If you’re sitting on a crypto portfolio worth millions, you’ve probably heard the whisper: crypto tax relocation could save you millions. But what does it actually cost to do it legally? And why do some people pay $50,000 while others shell out $250,000-or more?

This isn’t about dodging taxes. It’s about restructuring your life so your crypto gains are taxed where the rules work for you. Countries like Portugal, the UAE, Singapore, and Malta don’t tax capital gains on crypto. But moving there isn’t as simple as booking a flight. You need legal structure, residency proof, bank access, and a paper trail that holds up under scrutiny.

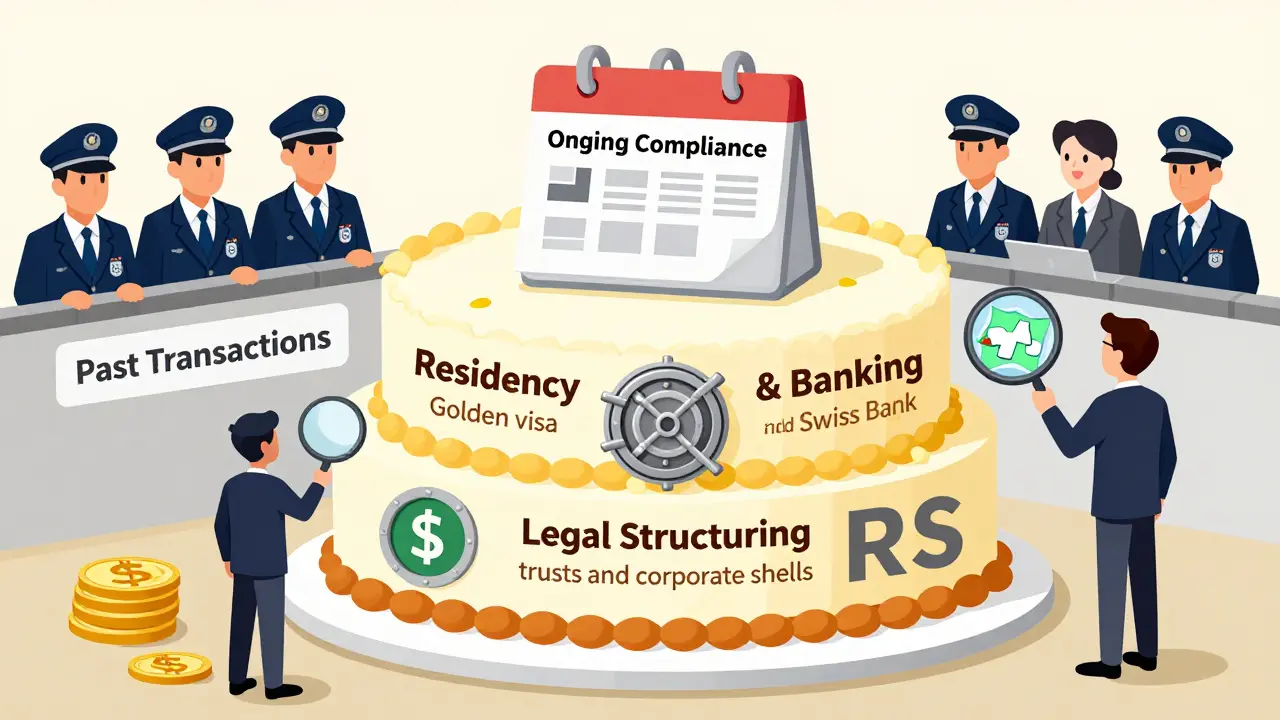

What You’re Really Paying For

When you hear $50,000 to $250,000, you might think: that’s a lot for a lawyer. But you’re not just paying for legal advice. You’re paying for a full relocation system built around your crypto holdings.

Here’s what that money covers:

- Legal structuring: Setting up trusts, foundations, or corporate entities in low-tax jurisdictions. This isn’t a one-page document. It’s a multi-layered architecture designed to separate your personal assets from your crypto holdings, shield them from future audits, and comply with anti-money laundering rules.

- Residency planning: Getting legal residency isn’t automatic. Some countries require proof of income, property ownership, or minimum stay. Others, like the UAE, let you get a golden visa through investment-but you need to prove your crypto isn’t from illicit sources. Lawyers help you build that proof.

- Banking access: Most global banks won’t touch crypto-related accounts. Specialized private banks in places like Switzerland, Liechtenstein, or Singapore will, but only if you come in with clean documentation. Lawyers connect you with these institutions and prep your paperwork so you’re not rejected.

- Tax compliance transition: You can’t just leave your home country and forget about your past. The IRS, HMRC, and other tax agencies still want to know what you sold before you moved. Lawyers help you file back taxes, disclose past transactions, and avoid penalties that could wipe out your savings.

- Ongoing compliance: Once you relocate, you still need to report. Some countries require annual filings. Others demand proof you didn’t earn income locally. This isn’t a one-time fix. It’s a yearly process. Many firms charge $10,000-$25,000 per year just to keep your setup compliant.

Think of it like buying a house. You don’t just pay for the land. You pay for permits, inspections, wiring, plumbing, and ongoing maintenance. Same here.

Why the Huge Price Range?

Not everyone needs the same level of service. The $50,000 package usually goes to someone with:

- A portfolio under $5 million

- Simple holdings (BTC, ETH, maybe a few stablecoins)

- No complex past transactions

- No dependents or family to relocate

- Willingness to handle some compliance themselves

The $200,000+ packages are for people with:

- Portfolios over $10 million

- Multiple wallets, DeFi positions, NFTs, and tokenized assets

- History of trading on centralized exchanges with KYC

- Family members relocating with them

- Assets spread across multiple jurisdictions already

One client in Singapore had 87 different wallet addresses from 2017 to 2023. Tracking every transaction, matching them to fiat conversions, and proving they were all taxed properly took three accountants six months. That’s not a $50,000 job. That’s a $120,000 audit.

What Happens If You Skip the Experts?

Some people try to do this themselves. They move to Portugal, open a local bank account, and think they’re fine because they don’t pay capital gains tax there.

Then the IRS sends a notice.

They didn’t file Form 8949 for their 2022 sales. They didn’t report their foreign bank account (FBAR). They didn’t prove they were a tax resident before the end of the year. Suddenly, they’re facing penalties of 50% of the unreported amount-plus interest.

Or worse: they get flagged for structuring. The IRS has AI tools that scan for patterns. If you moved right after selling $2 million in ETH, and your new bank account in Dubai received $1.9 million the next week? That’s a red flag.

Lawyers don’t just help you move. They help you move without leaving a trail that triggers audits.

Where Do People Actually Go?

Not every low-tax country is equal. Here’s what’s working in 2025:

| Country | Crypto Capital Gains Tax | Residency Requirement | Banking Access | Best For |

|---|---|---|---|---|

| United Arab Emirates | 0% | 6 months/year (Golden Visa) | Good (specialized banks) | High-net-worth individuals with large portfolios |

| Portugal | 0% (for non-habitual residents) | 183+ days/year | Challenging for crypto | Those who want EU access and lifestyle |

| Singapore | 0% | Work visa or investor visa | Excellent (global banks) | Professionals with crypto income |

| Malta | 0% (if structured correctly) | 183+ days/year | Moderate (crypto-friendly banks) | EU citizens wanting stability |

| El Salvador | 0% (BTC as legal tender) | Residency requires investment | Poor (limited banking) | Bitcoin maximalists |

Portugal sounds great-until you realize they require you to live there for over half the year. If you’re still running a U.S.-based crypto business, you might still owe taxes there. Singapore is clean, but you need a job offer or $2.5 million in investment. The UAE is the most flexible-but you still need to prove your crypto wasn’t from illegal activity.

Timing Matters More Than You Think

IRS rules changed in 2025. Now, exchanges must report all crypto-to-fiat sales over $10,000. That means if you sold $15,000 worth of Bitcoin in January 2025 and moved to Dubai in February, the IRS already knows. Your move won’t erase that.

Smart relocation happens before large sales. If you’re planning to sell $1 million in crypto, you need to be legally resident in your new country before the sale closes. Otherwise, the tax liability sticks to you.

One client in New Zealand waited until after selling $3 million in ETH to move. The IRS flagged him. He spent $180,000 on lawyers just to settle the audit. He could’ve paid $60,000 to move first and avoided the whole mess.

What You Should Do Next

If you’re considering crypto tax relocation:

- Get your crypto transaction history in order. Use tools like Koinly or CoinTracker to export all trades, staking rewards, and airdrops from 2017 onward.

- Identify your target country. Don’t pick based on tax rate alone. Consider banking, lifestyle, and ease of residency.

- Consult a firm that specializes in crypto tax migration-not general tax lawyers. Look for firms that have handled at least 50 crypto relocation cases since 2020.

- Start the process at least 12 months before you plan to sell large amounts.

- Don’t move until your residency is approved. Waiting until after the sale is a gamble you can’t afford.

This isn’t a shortcut. It’s a long-term strategy. And like any strategy, it costs money upfront to save much more later.

Is It Worth It?

Let’s say you have $5 million in crypto. In the U.S., selling it all at once could mean $1.4 million in capital gains tax. In the UAE? $0.

That’s a $1.4 million difference.

If your relocation costs $150,000, you still come out $1.25 million ahead. Even if you only sell half your portfolio, you’re still ahead by $625,000.

For most people with over $2 million in crypto, this isn’t a luxury. It’s financial survival.

But only if you do it right.

Can I just move to a tax-free country and ignore my past crypto taxes?

No. The IRS, HMRC, and other tax agencies can still audit you for past transactions, even if you’ve moved. If you sold crypto before relocating and didn’t report it, you could face penalties up to 50% of the unreported amount. The key is to file back taxes and disclose everything before you move. A good lawyer will help you do this cleanly.

Do I need to sell my crypto before relocating?

No. In fact, it’s better not to. Selling before moving locks in your tax liability in your old country. The goal is to become a tax resident in your new country before you sell. Then, you can sell without owing capital gains tax. But you must prove residency before the sale date.

What if I only have $500,000 in crypto? Is relocation worth it?

For most people under $1 million, the cost of relocation ($50,000+) outweighs the tax savings. But if you plan to hold and grow your crypto for decades, or if you’re in a high-tax state like California, it may still make sense. Run the numbers: if you’ll save $100,000+ in taxes over 5 years, then $50,000 is a solid investment.

Can I use a VPN or remote work to avoid taxes?

No. Tax residency is based on physical presence, not where you log in from. If you live in the U.S. and work remotely, you’re still a U.S. tax resident-even if you use a VPN to access your crypto wallet. Tax authorities look at where you sleep, where your family lives, and where your bank accounts are. A VPN won’t fool them.

How long does crypto tax relocation take?

At least 6-12 months. Residency applications can take 3-9 months. Bank approvals take 2-6 months. Tax filings and transaction cleanups take another 2-4 months. Rushing it increases the risk of audit. The best results come from planning ahead.

Are there risks even if I do everything legally?

Yes. Tax laws change. Portugal could end its non-habitual resident program. Singapore could start taxing crypto gains. The UAE might require more proof of source of funds. That’s why you need ongoing compliance. A good firm doesn’t just set you up-they monitor changes and adjust your structure yearly.

What happens if I’m caught trying to hide crypto?

Penalties can be severe. The IRS can impose criminal charges for tax evasion, including fines up to $100,000 and five years in prison. Even if you’re not prosecuted, you’ll face civil penalties, asset seizures, and permanent loss of banking access. Legal relocation is about transparency-not hiding.

People Comments

This is FIRE 🔥 I just sold half my ETH last month and moved to Dubai. Paid $85k for the whole package and honestly? Worth every penny. My bank account got approved in 3 weeks. No more stressing about IRS notices. 🚀

I love how this breaks it down like a home renovation - you’re not just buying land, you’re paying for plumbing AND insulation AND smart wiring. So many people think it’s just ‘move and forget’ but nope. It’s a full system upgrade. 💪

Portugal sounds dreamy until you realize you’re basically signing up for a 365-day Airbnb with a side of bureaucratic tango. And don’t even get me started on trying to open a bank account with a wallet full of NFTs. I tried. The teller asked if my crypto was ‘real money.’ I cried a little.

This is a textbook example of tax avoidance masquerading as financial planning. The wealthy exploit loopholes while the rest of us pay 37% on capital gains. It’s morally indefensible.

I’ve helped 47 clients relocate over the last 3 years. The biggest mistake? Waiting until after the sale. One guy sold $4M in BTC in January, moved to Malta in March. Got flagged by the IRS in May. Ended up paying $210k in penalties. Could’ve saved $1.8M with a 6-month head start. Don’t be him.

So you’re telling me if I’m rich enough, I can legally avoid paying taxes? And the rest of us are just supposed to grin and bear it? This system is rigged. I work 60 hours a week and still pay more in taxes than some of these crypto billionaires.

The term 'crypto tax relocation' is a misnomer. It's not relocation-it's asset shielding with a side of legal obfuscation. The real cost isn't the lawyer-it's the erosion of social contract.

I just moved to El Salvador and bought a house with BTC. I don’t pay taxes. I don’t care about banks. I live in the sun. My dog has a crypto wallet. This is the future. 🌞

If you’re thinking about this, start with Koinly. Export every single transaction. Even the tiny ones. I did it for 2017–2023 and it took me 3 weeks. Then find a firm that’s done at least 50 cases. Don’t go with the first guy who says 'we can help.' This isn’t Uber.

America is falling apart. If you can leave, do it. The IRS is a tax vampire. The system is broken. Stop complaining and move. If you’re still here, you’re part of the problem.

Oh wow, $250k to save $1.4M? That’s like paying $20 for a $200 haircut. So generous of you to share your privilege.

i just read this and i’m like… wow. i have 300k in btc and i live in texas. i think i need to talk to someone. maybe? idk. but this made me think. 🤔

The structural arbitrage between jurisdictional tax regimes represents a rational optimization of capital allocation under global regulatory heterogeneity. The $50k–$250k expenditure is not a cost but a capital investment in sovereign risk mitigation.

You think this is about money? It’s about freedom. The system wants you chained to your desk, paying taxes so they can fund wars and prisons. Break the chains. Move. Live. Breathe. The blockchain doesn’t care where you sleep.

You all are fools. The US will come for you. They have AI that tracks every satoshi. Even if you move to Dubai, they’ll freeze your assets. I know a guy. He got banned from every bank in the world. Now he lives in a tent. Don’t be that guy.

Wait-so you’re telling me if I have $10M, I can just… leave? And not pay anything? And I’m still paying $15k in state taxes on my salary? This feels… wrong. Like, morally wrong. Like, ‘I’m stealing from the public school system’ wrong.

i read this and i was like… wow. i have like 80k in crypto and i live in florida. i just wanted to chill. now i’m thinking… maybe i should move to portugal? but i dont even know how to get a visa. help?

You think this is expensive? Try being a Nigerian who moved to Singapore with $2M in crypto and got rejected by 12 banks because your wallet had 17 DeFi swaps in 2021. The real cost isn’t the lawyer-it’s the sleep you lose wondering if your 2018 ETH trade will haunt you in 2030.

In India, we have no capital gains tax on crypto, but we also have no banking access for it. This article made me realize: relocation isn’t about taxes. It’s about dignity. The ability to exist without being treated like a criminal for holding digital assets.

The entire premise is flawed. Taxation is a social contract. You benefit from infrastructure, security, education. To evade it is to betray civilization. These people are not entrepreneurs-they are parasites.

The IRS doesn’t care about your passport. They have satellite tracking. They know if you bought a house in Dubai. They know if you used your phone to check your wallet. This is all a scam. The government owns your crypto. Always has. Always will.