining rigs, no fancy tech, just lock it and forget it. I started with 5 SOL on Phantom and now I’m earning daily like clockwork. It’s chill.

It’s not passive income. It’s financial Stockholm syndrome.

I just want to say-thank you for explaining slashing so clearly. I’ve read a dozen posts on this and no one ever made it feel real until now. The idea that you could lose part of your stake for a server glitch? That’s terrifying… but also kind of beautiful? Like the blockchain has its own justice system. I’m nervous but hooked.

Everyone’s acting like staking is some kind of spiritual awakening. It’s not. It’s just a fancy interest account with extra steps and zero FDIC protection. I’m not putting my life savings into a system where my coins get locked for weeks just to earn 4% while the market tanks 30%. Pass.

Staking feels like the crypto version of meditation-you’re not doing anything, but you’re still somehow contributing to the universe’s balance. The fact that the network rewards you for just… believing… in it? That’s poetry. I mean, think about it: you’re not just holding value-you’re holding faith. And faith, in this case, pays in ETH.

Who’s really behind these staking protocols? The same people who told you Bitcoin would be digital gold? Now it’s ‘digital savings account’? Wake up. They’re just rebranding Ponzi mechanics with blockchain buzzwords. And don’t get me started on liquid staking-stETH? That’s just a synthetic IOU waiting to collapse when the Fed hikes again.

Staking is free money. Stop overthinking it. Just do it.

I’ve been staking ADA for over a year. It’s slow, sure-but it’s steady. Like watching grass grow. I don’t check it every day. I just know it’s there. Quietly growing. Kinda peaceful, honestly.

so i staked my eth last month and now my wallet says 0.045 eth less?? did i get hacked or is this the slashing thing?? idk what happened but i think i lost money??

Staking isn’t about getting rich quick. It’s about aligning your values with the tech you believe in. If you think blockchain should be green, efficient, and decentralized-staking is how you vote with your wallet. You’re not just earning. You’re building. And that’s worth more than the APR.

I used to think staking was for nerds. Then I did it on Coinbase and got paid while scrolling TikTok. Now I’m staking everything I can. It’s just… smart. Why not?

My dad asked me what staking was yesterday. I showed him my Coinbase dashboard. He said, ‘So it’s like a CD, but with crypto?’ I said, ‘Yeah, but cooler.’ He nodded, then asked if I could stake his Social Security. I told him to chill. He’s 72. He’s not staking anything. But I love that he gets it.

Why do you all care so much? I just want to know: if I stake 100 ADA, can I use it to buy a coffee? Or is it locked forever? I’m confused. Someone explain like I’m 10.

Let’s be real: staking rewards are a subsidy for the protocol’s inflationary model. You’re not earning interest-you’re being paid in new tokens to maintain the illusion of scarcity. And let’s not forget: if 70% of ETH is staked, the network becomes centralized by default. Validators become gatekeepers. This isn’t decentralization-it’s oligarchy with a blockchain UI.

Staking = 🚀💰🌙✨

Wow. A whole article about staking like it’s revolutionary. Newsflash: it’s just proof-of-stake. We’ve known about this since 2012. The real story is how retail investors are being sold a fantasy while institutions quietly consolidate control. You’re not a validator. You’re a pawn. And your 4%? That’s the bait.

Staking, as a mechanism, reflects a broader philosophical shift: from extraction to participation. In mining, energy was consumed to prove value. In staking, value is committed to preserve integrity. It’s not just economic-it’s ethical. And perhaps, in an age of climate crisis, that distinction matters more than the APR.

You all are missing the point. The real risk isn’t slashing or volatility-it’s regulation. The SEC is already eyeing staking as an unregistered security. If they shut it down tomorrow, your rewards vanish overnight. You’re not earning crypto-you’re gambling on legal gray zones. And if you think that’s safe, you’re delusional.

Let’s not pretend this is passive. Running your own validator requires constant monitoring, patching, uptime SLAs, and hardware redundancy. Even pools have counterparty risk. And don’t get me started on the tax implications-each reward is a taxable event. You think you’re earning 4%? After taxes, gas fees, and slippage, you’re lucky to net 1.8%. This isn’t yield. It’s a tax audit waiting to happen.

Staking? That’s what you call it? In America, we call it ‘letting foreigners run our infrastructure while we collect pennies.’ Meanwhile, China’s building quantum-resistant chains. Europe’s regulating staking into oblivion. And we’re here debating whether 4% is worth locking up ETH. Pathetic.

I appreciate the effort here. Really. But I think we’re all missing something bigger: staking works because people trust the system. Not the code. Not the math. The people behind it. The devs, the node operators, the community moderators. That’s the real asset. The coins? Just the vehicle. If trust breaks, the whole thing collapses. And no algorithm can fix that.