DeFi Loan Liquidation Risk Calculator

Loan Details

Risk Analysis

Enter loan details to see your liquidation risk assessment

When you borrow money using crypto as collateral, you’re not just making a trade-you’re entering a high-stakes contract that can end in one sudden moment: liquidation. Unlike traditional banks that give you months to catch up on payments, blockchain loans can wipe out your position in seconds if the market moves against you. This isn’t theoretical. In 2022, over $3 billion in crypto collateral was automatically seized across DeFi protocols during market crashes. Understanding how liquidation works isn’t optional-it’s survival.

What Triggers a Liquidation in DeFi Loans?

In traditional lending, a bank might call you, send a notice, or offer a repayment plan. In DeFi, there’s no human. There’s only code. And that code follows one rule: keep your collateral above a certain threshold.

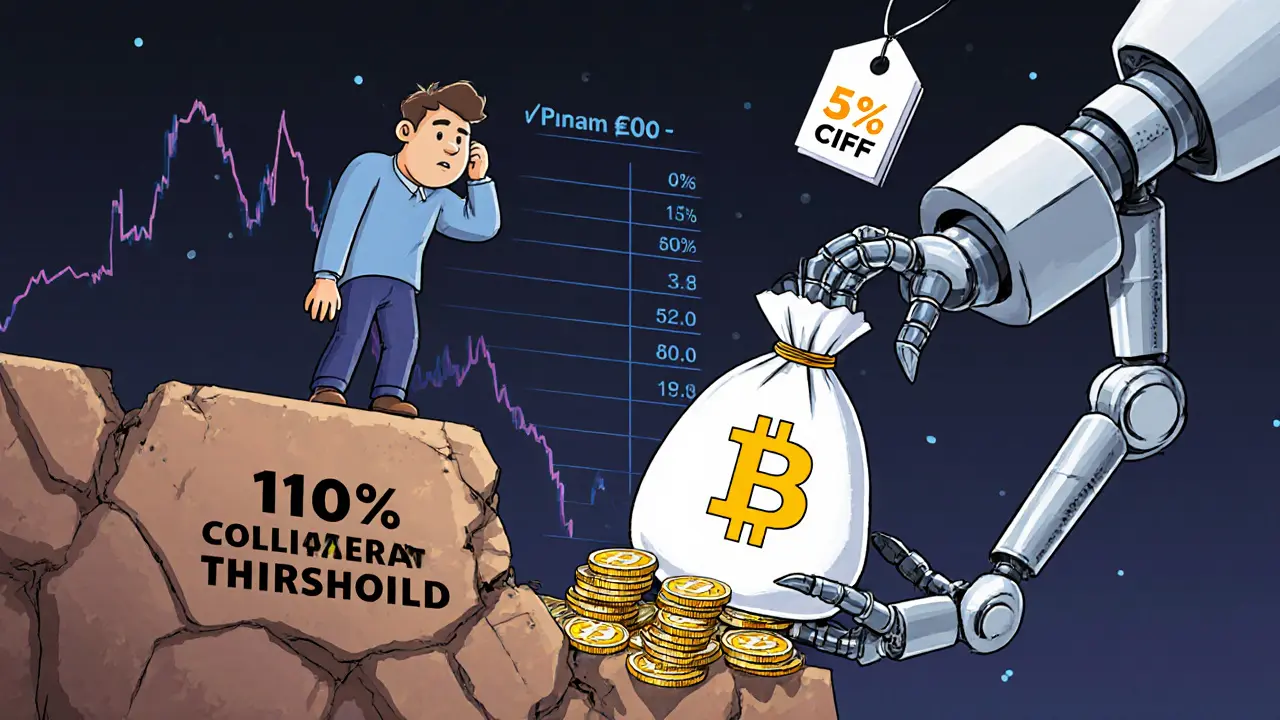

Most DeFi platforms set a liquidation threshold at 110% collateralization. That means if you borrow $1,000 worth of ETH, you must keep at least $1,100 worth of collateral in the loan position. If ETH’s price drops and your collateral falls to $1,090, the system flags your loan as under-collateralized. The moment it drops below $1,100, the liquidation bot springs into action.

These bots-run by third-party traders-are incentivized to act fast. They get a reward, usually between 5% and 10% of the seized collateral, for stepping in and repaying your loan on your behalf. In return, they take your collateral at a discount. So if you had $1,000 in ETH as collateral, the bot might pay off your $1,000 loan and walk away with $1,050 in ETH. You lose 5% of your position instantly.

But here’s the catch: if the liquidation fee is too high-say, 30%-the bots won’t act. Why? Because buying your collateral at a 30% discount might still leave them with a loss after gas fees and market slippage. That’s when things get dangerous. If no bot steps in, your loan stays under-collateralized. And if the price keeps falling, your entire position can evaporate without anyone intervening.

How Liquidation Differs from Traditional Loans

Compare this to a Small Business Administration (SBA) 7(a) loan in the U.S. When a borrower defaults, the lender doesn’t immediately seize assets. They first try to work out a repayment plan. They order appraisals. They contact the borrower. They file paperwork. The SBA requires lenders to exhaust every option before they can even request a guaranty payout. The whole process can take months, sometimes over a year.

DeFi doesn’t work like that. There’s no negotiation. No grace period. No phone call. The system is designed to be fast, automated, and irreversible. That’s the trade-off: you get instant loans without credit checks, but you lose control the moment your collateral dips below the line.

Even traditional collateralized loans like Collateralized Loan Obligations (CLOs) have buffers. CLOs are structured with multiple tranches-senior, mezzanine, equity-and losses are absorbed in order. Senior investors get paid first. Equity holders take the hit last. There’s a hierarchy. A buffer. A timeline.

DeFi has none of that. It’s a single, direct line between borrower and liquidator. No middlemen. No safety nets. Just math.

The Hidden Risks in DeFi Liquidations

It’s not just about price drops. Liquidations can be triggered by technical glitches, protocol pauses, and even bugs.

In early 2024, a major DeFi lending platform paused its smart contracts for 12 hours due to a security update. When it came back online, the system didn’t reset accrued interest or updated funding fees. Thousands of users who had been within their collateral limits before the pause suddenly found themselves liquidated because the system didn’t recalculate their real-time debt. Their loans had grown quietly in the background-while the platform was down-and the bots acted the moment the system woke up.

This isn’t rare. Many protocols still don’t refresh all variables-interest, yield, fees-before triggering liquidation. They use cached values. They rely on oracles that lag. They assume market conditions are stable. They’re not.

Another hidden risk: leveraged positions. Some users borrow crypto to buy more crypto-to amplify returns. A 3x leveraged ETH position might look great when ETH is rising. But when it drops 10%, your collateral ratio doesn’t just fall 10%. It falls 30%. And if your liquidation threshold is 110%, you’re gone in one move.

And then there’s the issue of market depth. If you’re using a less popular token as collateral-say, a new memecoin-there might not be enough buyers in the market to support a smooth liquidation. Bots can’t sell your collateral fast enough without crashing the price. That causes cascading failures. One liquidation drags down the token’s price. That triggers more liquidations. And suddenly, the whole system spirals.

How to Avoid Being Liquidated

You can’t control the market. But you can control your exposure.

- Keep your collateral ratio above 150%. The 110% threshold is the edge of the cliff. Don’t dance on it. Aim for 150% or higher. That gives you breathing room for a 25% price drop before you’re at risk.

- Use stablecoins as collateral. ETH, SOL, and BTC swing wildly. USDC and DAI don’t. If you borrow against stablecoins, your collateral value stays steady. Your risk drops dramatically.

- Set up alerts. Most DeFi wallets and dashboards let you set price alerts. Get notified when your collateral ratio hits 120%. That’s your warning sign. Time to add more collateral or pay down part of the loan.

- Never go all-in on leverage. If you’re borrowing to buy more crypto, you’re playing with fire. Even 2x leverage can wipe you out in a normal market correction. Stick to 1.2x or less.

- Monitor protocol health. Check if the lending platform has had recent audits, upgrades, or pauses. If the team is quiet or the contract hasn’t been updated in months, walk away.

One real-world example: In late 2023, a user borrowed $50,000 in DAI using $75,000 in ETH as collateral. Their ratio was 150%. When ETH dropped 18% over three days, their ratio fell to 122%. They got an alert. They added $10,000 more ETH. They stayed safe. Another user with the same loan but only $55,000 in ETH got liquidated when ETH dropped 12%. Same market. Different preparation.

What Happens After Liquidation?

Once the bot takes your collateral, your loan is paid off. Your position is closed. Your debt is gone. But so is your asset. You don’t get a second chance. You don’t get a refund. You don’t get to appeal.

Some protocols let you reclaim leftover collateral if the sale price was higher than your debt. But that’s rare. Most platforms sell your collateral at a discount to ensure the bot gets paid. Any excess usually goes to the protocol’s treasury-not back to you.

And unlike traditional loans, there’s no credit score hit. DeFi doesn’t report to Equifax. But there’s a different cost: trust. If you get liquidated once, you’ll be more cautious. If you get liquidated twice, you might quit DeFi altogether. That’s the real penalty.

Is DeFi Liquidation Fair?

Some say yes. It’s transparent. The rules are written in code. Everyone knows the terms before they borrow.

Others say no. The system favors those with deep pockets and fast bots. Retail users-people with small positions-are the ones who get wiped out. The bots? They’re run by hedge funds with algorithms trained on market patterns. They know exactly when to strike.

And there’s no regulation. No oversight. No SBA-style guidelines. No NGPC to review your case. If you’re liquidated, you’re on your own.

That’s why some DeFi projects are starting to experiment with grace periods. After a protocol restarts, they give users 24 to 48 hours to repay or add collateral before liquidations resume. Others are introducing dynamic thresholds-raising the liquidation ratio during high volatility. These are baby steps. But they’re steps toward fairness.

The Future of Collateralized Loans

The future isn’t just DeFi or traditional finance. It’s both, merging.

Big banks are testing blockchain-based collateralized loans. Insurance companies are using smart contracts to automate claims against real estate-backed loans. Even the SBA is exploring digital reporting systems to speed up liquidation tracking.

But the real innovation is in risk management. The next generation of DeFi protocols will combine real-time oracle data, dynamic collateral ratios, and automated margin calls-like a broker’s system, but on-chain. You’ll get alerts. You’ll get options. You might even get a chance to avoid liquidation before it happens.

For now, though, the rules are simple: if you borrow on blockchain, treat your collateral like a live wire. Don’t touch it unless you’re ready to lose it.

What happens if I get liquidated on a DeFi loan?

Your collateral is automatically sold to repay your loan. The liquidator-usually a bot-pays off your debt and takes your assets at a discount (typically 5-10%). Your loan is closed, your debt is cleared, and you lose your collateral. There’s no appeal, no refund, and no second chance.

Can I avoid liquidation in DeFi?

Yes. Keep your collateral ratio above 150%, use stablecoins as collateral, set price alerts, avoid leverage above 1.5x, and monitor protocol updates. These steps give you a buffer against market swings and reduce the chance of being liquidated.

Why do liquidation bots sometimes not act?

If the liquidation fee is too high (e.g., 30% or more), the bot may not profit after gas fees and market slippage. Low liquidity in the collateral asset can also make it hard to sell quickly. In these cases, the loan stays under-collateralized until the price recovers or a bot finds it profitable to act.

Is DeFi liquidation the same as traditional loan liquidation?

No. Traditional loans involve human review, appraisals, negotiation, and legal processes that can take months. DeFi liquidation is instant, automated, and irreversible. There’s no warning, no grace period, and no appeals-just smart contract execution.

What’s a healthy collateral ratio for a DeFi loan?

While most protocols trigger liquidation at 110%, a healthy ratio is 150% or higher. This gives you room to absorb a 25-30% price drop in your collateral without being at risk. The higher your ratio, the safer your position.

Understanding liquidation isn’t about fear. It’s about control. The blockchain doesn’t care if you’re a beginner or a pro. It only cares about numbers. If you know the rules, you can play the game without losing everything.