China Crypto Ban: What Happened, Who It Affected, and How It Changed Global Crypto

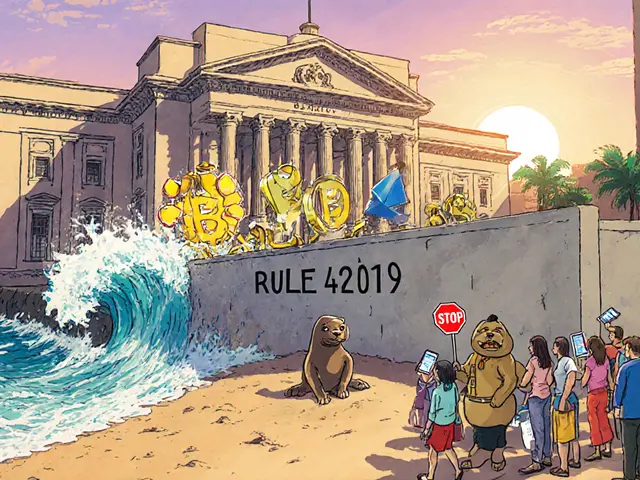

When China crypto ban, a sweeping government policy that outlawed cryptocurrency trading, mining, and exchange operations within China's borders. Also known as China's digital currency crackdown, it didn't just restrict coins—it rewrote the rules for how the world sees blockchain. In 2021, China didn’t just discourage crypto. It shut down mining farms, blocked access to foreign exchanges like Binance and Huobi, and forced platforms to stop serving Chinese users. This wasn’t a slow fade. It was a hard reset.

Behind the ban was a deeper move: the push for its own digital currency, the Digital Yuan, China’s state-controlled central bank digital currency (CBDC) designed to replace cash and monitor financial activity. Also known as e-CNY, it gave the government full control over transactions—something decentralized crypto could never offer. While Bitcoin and Ethereum thrived elsewhere, China’s move sent shockwaves through global markets. Miners fled to the U.S., Kazakhstan, and Canada. Exchanges moved headquarters to Singapore and the UAE. And suddenly, every country with crypto rules had to ask: Are we next?

The ban didn’t stop people in China from trading crypto—it just made it harder. Many turned to peer-to-peer platforms, VPNs, and offshore wallets. But the cost was high: access to global liquidity, transparent pricing, and secure custody vanished overnight. Meanwhile, regulators in India, Vietnam, and Bangladesh watched closely, using China’s playbook as both warning and template. The crypto exchange shutdown, the mass closure of platforms that refused to comply with China’s strict licensing and data control demands. Also known as exchange crackdown, it became the global benchmark for regulatory overreach.

What’s left today? A fragmented landscape. China still holds the world’s largest share of Bitcoin mining hardware, even if the machines now run in Kazakhstan or Texas. Chinese developers still build DeFi tools—but they’re hosted on foreign servers. And while the government promotes the Digital Yuan as the future, millions of Chinese citizens still quietly hold crypto, knowing the risks but trusting the technology more than the state.

What you’ll find below are real stories from people caught in the crossfire: scams that exploded after the ban, exchanges that vanished overnight, and crypto projects that tried to hide in plain sight. These aren’t theoretical risks. They’re the consequences of a policy that changed everything.