Russian crypto risks: What you need to know before trading or investing

When it comes to Russian crypto risks, the legal, financial, and operational dangers faced by individuals and businesses engaging with cryptocurrency in Russia. Also known as crypto crackdown Russia, it’s not just about government warnings—it’s about frozen bank accounts, seized hardware, and jail time for simple wallet usage. Unlike places where crypto is ignored or lightly taxed, Russia has shifted from early tolerance to active suppression, especially after 2022 sanctions and the war in Ukraine.

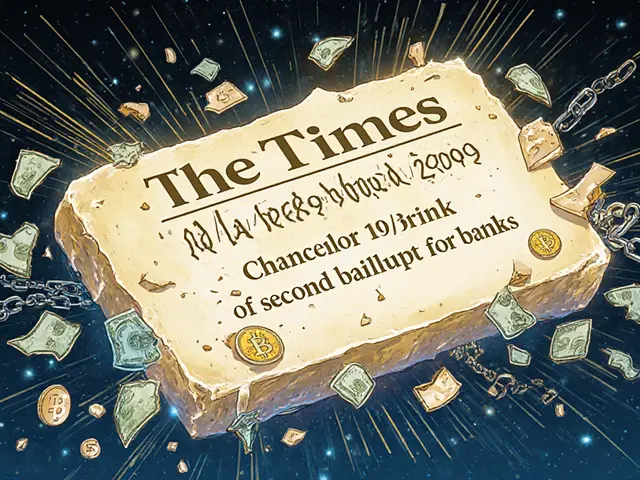

One major crypto regulation Russia, the legal framework that restricts cryptocurrency use as a payment method while allowing mining under strict conditions makes it illegal to use Bitcoin or Ethereum to pay for goods or services. But here’s the twist: mining is still allowed—if you register with the state and pay heavy energy taxes. The government doesn’t want you spending crypto, but it’s fine if you’re turning electricity into digital coins for export. Meanwhile, crypto sanctions Russia, international financial penalties targeting Russian entities using crypto to bypass Western banking restrictions have made it nearly impossible for Russian exchanges to connect to global liquidity pools. Wallets that once worked with Binance or Coinbase now get flagged, frozen, or outright blocked.

And it’s not just about rules—it’s about enforcement. In 2023, Russian authorities raided homes looking for mining rigs, confiscated laptops with crypto wallets, and fined people for using peer-to-peer apps like LocalBitcoins. There’s no official ban on holding crypto, but if you’re caught transferring it abroad or using it to buy foreign goods, you could face criminal charges. Even using a VPN to access a foreign exchange isn’t safe—Russian ISPs now monitor traffic patterns linked to crypto platforms. The crypto taxes Russia, the complex and inconsistently applied tax regime on crypto gains, mining income, and foreign transfers adds another layer: if you report your gains, you risk drawing attention. If you don’t, you risk prosecution.

What does this mean for you? If you’re in Russia, you’re playing a high-stakes game with no safety net. If you’re outside Russia and trading with Russian users, you’re exposing yourself to compliance nightmares and potential sanctions violations. Even a simple airdrop claim from a Russian wallet could trigger a red flag in global AML systems. The posts below break down real cases, show how people are adapting, and reveal which platforms are still accessible—and which ones will get you in trouble. You’ll find reviews of exchanges that still work in Russia, guides on how miners are staying legal, and warnings about scams targeting desperate users. This isn’t theory. This is what’s happening right now.