CremePie Swap: What It Is, How It Works, and What You Need to Know

When you hear CremePie Swap, a decentralized exchange built for quick, low-cost token swaps on blockchain networks. Also known as a DeFi swap protocol, it lets users trade crypto directly from their wallets without needing a central authority. Unlike big exchanges like Binance or Coinbase, CremePie Swap runs on smart contracts—code that automatically executes trades when conditions are met. That means no sign-ups, no KYC, and no middleman taking a cut. But it also means you’re fully responsible for what happens next.

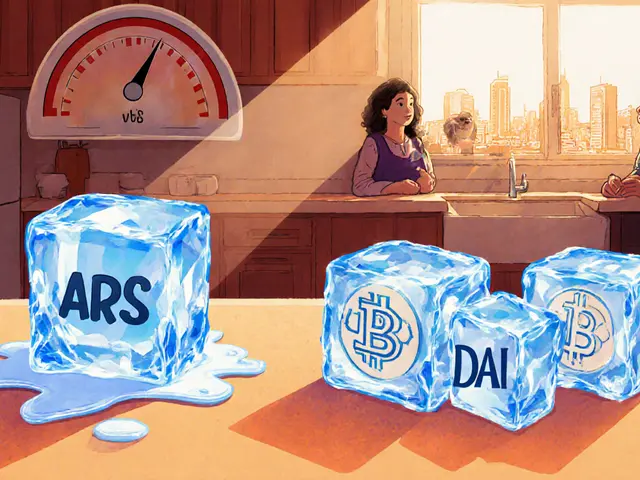

It’s part of a bigger trend: DeFi protocols, blockchain-based financial tools that replace banks and brokers with automated systems. Think of them as apps for money, built on open networks like Ethereum or BSC. CremePie Swap fits right in with others like Uniswap or PancakeSwap, but it often targets niche tokens or new projects that bigger platforms ignore. That’s both a strength and a risk. You might find early-stage coins here before they hit major exchanges—but you might also stumble into scams with no team, no audit, and no way back.

What makes CremePie Swap stand out? It’s not the tech—it’s the speed and cost. Most swaps on this platform take under 30 seconds and cost less than a dollar in gas fees. That’s why it’s popular among traders who move fast and trade small. But here’s the catch: low fees don’t mean low risk. Many tokens listed here have zero liquidity, fake volume, or are just memecoins with no real use. If you swap into one, you might not be able to swap back out. And if the contract has a backdoor? Your funds could vanish overnight.

Behind every swap is a liquidity pool, a reserve of two tokens locked in a smart contract to enable trading. When you trade on CremePie Swap, you’re not buying from someone else—you’re trading against this pool. The price moves based on supply and demand inside it. If a token gets dumped hard, the pool can’t keep up. That’s when you see 90% price drops in minutes. That’s not a glitch—it’s how these systems work.

Some users think CremePie Swap is a place to get rich quick. Others use it to test new tokens before investing real money. Either way, you need to know what you’re doing. Check the contract address. Look for audits—even if they’re old. See if the liquidity is locked. And never invest more than you’re willing to lose. Most of the tokens you’ll find here aren’t listed on CoinMarketCap or CoinGecko. That’s not a bug; it’s a warning.

What you’ll find below are real breakdowns of projects that used CremePie Swap—or got caught up in its ecosystem. From tokens that vanished overnight to ones that quietly gained traction, these posts show you what actually happens when you click "Swap." No fluff. No hype. Just what’s real.