Providing liquidity to Automated Market Maker (AMM) pools isn’t just a way to earn passive income in DeFi-it’s a high-stakes game of capital efficiency, timing, and risk management. In 2026, the landscape has changed dramatically since the early days of Uniswap. Back then, you could deposit ETH and USDC, hit ‘supply,’ and hope for the best. Today, that approach loses money more often than it makes it. If you’re still using a ‘set-and-forget’ strategy, you’re probably losing to impermanent loss, high gas fees, and poorly chosen price ranges.

What Exactly Is Liquidity Provision?

When you provide liquidity to an AMM pool, you’re depositing two tokens in equal value into a smart contract. For example, you might put in $1,000 worth of ETH and $1,000 worth of USDC. In return, you get LP tokens that represent your share of that pool. Every time someone trades ETH for USDC (or vice versa) in that pool, a small fee-usually 0.05% to 1%-is charged. That fee gets distributed to all LPs based on how much they’ve contributed.

But here’s the catch: your tokens aren’t sitting still. As prices move, the ratio of ETH to USDC in the pool changes. If ETH goes up, the pool automatically sells some ETH to buy USDC to keep the math balanced. When you withdraw, you might end up with less ETH than you put in-even if ETH’s price went up overall. That’s called impermanent loss. And in 2025, studies showed that on average, LPs lost 3.8% per position compared to just holding their tokens.

Why Impermanent Loss Is Bigger Than You Think

Impermanent loss isn’t a glitch-it’s built into the system. AMMs use a formula (x*y=k) that forces the pool to rebalance as trades happen. When one token’s price swings hard, the pool becomes unbalanced. If you’re providing liquidity in a volatile pair like SOL-USDC, you’re essentially selling high and buying low automatically. And if you’re not actively managing your position, you’re giving away free money to arbitrage traders.

Here’s a real example: You deposit 1 ETH and 2,000 USDC when ETH is $2,000. A week later, ETH hits $3,000. If you’d just held, you’d have $5,000 total. But because the pool rebalanced, you might only get back 0.8 ETH and 2,400 USDC-worth $4,800. That $200 gap? That’s impermanent loss. And it’s real, even if the token price recovers later.

Uniswap V3 Changed Everything-Here’s How to Use It

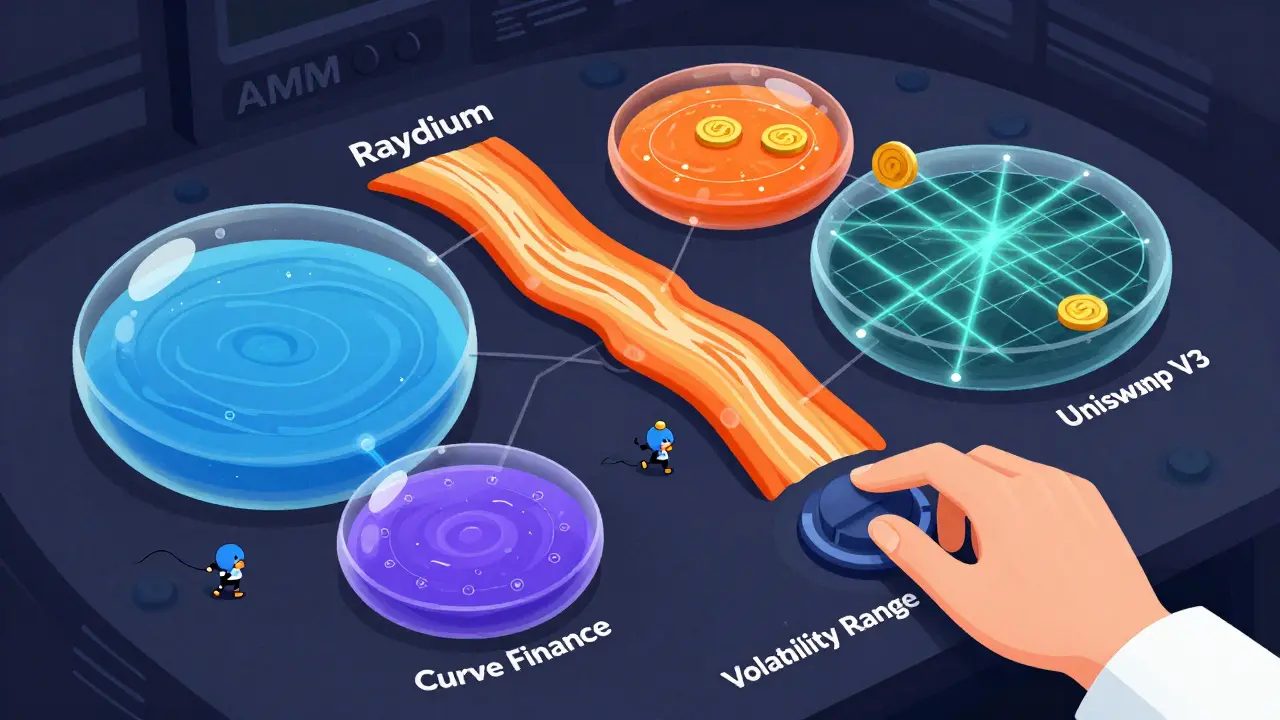

The biggest shift since 2020 came with Uniswap V3 in 2021. Instead of spreading your capital across every possible price, you now pick a range. Think of it like setting a price band: you only provide liquidity between $1,800 and $2,500 for ETH. If ETH stays in that range, you earn way more fees than you would on V2. But if it moves outside, your capital stops earning anything.

This is where most new LPs fail. They set ranges too wide-like $1,000 to $4,000-and end up with the same low returns as V2. Or they set ranges too tight and get pulled out of the pool on minor price swings. The sweet spot? Use historical volatility data. If ETH usually swings 15% a week, set your range to ±20%. That gives you breathing room without diluting your exposure.

According to 2025 research, LPs who use ranges under 25% volatility width earn 2-4x more in fees than those using wider ranges. And those who actively rebalance every 2-4 weeks outperform passive LPs by 18-22% annually.

Which Pools Actually Make Money in 2026?

Not all pools are created equal. Some are money pits. Others are goldmines-if you know where to look.

- Curve Finance: Best for stablecoins like USDC, DAI, USDT. Because these tokens don’t move much, impermanent loss is near zero. Fees are lower, but so is risk. Great for beginners.

- Uniswap V3 (WETH-USDC): The most popular pool, but also the most overcapitalized. Over 66% of capital here is sitting outside optimal price ranges. You’ll earn 12-22% APY, but only if you manage your range well. Most people earn less than 8%.

- PancakeSwap (BNB-USDT): On BSC, fees are cheap. Yields are higher-sometimes 25-40% APY-but the tokens are more volatile. Good for aggressive LPs who can monitor positions daily.

- Balancer: Lets you create pools with 3-8 tokens. Want to provide liquidity in 50% BTC, 30% ETH, 20% SOL? Balancer lets you do that. Complex, but powerful for portfolio diversification.

- Raydium (SOL-USDC): On Solana, transactions cost pennies. Liquidity is thinner, so your capital gets used more efficiently. APYs are often 15-30%, and the chain’s speed makes rebalancing easy.

- SushiSwap: Multi-chain, but fragmented. You’ll find decent yields on Polygon and Avalanche, but the interface is clunky. Only use if you’re already active on those chains.

2025 data shows that pools with correlated tokens (like USDC/DAI or WBTC/ETH) have far lower impermanent loss than uncorrelated pairs (like ETH/SOL). If you’re unsure, stick to stablecoin pairs or major asset pairs with low volatility.

How to Avoid Losing Money (Even When the Market Rises)

Here’s what successful LPs do differently:

- Never provide liquidity in a pair you don’t understand. If you can’t explain why the two tokens move together (or apart), don’t deposit.

- Use tools like DeFiLlama or Uniswap Analytics to see how often a pool’s price moves outside the current range. If it’s happening weekly, your range is too tight.

- Rebalance every 2-4 weeks. Move your range to center around the current price. Don’t wait for a crash to fix it.

- Track gas costs. On Ethereum, a single rebalance can cost $15-$30. If your fees only earn $20 that week, you’re losing money after fees.

- Use Layer 2s. Arbitrum, Optimism, and Base have 90% lower fees than Ethereum. Your capital works harder and costs less to manage.

One LP in Wellington told me he switched from Ethereum to Base for his ETH-USDC position. His fees doubled, his gas costs dropped from $25 to $0.50 per rebalance, and his net return jumped from 9% to 24% in six months.

Advanced Tactics: Algorithmic Liquidity and Hedging

The top 5% of LPs don’t manually manage positions. They use bots.

Tools like DeFi Saver, Good Dollar, or custom scripts on Flashbots can automatically adjust your Uniswap V3 ranges based on price trends, volatility spikes, or even Twitter sentiment. Some even hedge impermanent loss by shorting the same token on a centralized exchange.

For example: You deposit ETH-USDC on Uniswap V3. You also short 10% of your ETH position on Binance. If ETH crashes and you lose on the pool, your short position offsets it. If ETH surges, you win on the pool and lose a little on the short. Net result? Smoother returns, less emotional stress.

This isn’t for beginners. But if you’re spending 10+ hours a week on DeFi, it’s worth learning.

What’s Next? The Future of AMM Liquidity

2026 is seeing new solutions to the core problems:

- Impermanent loss insurance: Protocols like Uniswap V4’s optional insurance layer and Lyra let you pay a small fee to hedge against losses.

- Cross-chain liquidity: New protocols like LayerZero and Wormhole let you lock liquidity on one chain and earn fees on another-no need to bridge tokens.

- AI-driven LP platforms: Startups are launching dashboards that analyze 50+ metrics (volatility, correlation, fee tiers, token sentiment) and recommend optimal positions in seconds.

But the truth hasn’t changed: liquidity provision is no longer passive income. It’s active trading-with your capital.

Should You Provide Liquidity in 2026?

Yes-if you treat it like a business.

If you’re looking for a hands-off way to earn 5-10% APY, stick to stablecoin pools on Curve or a low-fee L2. If you want to make 20%+ and don’t mind checking your position weekly, go for concentrated liquidity on Uniswap V3 or Raydium. If you want to go all-in, learn to use bots and hedging.

But if you’re just depositing tokens and hoping for the best? You’re not an LP. You’re a target.

What’s the biggest mistake new liquidity providers make?

They assume liquidity provision is passive. Most new LPs deposit tokens, forget about them, and end up losing money to impermanent loss. The real profit comes from actively managing price ranges, rebalancing, and choosing the right pools-not just picking the highest APY.

Is it better to use Uniswap V3 or Curve for beginners?

Curve is better for beginners. Its stablecoin pools (like USDC/DAI/USDT) have almost no impermanent loss and lower volatility. Uniswap V3 offers higher returns but requires understanding price ranges and active management. Start with Curve to learn how liquidity pools work before moving to volatile pairs.

How do I calculate my real return after fees and gas?

Track your total LP token value over time, subtract your initial deposit, then subtract all gas fees paid during that period. Use tools like DeFiLlama or Zerion to auto-calculate this. If your net return is below 5% after fees, you’re likely better off just holding the tokens.

Can I lose more than I deposited?

No, you can’t lose more than your deposit. But you can lose a portion of it. Impermanent loss doesn’t mean you go negative-it means you end up with less than if you’d just held your tokens. For example, you deposit $2,000 and withdraw $1,800 worth of assets. That’s a $200 loss, not a negative balance.

Do I pay taxes on liquidity provision rewards?

Yes. In most jurisdictions, the trading fees you earn are treated as income when you receive them. LP tokens themselves aren’t taxed until you swap them back. But if you receive additional tokens as rewards (like SUSHI or CRV), those are taxable events. Always consult a crypto-savvy accountant.

What’s the safest AMM pool to provide liquidity to in 2026?

The safest option is a stablecoin pool on Curve Finance, like USDC/DAI/USDT. These tokens are pegged to $1, so price swings are minimal. Impermanent loss is near zero, and fees are reliable. It won’t make you rich, but it won’t wipe you out either.

People Comments

It's wild how liquidity provision turned from a lazy side hustle into a full-time trading job. I used to think just dumping ETH and USDC into Uniswap was enough. Turns out, I was just subsidizing arbitrage bots while they siphoned off my capital. The real insight here isn't about ranges-it's about mindset. You're not a lender. You're a market maker. And if you treat it like a savings account, you're gonna get robbed.

Thank you for this comprehensive and meticulously structured analysis. The distinction between passive yield farming and active liquidity management is not merely technical-it is philosophical. One must approach DeFi with the discipline of a professional trader, not the optimism of a retail investor. The data presented here is not only accurate but essential for sustainable participation in decentralized finance.

Uniswap V3 is overhyped. Everyone’s chasing 20% APY but ignores that 90% of their capital sits idle. I’ve seen guys lose more on gas than they made in fees. And don’t even get me started on Layer 2s-Base is fine but still slower than Solana. If you want real yield, go Raydium. No capes, no fluff, just pure Solana speed.

Wait so you’re saying if I just hold my ETH instead of LPing I’d be better off? 😅 I’m confused. I thought this was supposed to be passive income. So if I’m rebalancing every 2 weeks and paying $20 in gas each time… am I just trading manually but with extra steps? I’m not mad, just… confused. Can someone explain this like I’m 12? Like, why is this better than just buying and holding? I feel like I’m missing the point.

India is the future of DeFi. Why are you all still using USDC? Use INR-backed stablecoins. Why are you paying gas on Ethereum? Solana is faster. Why are you scared of volatility? We handle it daily. Stop acting like Westerners are the only ones who understand markets. We’ve seen crashes. We’ve rebuilt. You’re still learning. We’re already winning.

The most profound observation in this entire piece is not about impermanent loss, nor about range optimization-it is that liquidity provision has ceased to be a form of passive income and has instead evolved into a form of active capital allocation. This paradigm shift demands not only technical proficiency but epistemological humility. One must surrender the illusion of control while simultaneously exercising rigorous discipline. It is, in essence, the paradox of modern finance.

so i tried lp on curve with usdc/dai and made like 6% in 3 months and felt so proud lol. then i saw someone else on twitter making 30% on solana and felt so behind 😅 but honestly i dont even care anymore. i sleep better knowing my money isnt getting drained by price swings. sometimes slow is the real win.

I used to be the guy who just deposited and forgot. Then I lost $1,200 on a SOL-USDC pool because I didn’t rebalance. Now I check my positions every Sunday morning with coffee. It’s not glamorous. But it’s the difference between losing money and actually making something. If you’re not willing to spend 10 minutes a week, don’t even bother.

Liquidity provision is the financial equivalent of being the bartender at a party where everyone’s drunk and trading your snacks. You’re not getting paid to chill-you’re getting paid to watch your damn hummus get eaten by someone who thinks it’s free. And if you don’t move your tray when the crowd shifts? Congrats, you’re now the snack stand that got trampled.

Stop acting like V3 is hard. It’s just math. You don’t need a bot. You need a spreadsheet. Track the 7-day volatility of your pair. Set your range ±25%. Rebalance when price hits the edge. Use Base or Arbitrum. Gas under $1. APY jumps from 8% to 22%. Done. No fluff. No crypto bro jargon. Just numbers. If you’re still losing, you’re not tracking. Not the market. YOU.

While I appreciate the depth of this analysis, I must respectfully note that the implicit assumption-that liquidity providers are rational actors operating within a predictable market framework-fails to account for systemic behavioral biases. The very structure of AMMs incentivizes herding behavior, which undermines the efficiency of price discovery. Thus, the notion of ‘optimal’ ranges is inherently flawed when participants are reacting to sentiment, not fundamentals.

Wow, what a long-winded lecture. You just described how to not get scammed by your own wallet. Newsflash: if you need a 2,000-word guide to put $1k into a pool, maybe you shouldn’t be in DeFi. Go buy ETFs. Or better yet-just hold Bitcoin and shut up. This whole ‘concentrated liquidity’ nonsense is just Wall Street repackaged with blockchain buzzwords.

Impermanent loss is just the market saying you’re not paying attention. I used to think it was magic. Now I know it’s just math punishing laziness. I don’t even check my positions every day anymore. Just when the price moves 15%. And I use Base. Gas is cheaper than my morning coffee. That’s it. No bots. No drama.

Curve is for grandmas. If you’re not chasing 50% APY on a new memecoin pair, you’re wasting your time. Why are you even reading this? Go farm PEPE on Raydium. The real money’s in the chaos. Stability is for losers.