OMNIA Protocol Price Tracker

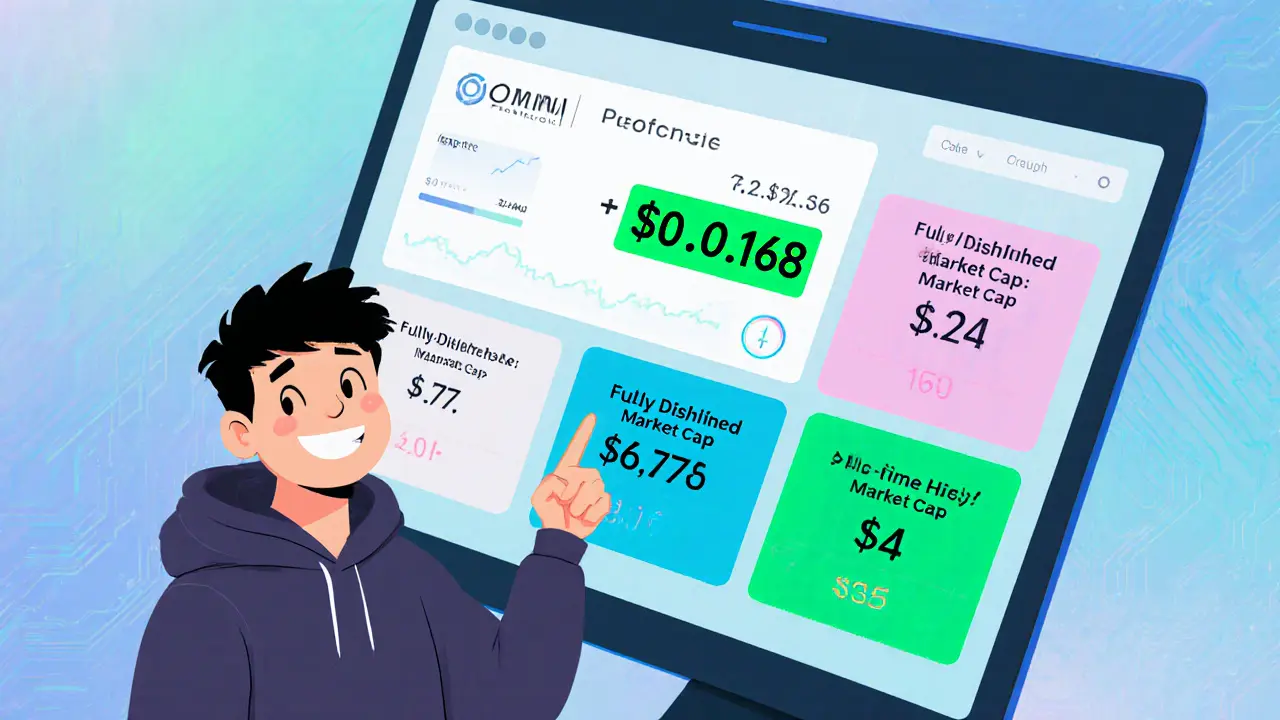

Current Price

Last updated: October 2025

Market Overview

Market Cap

$144,160

Fully Diluted MC

$619,310

All-Time High

$1.77

IEO Price

$0.350

Historical Price Chart

Quick Stats

Contract Address (ERC-20)

0x2e7e487d84b5baba5878a9833fb394bc89633fd7

Contract Address (BEP-20)

0xb53cc8303943582949b9a23f0556b0f0c41fec98

Launch Dates

Ethereum - Nov 23, 2021

BSC - Apr 8, 2024

Key Takeaways

- OMNIA Protocol is a decentralized platform that secures RPC connections and hides DeFi trades from MEV bots.

- The native $OMNIA token powers staking, service discounts, and node security.

- MEV protection uses encrypted mempools and random ordering to stop sandwich attacks.

- Token launch dates: ERC‑20 on Ethereum (Nov2021) and BEP‑20 on BSC (Apr2024).

- Price volatility is high - from $1.77 all‑time high in 2024 to under $0.02 in 2025.

OMNIA Protocol is a decentralized blockchain infrastructure platform that offers private, secure RPC services and built‑in MEV protection for DeFi traders. Founded by cryptography experts Cristian Lupascu and Alexandru Lupascu, the project aims to make blockchain interactions safer without sacrificing speed.

What is OMNIA Protocol?

At its core, OMNIA acts as a middle‑man between your wallet and the blockchain. Instead of sending a transaction directly to a public node, you route it through OMNIA’s RPC (Remote Procedure Call) endpoint. The endpoint does three things:

- Encrypts the transaction so it never appears in the public mempool.

- Orders transactions randomly to stop bots from front‑running.

- Ensures the request reaches the target chain even if gas prices spike or the original node drops it.

This “secure tunnel” is useful for anyone who swaps tokens on a DEX, supplies liquidity, or runs automated strategies. By keeping the trade hidden until it’s confirmed, OMNIA blocks the sandwich bots that would otherwise squeeze you on price.

How does the OMNIA token work?

The native cryptocurrency is simply called OMNIA token and carries the ticker $OMNIA. It has three main jobs:

- Staking: Node operators lock up OMNIA tokens as collateral. If they misbehave (e.g., serve malformed responses), a portion of the stake is slashed.

- Service access: Paying for RPC calls is done in OMNIA. The more requests you need, the larger the subscription plan you buy.

- Discounts & rewards: Token holders enjoy lower fees and earn rewards that are proportional to the amount they stake and the performance of the nodes they support.

Because the token is needed to run honest nodes, attacking the network becomes economically irrational - you’d have to own enough tokens to sabotage it, but the slashing penalties would outweigh any profit.

MEV Protection Explained

MEV (Maximum Extractable Value) is the extra profit that miners, validators, or bots can grab by re‑ordering, inserting, or dropping transactions in a block. In DeFi, the most common form is the “sandwich attack”: a bot sees a large trade, quickly places a buy order before it, then sells right after, pocketing the price difference.

OMNIA’s approach has three layers:

- Encrypted mempool: Transactions are encrypted before they leave your wallet, so they never appear in the public queue where bots scrape data.

- Randomized ordering: Even if a batch of encrypted transactions reaches a validator, the order is shuffled, removing the advantage of timing.

- Private submission: Only the selected validator receives the decoded transaction at the moment of block inclusion, making front‑running practically impossible.

For a regular trader, the result is a smoother price and less unexpected slippage.

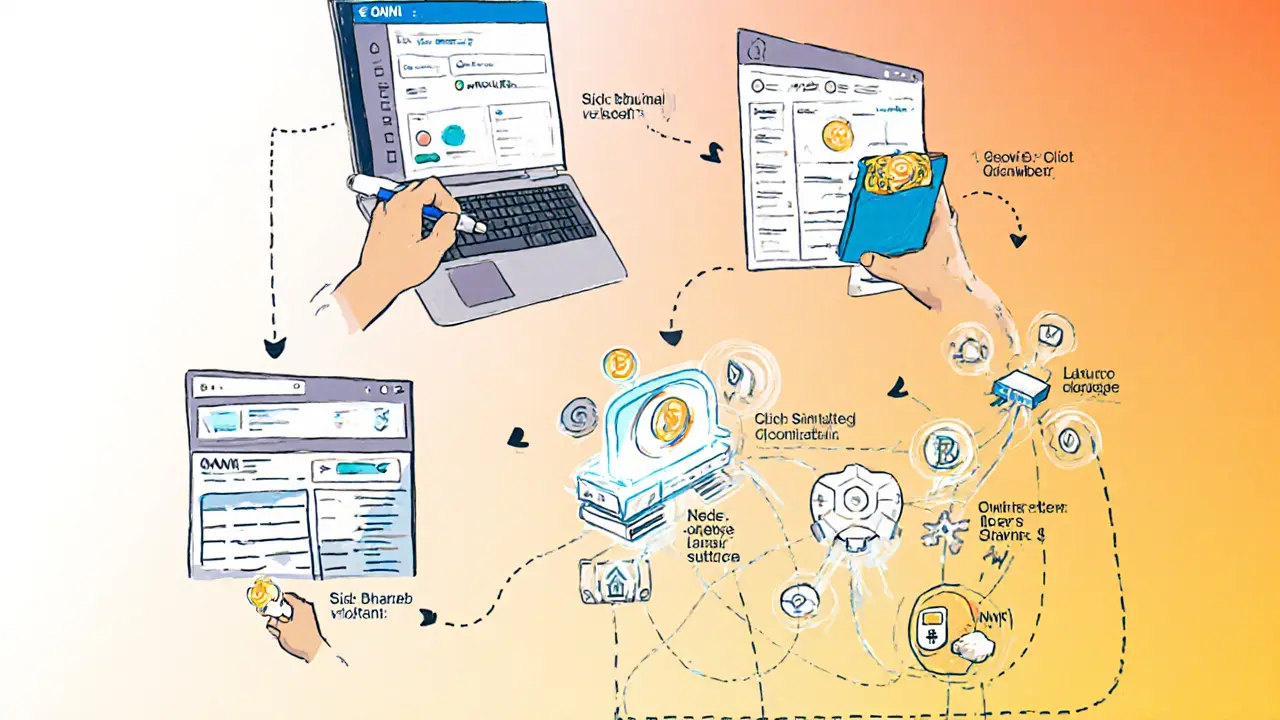

How OMNIA Handles RPC Requests

OMNIA supports both HTTP and WebSocket RPC endpoints for several blockchains. The platform’s dashboard lets you add a new wallet, choose a network (Ethereum, Binance Smart Chain, etc.), and generate a unique endpoint URL. Behind the scenes, the request flow looks like this:

- Your wallet signs a transaction and sends it to OMNIA’s endpoint.

- The endpoint encrypts the payload and forwards it to a pool of vetted nodes.

- Node operators that have staked OMNIA process the request, attach any needed gas adjustments, and broadcast it to the target chain.

- If the transaction fails due to low gas, OMNIA automatically retries with a higher fee, increasing the chance of confirmation.

The service is built on what the team calls a “decentralized physical infrastructure network” (dePIN). In plain terms, the nodes are spread across the globe, reducing the risk of a single point of failure.

Tokenomics & Staking Details

| Attribute | Value |

|---|---|

| ERC‑20 Contract | 0x2e7e487d84b5baba5878a9833fb394bc89633fd7 |

| BEP‑20 Contract | 0xb53cc8303943582949b9a23f0556b0f0c41fec98 |

| Launch Dates | Ethereum - Nov232021; BSC - Apr82024 |

| IEO Price | $0.350 per token (Oct13‑152024) |

| All‑time High | $1.77 (Oct152024) |

| Current Price (Oct2025) | ≈ $0.0178 (source: CoinDesk) |

| Market Cap | ≈ $144,160 |

| Fully Diluted MC | ≈ $619,310 |

Staking rewards are calculated weekly. The more you lock, the higher your share of the pool, but you also commit to a lock‑up period (usually 30‑90days). If a node misbehaves, the protocol slashes a portion of its stake, which is redistributed to honest participants.

Real‑World Use Cases & Adoption

Because OMNIA focuses on privacy and transaction reliability, it’s most appealing to:

- High‑frequency traders who can’t afford MEV‑driven slippage.

- DeFi projects that need guaranteed transaction finality for users.

- Institutional investors looking for compliance‑friendly RPC access.

So far, public adoption numbers are modest - the platform is still early in its rollout and community documentation is limited. However, several niche wallets have added OMNIA as an optional RPC provider, and a handful of DeFi dashboards report reduced transaction failures when routing through OMNIA.

Risks & Things to Watch

Like any crypto project, OMNIA carries risk. The biggest red flags for a potential user are:

- Price volatility: The token has dropped over 98% from its IEO price, making staking rewards highly variable.

- Limited public roadmap: Future milestones are vague, so it’s hard to gauge long‑term development.

- Node centralization risk: If a small number of operators hold the majority of stakes, the network could become less decentralized.

- Regulatory scrutiny: MEV protection can be seen as a form of transaction obfuscation, which regulators might scrutinize in some jurisdictions.

Before committing funds, check the current token price on multiple exchanges, review the latest whitepaper updates, and consider diversifying across different RPC services.

How to Get Started with OMNIA

- Visit the official OMNIA dashboard (search for “OMNIA Protocol dashboard”).

- Create an account using an email or social login.

- Connect your preferred wallet (MetaMask, Trust Wallet, etc.).

- Select the blockchain you want to access (Ethereum, BSC, etc.).

- Generate a private RPC URL and copy it into your wallet’s custom RPC settings.

- If you plan to run a node, stake the required amount of $OMNIA through the “Node Operator” tab.

That’s it - you’ll now send transactions through a protected tunnel that hides your trades from sandwich bots.

Frequently Asked Questions

What chains does OMNIA support?

As of October2025, OMNIA offers RPC endpoints for Ethereum, Binance Smart Chain, Polygon, and several emerging Layer‑2 solutions. New chains are added quarterly.

Do I need to hold $OMNIA to use the service?

No. Anyone can use the free tier, which provides a limited number of requests per day. Holding $OMNIA unlocks higher limits, fee discounts, and staking rewards.

How does OMNIA compare to traditional RPC providers like Infura?

Infura focuses on raw connectivity and scalability, while OMNIA adds built‑in privacy and MEV protection. If you care about hidden transactions and anti‑sandwich features, OMNIA is the better choice; for pure speed and public data, Infura remains popular.

Is staking $OMNIA risky?

Staking rewards are attractive, but they depend on token price and node performance. If the market price collapses or a node is slashed, you could lose a portion of your stake.

What is the future roadmap for OMNIA?

The team has hinted at deeper AI integration for natural‑language transaction queries, support for more Layer‑2 networks, and a governance token upgrade. Exact dates are not yet public.

- Poplular Tags

- OMNIA Protocol

- OMNIA token

- MEV protection

- decentralized RPC

- crypto coin

People Comments

OMNIA’s approach to hiding DeFi trades feels like a fresh breeze for anyone who’s been tired of sandwich attacks. The encrypted mempool and random ordering are pretty clever ways to keep bots guessing.

Wow, the way OMNIA blends privacy with speed is seriously impressive! 🌈💎 It’s not just about protecting your trades, it’s also about giving you peace of mind while you’re swapping tokens. The token‑staking rewards add an extra sparkle to the whole ecosystem. Keep the optimism flowing, folks!

Look, the whole "MEV protection" hype is just marketing fluff until they prove real slippage reductions. If the network is still vulnerable to centralised node operators, it’s nothing but a fancy front.

Maybe, but the encryption of the mempool actually removes the data bots need to launch sandwich attacks. Even if a few nodes hold more stake, the slashing penalties keep them honest.

From a formal standpoint, the protocol’s architecture presents a layered security model wherein each component-encryption, random ordering, and private submission-contributes to a deterrent effect against MEV extraction. Such a construct, while theoretically sound, must be validated through extensive on‑chain testing to ascertain its resilience under adversarial conditions.

Honestly, the token price has tanked so hard that staking rewards feel like a consolation prize. If you’re not already in on it, you might be better off looking elsewhere.

omnia got real potential, but the documenation is kinda thin rn. gr8 if they add more tutorials and community guides. ppl need to see how easy it is to switch rpc.

Alright, let’s break down why OMNIA might actually be worth a second look. First, the encrypted mempool means your transaction never shows up in the public queue where bots normally sniff for large trades. That alone cuts down the surface area for sandwich attacks. Second, the random ordering of transactions adds another layer of uncertainty; even if a validator got a batch of encrypted payloads, they can’t simply prioritize the one that would profit them the most. Third, the private submission to a chosen validator means the final broadcast to the chain happens at the last possible moment, effectively hiding the trade until it’s baked into a block.

Now, consider the staking mechanism. By requiring node operators to lock up OMNIA tokens, the protocol aligns incentives-misbehaving nodes risk having a chunk of their stake slashed, which should theoretically keep the network honest. The reward distribution is proportional to both the amount staked and the performance of the node, so diligent operators get a nice upside.

On the tokenomics side, the current price is low, which might look like a bargain, but remember the all‑time high of $1.77-so volatility is massive. If you’re comfortable with that swing, the high‑yield staking could offset price drops.

Practical usage: the dashboard is fairly straightforward. You create an account, link your wallet, pick your chain (Ethereum, BSC, Polygon, etc.), and generate a private RPC endpoint. Then you paste that URL into your wallet’s custom RPC settings and you’re good to go. For developers, the API docs (though sparse) show how to switch between HTTP and WebSocket endpoints.

Lastly, the ecosystem adoption is still in its infancy. A few niche wallets have integrated OMNIA, and some DeFi dashboards report fewer failed transactions when routed through it. If the community grows and more dApps start offering OMNIA as a native option, network effects could drive both token demand and node participation.

In short, the tech stack is solid, the incentives are aligned, but the market risk is high. If you’re looking for a project that blends privacy with potential yield, it’s worth keeping on your radar, but only allocate what you can afford to lose.

Indeed, the multi‑layered architecture of OMNIA invites a fascinating philosophical discussion on the nature of trust in decentralized systems: does encrypting the mempool merely shift the locus of trust from public transparency to a network of vetted validators? Moreover, the stochastic ordering of transactions may be seen as a probabilistic safeguard, yet one wonders about its statistical robustness under extreme market conditions-perhaps a fertile ground for further empirical study.

The protocol’s whitepaper offers little in terms of rigorous security proofs; without formal verification, the claims remain speculative. Additionally, the token’s market cap of merely $144k raises concerns about liquidity and price manipulation. Investors should demand more transparent roadmaps and audited code before committing.

While the concerns are valid, it’s also worth noting that early‑stage projects often iterate rapidly. Constructive feedback from the community could help OMNIA refine its roadmap and address the transparency gaps.

Sure, sure-another “revolutionary” layer‑2 solution that probably won’t get past the testnet.

Honestly, if you think OMNIA is the next big thing, you’re drinking the hype juice a little too fast. The token’s price plummeted, and the community looks more like a ghost town than a bustling forum. Maybe wait for real adoption before shouting from the rooftops.

From a procedural standpoint, the documentation provided by the development team appears insufficient for comprehensive third‑party integration. A more thorough technical specification, including API rate limits and failure handling mechanisms, would be advisable for enterprises seeking to adopt the service.

Encryption hides the trade, but you still need trust in the validator.

Great rundown! 👍 Keep an eye on how the staking rewards evolve as the network grows.

Sounds good but the price is too low for me to care.

In reviewing the OMNIA protocol, one must consider the tokenomics matrix, specifically the dilution factor relative to the projected staking velocity and the stochastic network latency distribution inherent in decentralized RPC architectures. The cryptographic nonce management – leveraging elliptic curve signatures – aligns with industry best practices, yet the lack of formal verification of the smart‑contract escrow logic introduces a non‑trivial attack surface. Furthermore, the economic incentive model presupposes a sufficient liquidity depth to sustain slashing penalties without inducing a deflationary spiral, which is questionable given the current market cap of $144 k. A layered approach to risk assessment, incorporating both on‑chain telemetry and off‑chain governance metrics, will be essential for stakeholders assessing long‑term viability.

Wow, that was a mouthful! 😅 But you nailed the key points: the math needs to work, and the governance mechanisms have to be transparent. If they can pull it off, there’s real potential here.

OMG, the drama of the token’s rise and fall could rival a reality TV show! 🎭 The encryption tech is like a ninja, slipping past the bots, while the staking rewards are the glittering prize at the end of the tunnel. If you can stomach the volatility, it might just be the epic saga you’ve been waiting for.

We need more American‑made crypto solutions that protect users from predatory bots. OMNIA looks like a step in the right direction, especially with its focus on privacy and security. Let’s push this tech forward.

Honestly, this project is a mess. The token’s price is a joke, the roadmap is vague, and the community is practically nonexistent. I’d give it zero stars if I could.

Even though there are risks, I’m hopeful that OMNIA can carve out a niche for privacy‑focused traders. It’s worth keeping an eye on future updates and community growth.

Curious to see how OMNIA’s developer tools evolve-especially if they introduce SDKs for seamless integration. 🤔 If they can lower the barrier for dApp developers, adoption could really take off!