Collateralized Loans in Crypto: How They Work and Why They Matter

When you take out a collateralized loan, a type of loan where you lock up digital assets as security to borrow cash or crypto. Also known as crypto-backed loans, they let you access liquidity without selling your Bitcoin or Ethereum. This is the backbone of DeFi lending — it’s how people borrow money while still holding onto their crypto holdings. Unlike banks, you don’t need a credit score. You just need to lock up more value than you borrow. That’s the rule: over-collateralization.

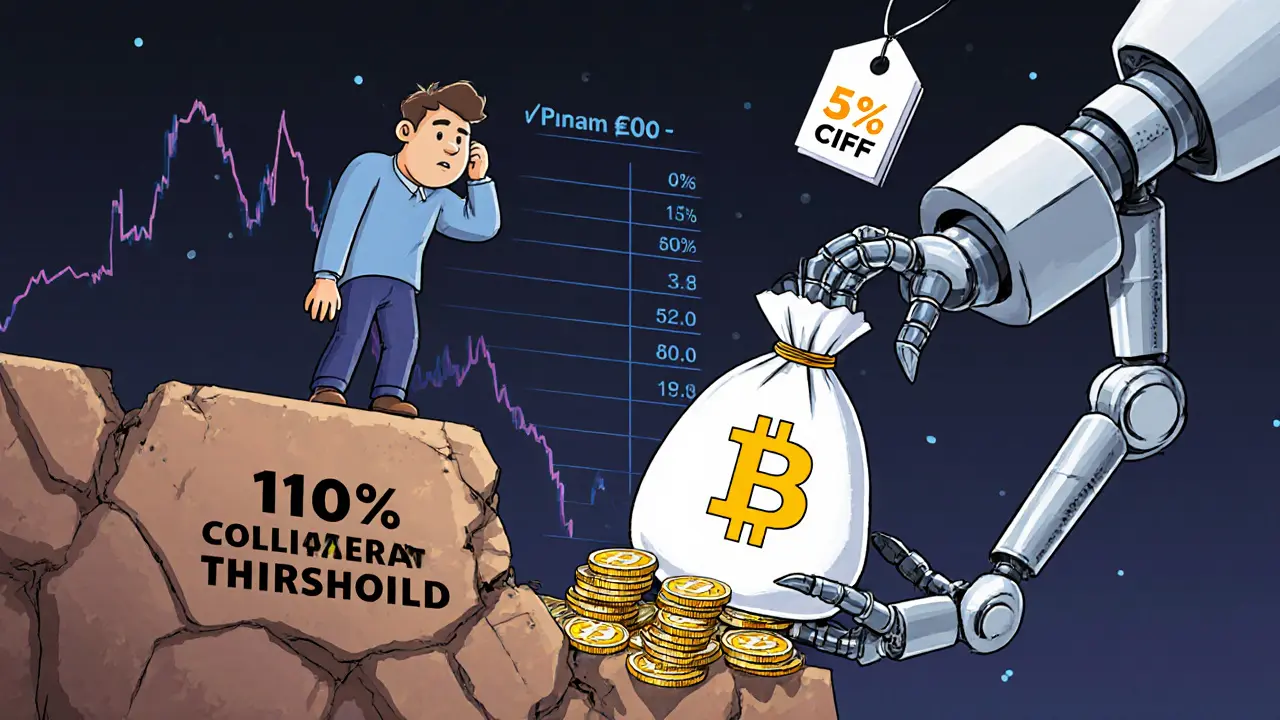

Most crypto loans require you to put up at least 125% to 150% of the loan value as collateral. If the price of your crypto drops too much, your loan gets liquidated. That’s why many users turn to over-collateralized stablecoins, stablecoins like MAI (MIMATIC) that are backed by more crypto than their face value. Also known as decentralized stablecoins, they’re built to stay at $1 even when markets swing. MAI, for example, is backed by assets on Polygon and lets users mint it by locking up other tokens. It’s not magic — it’s math. The system forces users to keep extra crypto on hand to cover risk. That’s what makes these loans safer than uncollateralized ones.

Collateralized loans are everywhere in DeFi. They power lending platforms like Aave and Compound. They’re how traders get leverage without going through centralized exchanges. And they’re why stablecoins like MAI exist — to give people a way to borrow without trusting a bank. But they’re not risk-free. If you borrow against volatile assets and the market crashes fast, you can lose your collateral. That’s why smart users watch their loan-to-value ratios like a hawk. Some even use automated tools to rebalance their positions before liquidation hits.

You’ll find real examples of this in the posts below. One article breaks down how MAI works as a stablecoin backed by crypto — not cash. Another explains how crypto exchanges enforce rules to prevent abuse. There’s also a guide on how Vietnam’s new rules are shutting down platforms that can’t handle collateralized lending properly. And a review of a risky exchange that failed to protect users’ locked assets. These aren’t theoretical concepts. They’re live systems with real money at stake.

Whether you’re borrowing to buy more crypto, hedge a position, or just avoid taxes by not selling, collateralized loans are one of the most powerful tools in DeFi. But they demand attention. You can’t just lock up your ETH and walk away. You need to understand the rules, the risks, and how the system reacts when prices move. The posts here show you exactly how it works — from the technical side to the real-world traps. No fluff. Just what you need to know before you lock up your assets.