If you're in Russia and thinking about using a crypto exchange, you need to know which ones could land you in serious trouble. It’s not just about losing money - it’s about risking your freedom. Since early 2025, Russian authorities have been aggressively targeting unlicensed crypto platforms, and the crackdown isn’t slowing down. Hundreds of users have already lost access to their funds, and some are facing criminal charges. The exchanges you should avoid aren’t just unreliable - they’re legally dangerous.

Why Some Exchanges Are Deadly for Russian Users

Not all crypto exchanges are created equal, especially for people living in Russia. While owning cryptocurrency isn’t illegal, using certain platforms can trigger investigations under Article 193.1 of the Russian Criminal Code - which deals with illegal currency transactions. The real danger comes from exchanges that help users bypass Russia’s capital controls or launder money for sanctioned entities. The Bank of Russia has made it clear: any platform not licensed under the country’s experimental legal regime is high-risk. These unlicensed exchanges often operate through offshore shell companies in places like Hong Kong, Georgia, or the UAE. They don’t report transactions to Rosfinmonitoring, Russia’s financial monitoring service. That might sound convenient, but it’s exactly what makes them targets for police raids. In October 2024, Russian security services raided over a dozen locations and seized more than $10 million in cash and crypto. The targets? Operators and users of platforms linked to money laundering. One major player in this network was Garantex - and its successor platforms like Grinex and Exved. These weren’t just shady businesses. They were key nodes in a system used to move billions of rubles out of Russia, often tied to ransomware, darknet markets, and sanctions evasion.The Big Three: Garantex, Exved, and Grinex

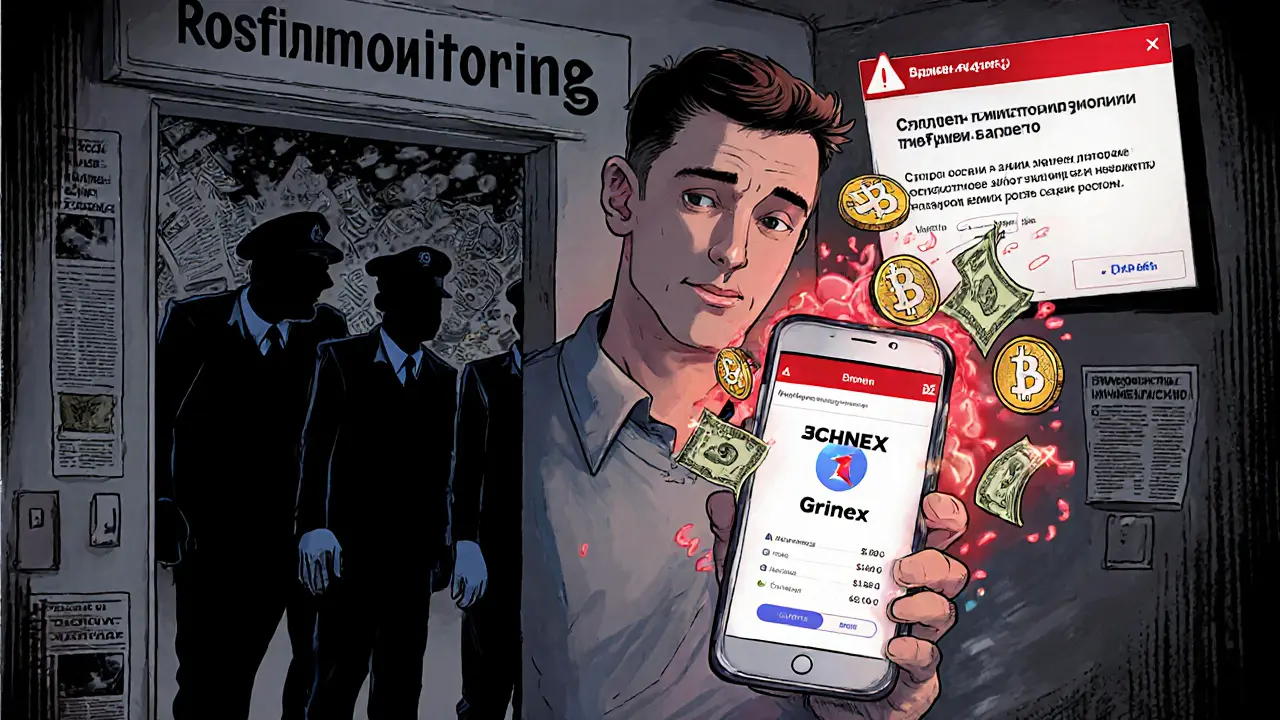

If you’ve heard of Garantex, you should know it’s officially sanctioned by the U.S. Treasury’s OFAC. In April 2022, the U.S. government named Garantex for helping ransomware groups like Hive move money. Chainalysis later found that 68% of its transaction volume was linked to criminal activity - including 12 major darknet markets and seven ransomware variants. Garantex shut down in 2024, but its team didn’t disappear. They simply rebranded. Exved and Grinex emerged as its direct successors, run by the same people, including Sergey Mendeleev - the original architect behind Garantex. These new platforms still use the same tricks: minimal verification (sometimes just a phone number), fast transfers, and hidden ownership. Grinex, for example, operates heavily through Telegram. Users deposit rubles, and within minutes, they receive USDT or other crypto sent overseas. No paperwork. No questions. Sounds easy, right? But here’s the catch: when Russian banks trace those ruble transfers back to Alfa-Bank accounts linked to Hong Kong-based companies like Feilian Limited, the entire chain gets flagged. And when the crackdown came in March 2025, thousands of Grinex users woke up to frozen accounts and zero customer support. Exved, meanwhile, processed over 2 billion rubles monthly through Alfa-Bank, disguising crypto flows as legitimate import-export payments. The U.S. Department of Justice indicted Exved’s leadership in March 2025 for facilitating over $500 million in illicit transactions. Russian courts have since started prosecuting users who transferred more than 50,000 rubles through these platforms - yes, even small amounts can trigger criminal investigations.

What Happens When You Use These Exchanges?

It’s not just about losing your crypto. Real people have faced real consequences. On Russian forums like Dvach and RuTracker, users report the same nightmare: deposit rubles, get crypto, try to withdraw - and then everything vanishes. One user, CryptoPatriot_88, lost 1.2 million rubles after Grinex froze accounts during the March 2025 takedown. He sent daily messages for three weeks. No reply. Trustpilot reviews for Grinex average just 1.2 out of 5 stars. Common complaints: “No withdrawals after depositing,” “Account disappeared overnight,” “No contact info.” On Reddit’s r/RussianCrypto, 87% of 1,243 respondents said they’d never use an unlicensed exchange again after the 2025 crackdowns. And it’s not just financial loss. Russian police have started visiting homes of frequent users. Based on bank transaction data, authorities can identify individuals who regularly moved money through these platforms. In some cases, users were detained for questioning under suspicion of aiding illegal currency operations. The Ministry of Finance confirmed in September 2025: users of unlicensed exchanges have no legal recourse if their funds are seized or frozen.Why These Exchanges Still Exist (And Why They’re Still Tempting)

You might wonder: if they’re this risky, why do people still use them? The answer is simple: speed and access. Licensed Russian exchanges require users to be “especially qualified investors” - meaning at least 6 million rubles in assets. That’s out of reach for most. Unlicensed platforms, on the other hand, let anyone sign up with a phone number and a passport photo. Transactions happen in minutes, not days. For people trying to send money abroad, pay for overseas services, or protect savings from inflation, it feels like the only option. But here’s the math: sanctioned exchanges process 30-40% faster than compliant ones - because they skip all AML checks. That speed is a trap. It’s not efficiency; it’s recklessness. And when the government moves in, you’re the one who pays. Market data shows these platforms still handle 15-20% of Russia’s crypto volume, even though they make up only 5% of available options. That’s because they fill a gap - but at a deadly cost. After the March 2025 Garantex takedown, trading volume on these platforms dropped by 78%. That’s not a coincidence. It’s enforcement.

What’s Coming Next: New Laws and Tighter Controls

The Russian government isn’t done. In September 2025, the State Duma introduced Draft Bill No. 45876-8, which would make using unlicensed crypto exchanges a criminal offense. First-time offenders could face fines up to 1 million rubles. Repeat offenses? Jail time. The Ministry of Finance is also pushing to lower licensing requirements - but only for exchanges that serve sanctioned international trade. That means even if you’re trying to pay for foreign goods legally, you still need to use a platform that reports everything to Rosfinmonitoring. No exceptions. International pressure is growing too. The U.S. State Department is offering up to $5 million for information leading to the arrest of Garantex’s top executives. Rosfinmonitoring now shares crypto transaction data with FATF members - meaning Russian users’ activity is being monitored by global agencies. By Q2 2026, analysts predict 90% of Russians will stop using these high-risk platforms. The only ones left will be those who don’t understand the risks - or those who think they won’t get caught.What to Do Instead

If you need to use crypto in Russia, there are safer paths - but they’re not glamorous. First, stick to platforms licensed under Russia’s experimental legal regime. They’re few - only about a dozen - but they’re legal. They require more paperwork, longer verification, and higher thresholds. But they also protect you. Second, avoid anything that operates through Telegram. No legitimate exchange uses private channels for onboarding. If it asks for your passport photo in a DM, walk away. Third, never use an exchange that doesn’t disclose its legal entity or location. If you can’t find a registered company name, address, or license number - it’s not worth the risk. And finally, remember this: if it sounds too good to be true - fast transfers, no ID, no limits - it’s probably a trap. The cost isn’t just financial. It’s legal. It’s personal. And it’s irreversible.Is it illegal to own cryptocurrency in Russia?

No, owning cryptocurrency is not illegal in Russia. Federal Law No. 114-FZ, effective since January 2021, allows individuals to hold and trade digital assets. However, using crypto for domestic payments is banned, and only licensed exchanges can legally facilitate transactions under the experimental legal regime. The risk comes from using unlicensed platforms that violate capital control laws.

Can I get arrested for using Garantex or Grinex?

Yes. Russian authorities have already arrested exchange operators and are now targeting users who transferred significant amounts through sanctioned platforms. Under Article 193.1 of the Russian Criminal Code, individuals involved in illegal currency transactions can face up to 7 years in prison. Even small transfers - as low as 50,000 rubles - have triggered investigations. Police raids have targeted residential addresses based on bank transaction records.

What happens if my funds are frozen on an unlicensed exchange?

If your funds are frozen on an unlicensed exchange like Grinex or Exved, you have no legal recourse. The Russian Ministry of Finance confirmed in September 2025 that users of unlicensed platforms are not protected by law. Customer support is often non-existent, and recovery is nearly impossible. Most users report losing 100% of their deposits after platform takedowns.

Are there any legal crypto exchanges in Russia?

Yes, but they’re limited. Only 12 exchanges are licensed under Russia’s experimental legal regime. These platforms require users to meet strict criteria, such as being classified as “especially qualified investors” with at least 6 million rubles in assets. They report all transactions to Rosfinmonitoring and comply with AML rules. While they’re slower and more restrictive, they’re the only safe option under current law.

Why do people still use banned exchanges like Exved?

People use them because they’re fast, easy, and bypass Russia’s strict capital controls. Licensed exchanges take days to verify users and require large minimum balances. Unlicensed platforms like Exved and Grinex sign you up in minutes with just a phone number. They let you send money abroad without paperwork - but at the cost of legal safety. Many users don’t realize the risks until it’s too late.

Will these banned exchanges come back?

The major platforms like Garantex, Grinex, and Exved are unlikely to return in their current form. Russian authorities have seized servers, arrested operators, and are prosecuting users. However, decentralized alternatives - especially Telegram-based crypto bots like MKAN Coin - may persist. These operate without central servers, making them harder to shut down. But they’re still illegal, and using them still carries the same legal risks.

People Comments

This is wild. I can't believe people still use these platforms. One wrong move and you're in jail. No thanks.

Just say no.

Period.

It is imperative to underscore that the legal ramifications associated with the utilization of unlicensed cryptocurrency exchanges in the Russian Federation constitute a direct violation of Article 193.1 of the Russian Criminal Code. The implications thereof are both severe and non-negotiable. One must exercise due diligence in all financial undertakings, particularly in jurisdictions characterized by stringent capital controls.

Compliance is not optional; it is obligatory.

Brooo, this is such a wake-up call! 😳 I live in India and I thought crypto was all about freedom - turns out, everywhere has rules, just different flavors!

Grinex on Telegram? Nah man, that’s like trusting a stranger with your house keys. 🚫

But hey, I get it - when inflation eats your salary, you look for loopholes. Still… not worth it. Stay safe, stay legal! 💪

Ugh. Another ‘crypto is dangerous’ article. Newsflash: everything’s dangerous if you’re dumb.

Why are we even talking about this? Just use Binance. Done.

Can we move on now?

Hey guys, i read this and it made me think - i know a guy in moscow who used exved for 2 years, sent like 15lakh rubles, never got caught. He says they changed their ip every week and used vpn + fake id. But he also said the app kept crashing and support never replied after march 2025. So… maybe not worth the risk? 🤔

Also, typo: garanex not garanex. lol

There’s a real human cost here that gets buried under the legal jargon. People aren’t criminals - they’re parents trying to pay for their kid’s meds abroad, or freelancers getting paid in crypto because their bank blocks international transfers.

Yes, the platforms are sketchy. But the system is rigged. You need 6 million rubles just to play nice? That’s not regulation - that’s exclusion.

Let’s not punish the desperate just because the government failed to build real alternatives.

So if I own crypto but don't use these exchanges, I'm fine? 😅

What about peer-to-peer trades? Like localbitcoins-style? Is that legal? Asking for a friend… who might be thinking about it 😬

While the risks associated with unlicensed cryptocurrency exchanges are clearly articulated in this piece, it is equally important to recognize the structural inequities that compel individuals toward such platforms.

Legal compliance cannot be expected in the absence of accessible, affordable, and functional alternatives.

Policy must evolve to include inclusion - not just enforcement.

Russia should shut down every single crypto exchange. Full stop. No exceptions. Foreign money is poison. Our ruble is sacred. If you want to gamble, go to Vegas. Don’t use our country as a laundering hub. These users deserve what they get. No sympathy.

Lock them up.

Okay, real talk - I used to think crypto was just about making money.

Now I see it’s about survival. People aren’t using Grinex because they’re criminals - they’re using it because the system gave them no other way out.

Yes, it’s risky. But what’s riskier? Losing your savings to inflation… or risking jail?

That’s not a choice. That’s a trap.

And the government? They built the trap. Then blamed the people for falling in.

Time to fix the system, not just punish the victims.

Bro this is so real 🤯

My cousin in Moscow used Grinex for 6 months - sent 200k rubles to buy USDT to pay for his sister’s surgery abroad. Then poof - everything vanished. No call, no email, no nothing.

Now he’s working 3 jobs to pay off the debt.

Don’t do it. Seriously.

❤️

The legal framework in Russia is clear. The risks are documented. The consequences are severe. There is no ambiguity in this matter.

Using unlicensed platforms is a violation of national law.

It is not a gray area. It is a red line.

Respect the law.

I… I just don’t know what to say.

It’s so sad.

People are just trying to survive.

And they’re being treated like criminals.

It’s not fair.

It’s not right.

And it’s going to get worse.

Why can’t we help them?

Why punish the people?

Why not fix the system?

Why?

Why?

Why?

...

While the moral and legal implications of using unlicensed exchanges are deeply concerning, the underlying socioeconomic pressures that drive individuals toward such platforms must not be dismissed as mere negligence.

Policy makers must recognize that financial exclusion is not a victimless crime.

Enforcement without equity is tyranny disguised as order.

Look, I get why people use these platforms - I really do.

But here’s the thing: you don’t have to be a millionaire to stay safe.

Start small. Learn the licensed ones. Even if it takes 3 days to verify, it’s better than 3 years in jail.

And if you’re scared? Talk to someone. Ask questions. Don’t just trust a Telegram bot.

You’re smarter than the scam. Prove it.

As a cultural anthropologist studying financial behavior in post-sanction economies, I find this case study fascinating.

These platforms aren’t just financial tools - they’re social artifacts of resistance, adaptation, and digital diaspora.

Their rise reflects the collapse of trust in state-backed financial infrastructure.

And while their methods are legally dubious, their emergence is sociologically inevitable.

Shutting them down without replacing them is like removing oxygen from a room and blaming the people for gasping.

What’s next? Criminalizing VPNs? 😅

Let’s not mistake survival for sin.

Honestly? I’m just here for the drama.

But also… kinda scared now.

Thanks for the info, I guess.

Man, this hits different.

I’m from Nigeria - we’ve had our own crypto crackdowns.

Same story: slow banks, no access, people turn to P2P.

But here’s the truth - the real enemy isn’t the user.

It’s the system that leaves them no choice.

We need solutions, not scares.

Let’s build bridges, not walls.

One must question the intellectual maturity of those who would willingly engage with entities that have been formally sanctioned by the U.S. Treasury and identified by Chainalysis as conduits for ransomware. The conflation of convenience with legitimacy is the hallmark of the financially naive.

One does not become an expert by ignoring warnings - one becomes a statistic.