Mexican Crypto Regulation Checker

Select entity type and service, then click "Check Regulations" to see what's allowed.

Traditional Banks

Restricted by Banxico's Rule 4/2019 from offering crypto services to customers.

Not AllowedFintech Platforms

Can register with CNBV for limited services, but no direct custody or public exchanges.

Limited PermissionCrypto Lenders

Operate in a regulatory grey zone under AML rules but lack specific licenses.

UnregulatedKey Regulatory Points:

- Banxico's Rule 4/2019 prohibits banks from providing crypto services

- Fintechs need CNBV registration for limited virtual asset services

- Crypto lenders operate under AML vulnerable activity rules

- Project Agorá aims to launch CBDC by end of 2025

- Crypto gains taxed as income from sale of goods

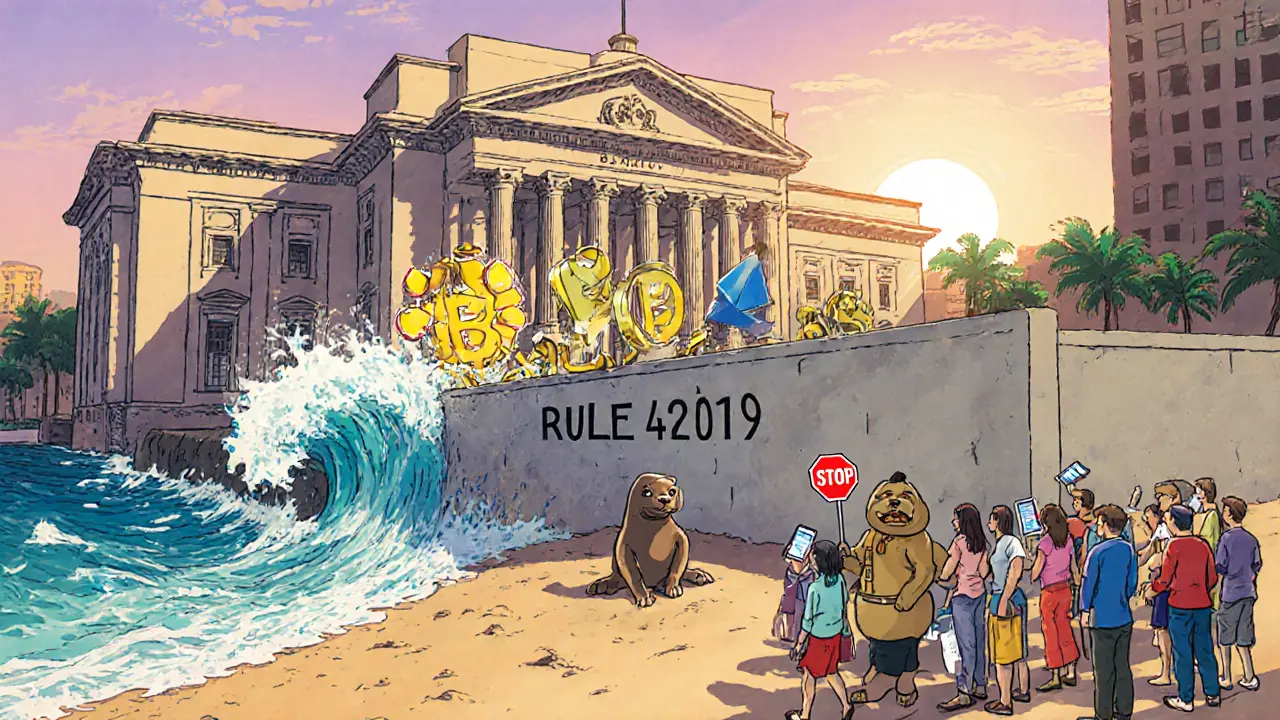

Mexico’s banks want to dip their toes into crypto, but a web of rules keeps them on the shore. If you’re a banker, fintech founder, or crypto‑enthusiast trying to understand why you can’t offer Bitcoin trading in a Mexican branch, this guide breaks down the key regulations, the agencies that enforce them, and what’s on the horizon.

TL;DR

- Banxico’s Rule4/2019 bans banks from providing any crypto‑related service to customers.

- Fintech Law (2018) defines virtual assets but does not grant banks a licence to handle them.

- Crypto lenders operate in a gray area, subject only to AML reporting.

- Banxico is piloting a CBDC (ProjectAgorá) slated for release by end‑2025.

- Tax treatment follows general income‑tax rules; profits are treated as sale of goods.

Regulatory Architecture: Who’s In Charge?

Bank of Mexico (Banxico) is the primary regulator for cryptocurrency activities. Its mandate focuses on financial stability, AML compliance, and oversight of digital‑asset transactions. National Banking and Securities Commission (CNBV) handles licensing for fintech firms and monitors any entity that wishes to deal with virtual assets. The Ministry of Finance and Public Credit (SHCP) enforces tax rules and AML reporting thresholds.

These three bodies share responsibility, but each has a distinct slice of the pie:

- Banxico: Sets the rules for how banks can (or cannot) interact with crypto.

- CNBV: Grants registration to fintech platforms that want to offer limited virtual‑asset services.

- SHCP: Collects taxes on crypto‑related gains and requires AML filings.

Fintech Law (2018): The Foundation

The Fintech Law introduced the term “virtual assets” and clarified that they are not legal tender. While the law opened a regulatory doorway for fintech startups, it stopped short of creating a banking‑grade licence for crypto services. As a result, traditional banks remain bound by older banking statutes plus the newer crypto‑specific rules.

Banxico’s Rule4/2019: The Hard Stop for Banks

Rule4/2019 explicitly forbids banks and electronic‑payment platforms from offering custody, exchange, or transmission of virtual assets to the public. The rule does allow limited internal use-such as using blockchain for inter‑bank settlement-but only after a prior authorization, which to date has never been granted. The practical upshot? No Mexican bank can legally let a customer buy Ethereum or hold crypto in a savings account.

Because the rule caps the authorization window at about sixty banking business days, many institutions simply abandon any crypto‑related project before submitting an application, knowing the odds of approval are near zero.

CNBV Registration: What Fintechs Can Do

Fintech firms can register with the CNBV to offer limited virtual‑asset services, but they must meet strict AML and KYC requirements. The registration process typically takes 45‑60 days, after which the platform may provide:

- Information portals that display crypto market data.

- Back‑office tools for internal settlement using blockchain.

- Limited token‑sale facilitation, provided no direct custody is involved.

Even then, they cannot act as a “crypto bank” for retail users.

Crypto Lending in the Grey Zone

Crypto‑backed lending platforms operate largely outside the traditional banking supervision. The 2023 AML Law classifies loan‑offering by non‑financial entities as a “vulnerable activity,” meaning providers must:

- Identify clients with the same KYC standards used by banks.

- File suspicious‑activity reports with the SHCP once transaction thresholds are crossed.

- Display clear disclaimers stating the service is not regulated by Banxico or CNBV.

Because there is no specific licence for crypto lending, these platforms sit in a regulatory blind spot. They can still be shut down if the authorities deem their activities to pose AML or consumer‑protection risks.

CBDC and ProjectAgorá: A Shift in Tone?

While private crypto is tightly shackled, Banxico is rolling out its own digital currency. Central Bank Digital Currency (CBDC) under the name “Digital Peso” is being piloted through ProjectAgorá. Expected by the end of 2025, the CBDC aims to broaden financial inclusion and showcase blockchain’s efficiency benefits.

The project signals a nuanced stance: the state wants control over digital money, but it does not want private banks to dilute that control with unchecked crypto services.

Tax Treatment: Income From the Sale of Goods

Mexico lacks a dedicated crypto tax code. The 2021 Tax Ombudsman clarified that crypto gains are taxed as income from the sale of goods. That means:

- Individuals must report profits on their annual ISR (Income Tax) return.

- Businesses treating crypto as a payment method must recognize revenue at fair market value on the transaction date.

- There is no specific withholding tax on crypto trades, but standard ISR rates (up to 35%) apply.

Failure to report can trigger audits and penalties under the general tax law.

BaselIII and the Wider Banking Landscape

Mexican banks are also adjusting to BaselIII capital and liquidity standards. By 2025, they must keep a total capital ratio of 10.5% and meet additional buffers for systemically important banks (0.6%‑2.25%). These requirements limit the appetite for high‑risk activities-including untested crypto ventures-because such activities attract higher capital charges.

Combined with strict related‑party transaction caps and leverage limits, the BaselIII framework reinforces the regulatory caution evident in Rule4/2019.

Comparison Table: What Different Players Can Do

| Entity | Can Offer Crypto Custody? | Can Provide Exchange Services? | AML/KYC Obligations | Licensing Needed |

|---|---|---|---|---|

| Traditional Banks | No (Rule4/2019) | No (Rule4/2019) | Full banking AML regime | Banking licence only |

| Registered Fintech Platforms | Limited (no direct custody) | Limited (no public exchange) | CNBV‑mandated AML/KYC | CNBV registration |

| Crypto Lending Providers | Typically self‑custody (unregulated) | Usually not an exchange | AML reporting under SHCP vulnerable‑activity rules | No specific licence |

Practical Next Steps for Stakeholders

For banks: Focus on internal blockchain pilots that improve settlement speed rather than retail crypto services. Prepare detailed authorization requests if Banxico ever relaxes Rule4/2019.

For fintech startups: Secure CNBV registration, build robust KYC/AML pipelines, and stay within the “no‑custody” limit. Consider partnering with licensed payment processors for fiat‑on‑ramp services.

For crypto lenders: Implement the AML‑vulnerable‑activity checklist, publish clear user disclosures, and monitor SHCP reporting thresholds. Treat the business as a fintech‑adjacent service rather than a bank.

For investors: Evaluate the regulatory risk premium. Projects aligned with ProjectAgorá or that offer tokenised assets without direct custody may face fewer legal hurdles.

Frequently Asked Questions

Can a Mexican bank offer Bitcoin trading to its customers?

No. Banxico’s Rule4/2019 expressly bans banks from providing custody, exchange, or transmission services for virtual assets to the public.

What licensing does a fintech need to handle crypto?

Fintech firms must register with the CNBV and comply with its AML/KYC standards. The registration process typically takes 45‑60 days.

Are crypto‑based loans regulated in Mexico?

They fall under the AML Law’s “vulnerable activity” category. Providers must perform client identification, file reports with the SHCP, and disclose that they are not supervised by Banxico or CNBV.

When will Mexico’s CBDC be available?

ProjectAgorá aims to launch the digital peso by the end of 2025, following pilot testing with select commercial partners.

How are crypto profits taxed in Mexico?

Profits are treated as income from the sale of goods and are subject to the regular ISR rates, up to 35% for individuals.

In short, Mexico’s banking world is tightly cordoned off from crypto, while the government pushes its own digital currency and lets fintechs walk a narrow, heavily regulated path. Keeping an eye on Banxico’s upcoming policy tweaks and the progress of ProjectAgorá will be key for anyone planning to operate in this space.

People Comments

The banking elite are clutching their pearls while the rest of us are left to drown in a sea of red tape.

While many hail Mexico's regulatory framework as progressive, it in fact erects unnecessary barriers that stifle innovation and contradict the very spirit of monetary freedom.

The whole document reads like a textbook for bureaucrats who love to complicate simple financial services with layers of pointless compliance.

Hey folks, love how this guide breaks down who can do what-it's like a roadmap for anyone wanting to dip a toe into Mexico's crypto scene!

Wow, what an exhilarating deep‑dive into Mexico’s crypto labyrinth! The way Banxico’s Rule 4/2019 slams the door shut on banks feels like watching a heavyweight champion refuse a challenger. Meanwhile, fintech pioneers get a teeny‑tiny window, but only if they promise not to actually hold anyone’s digital gold. I love how the guide spells out that crypto lenders operate in a grey zone, forced to dance around AML rules like a nervous ballerina. The tax section is a masterclass in how governments can turn a simple trade into a bureaucratic nightmare. Seeing the CBDC project labeled as Project Agorá gives a glimmer of hope that a state‑backed digital peso might finally give the market a stable anchor. But the reality is that every entity-from banks to crypto lenders-must bow to a trio of regulators who love to intersect their jurisdictions. The table comparing custodial permissions is pure gold, making the differences crystal clear for any curious reader. For banks, the message is unmistakable: stay away from crypto or risk heavy capital penalties under Basel III. Fintechs, on the other hand, can flirt with token sales, just don’t get too cozy with actual custody. Lenders can self‑custody, but they must keep an eye on the AML vulnerable‑activity thresholds or face a swift crackdown. What truly shines is the practical next‑steps section, urging banks to pilot internal blockchain projects instead of chasing retail crypto wallets. Fintech startups get a roadmap too, with a clear call to secure CNBV registration before dreaming of full‑scale exchanges. Investors are reminded to price in a regulatory risk premium, especially when dealing with projects that might clash with Banxico’s iron‑clad rules. Overall, this guide turns a tangled regulatory jungle into an accessible, colorful map that even a newcomer can navigate with confidence.

Listen up, this whole crypto ban is a joke and anyone still buying into it is wasting their time.

Banks should not handle crypto.

The comprehensive nature of this analysis underscores the necessity for financial institutions to align their strategic initiatives with the prevailing regulatory climate, thereby mitigating exposure to punitive measures while fostering sustainable innovation.

Honestly, I think all this hype about regulation is just a smokescreen for the real power players.

Thsi guide is super helpful, but i think it could use more real world exampels.

Briana, you nailed the bureaucracy vibe-let me add that many firms actually struggle to interpret overlapping CNBV and Banxico guidelines, so a clear compliance checklist is crucial.

Emma, your enthusiastic overview is delightful; however, one must consider that the regulatory landscape, while colorful, remains fraught with ambiguities, inconsistencies, and potential enforcement challenges, which could deter even the most adventurous investors.

The document fails to address the fundamental flaw that the regulatory apparatus is fundamentally reactive rather than proactive, resulting in a perpetual lag behind market developments.

I appreciate the thoroughness of this piece; still, it would benefit from a deeper exploration of how consumer protection measures could be integrated into the current framework.

Great, another guide telling us banks can't touch crypto-just what we needed.

Vijay, your point about compliance checklists is spot on; in the grand scheme, clarity in regulation is the bedrock of financial trust.

You’ve got this! Keep digging into the details, and you’ll master the landscape 😊

Mexico must stop hurting its own economy with these pointless crypto bans.

From a macro‑regulatory perspective, the confluence of AML directives, Basel III capital adequacy requirements, and the nascent CBDC architecture engenders a multidimensional compliance matrix that necessitates robust governance frameworks.

Stay focused and keep pushing forward-regulation is just another hurdle we’ll jump over! 💪

This guide is a beacon in the dark fog of uncertainty, illuminating every twist and turn for those brave enough to venture into Mexico’s crypto frontier!

Let’s be honest, the crypto ban is hurting everyday users, and it’s high time policymakers rethink their stance.

All in all, solid info-thanks for breaking it down in plain English.