Cryptex Exchange Risk Checker

Cryptex was a crypto exchange launched in 2017 that shut down in 2023. It was unregulated and faced numerous user complaints about withdrawal delays, blocked accounts, and poor customer support.

Use this tool to assess the safety risks of using Cryptex or similar unregulated exchanges:

Enter criteria above and click "Check Risk Level" to see assessment

Quick Summary / Key Takeaways

- Cryptex shut down its exchange operations in 2023 and is flagged as high‑risk by multiple watchdogs.

- It never secured regulation from top‑tier authorities such as the FCA, ASIC, or the SEC.

- Users repeatedly reported delayed or blocked withdrawals and unresponsive customer support.

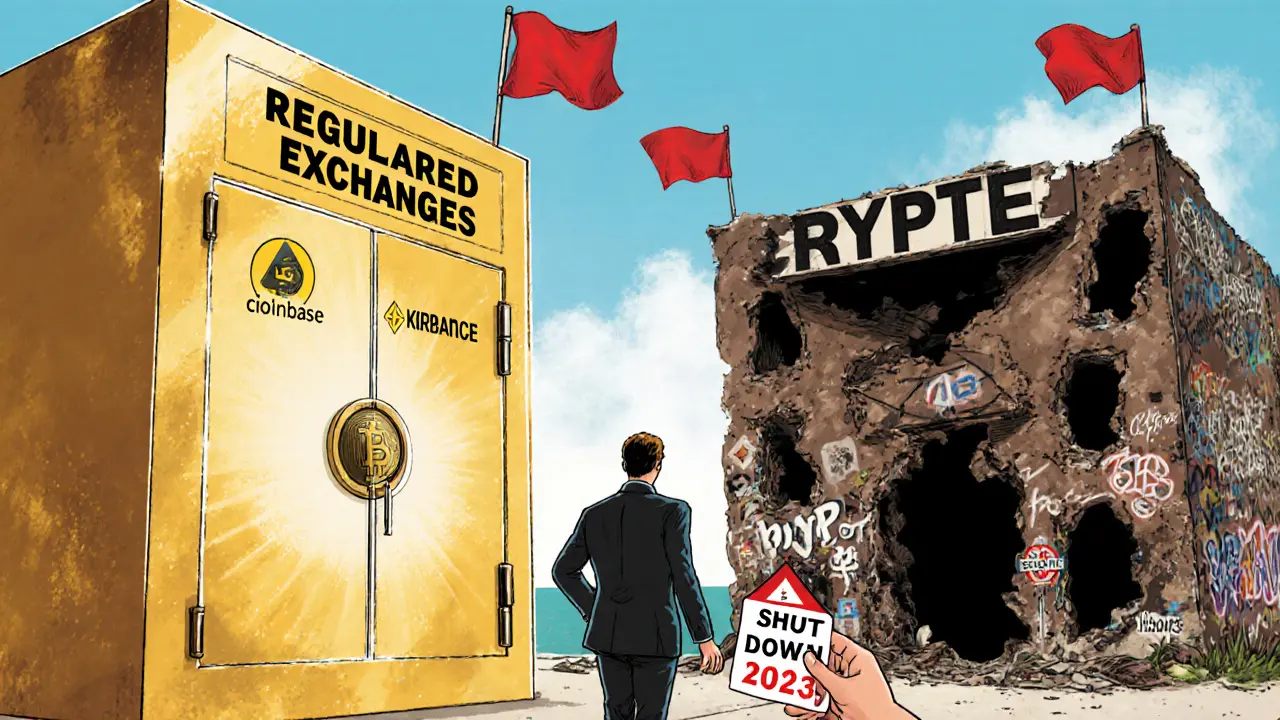

- Compared with regulated platforms like Coinbase and Binance, Cryptex offers no investor protection.

- Current status: delisted from monitoring services, no active trading, and active recovery scams targeting victims.

What is Cryptex?

When you hear the name Cryptex is a crypto exchange that marketed itself as a “global, institutional‑grade” platform. Launched in 2017, the service was registered in St.Vincent and the Grenadines and operated in English and Russian. Its public promise was simple: fast activation, 24/7 trading, and high‑return “Hybrid Contracts” that claimed compounding returns with no management fees.

In practice, Cryptex functioned more like a broker‑style front‑end that bundled exchange, OTC, and DeFi‑style staking products under a single brand. The platform required a mandatory KYC/AML check handled by a third‑party provider-a process advertised as 72‑hour verification but later revealed to be stuck for many users.

How Cryptex Operated

Below is a quick rundown of the core features Cryptex advertised:

- Standard cryptocurrency pairs (BTC/USDT, ETH/USDT, etc.) with no unique blockchain tech.

- OTC desk for large‑volume trades, promising better spreads for orders over $10,000.

- DeFi “Hybrid Contracts” that locked funds for 3-7years with promised ROI up to 2,363% by 2030.

- KYC verification processed through a GDPR‑compliant service, but real‑world reports indicated indefinite delays.

- Withdrawal fees ranging from $100 to $1,000, depending on the contract type.

Technical documentation was sparse. There was no public API, and the website never disclosed the underlying security stack beyond generic statements about “institutional‑grade blockchain security.” Independent audits were never released, a red flag that later regulators would cite.

Safety and Regulation

The biggest concern for any trader is whether the exchange is regulated. Cryptex never obtained a licence from any top‑tier regulator. Here’s how that compares with mainstream competitors:

- Coinbase is registered with the SEC and CFTC in the United States and adheres to strict AML/KYC rules.

- Binance operates under a mosaic of licences worldwide but still faces ongoing regulatory scrutiny, prompting it to adopt stronger compliance measures.

- Kraken holds licences in the EU, US, and Japan, giving users clear legal recourse.

In contrast, Cryptex’s registration in St.Vincent and the Grenadines placed it outside the reach of most financial regulators. Organizations like ASIC (Australia) and the FCA (UK) have issued public warnings about unregulated platforms-Cryptex appeared on several of those warning lists.

User Experience: Withdrawals, Support, and Complaints

Reality checks from real users paint a grim picture:

- Withdrawal delays ranged from 1week to indefinite holds. Some users reported that after depositing $5,000, the “withdraw” button disappeared entirely.

- Customer support tickets often went unanswered for weeks. When responses arrived, they were generic copy‑pastes that offered no resolution.

- Trustpilot archived data from 2022 shows a 1.2/5 rating, with 78% of reviewers citing “unable to withdraw funds.”

- Reddit’s r/CryptoScams thread from June2022 highlighted a case where a user lost $7,200 after Cryptex froze their account without explanation.

These issues line up with the findings of Bestchange and BrokerChooser, both of which removed Cryptex from their monitoring services in 2024 due to “multiple user complaints about failed transactions.”

Pros and Cons

Even a failing platform has a mix of features. Here’s a balanced list:

- Pros

- Wide range of crypto pairs at launch.

- OTC desk that could handle large orders.

- Promised 24/7 access and fast account activation (1-3days in marketing).

- Cons

- No recognized regulator; high legal risk.

- Frequent withdrawal blocks and opaque fee structure.

- DeFi contracts with multi‑year lock‑up periods and no insurance.

- Platform shutdown in 2023; delisted from monitoring services.

- Poor documentation and contradictory terms of service.

Side‑by‑Side Comparison

| Feature | Cryptex | Coinbase | Binance | Kraken |

|---|---|---|---|---|

| Regulatory status | Unregulated (St.Vincent & Grenadines) | US SEC & CFTC regulated | Multiple licences, under scrutiny | EU, US, JP licences |

| KYC/AML | Third‑party, 72‑hour claim, often delayed | Verified ID, instant | Verified ID, instant | Verified ID, instant |

| Withdrawal speed | Days to indefinite; many blocked | Minutes to few hours | Minutes | Minutes to 24hrs |

| Trading fees | $100-$1,000 per contract (flat) | 0.5% taker, 0% maker | 0.1%-0.2% | 0.16%-0.26% |

| Customer support | Often no response | Live chat, phone | Live chat, email | Email, ticket system |

| Current status (2025) | Shut down; delisted, recovery scams active | Active | Active | Active |

Is Cryptex Still Active?

Multiple sources-including Cryptowisser and Bestchange-confirm that the exchange closed in 2023. The domain still redirects to a marketing landing page for a new “DeFi Hybrid Contract” product, but no trading engine is live. Attempts to register a new account result in a notice that “services are currently unavailable.”

Because the original platform is offline, any new deposits are likely being routed to a phishing or recovery‑service scam. The safest move is to avoid any link that asks for your wallet address or personal data related to Cryptex.

Bottom Line: Should You Use Cryptex?

If you’re looking for a secure place to swap crypto, the answer is a definitive “no.” The platform’s lack of regulation, documented withdrawal blocks, and complete shutdown make it a high‑risk, low‑reward proposition. Instead, stick with exchanges that are licensed by reputable authorities and have transparent fee structures. Your funds and peace of mind are worth the extra diligence.

Frequently Asked Questions

Is Cryptex still operating as a crypto exchange?

No. Cryptex ceased exchange operations in 2023 and was delisted by monitoring services in 2024. The website now only promotes a DeFi product that is not functional.

Was Cryptex ever regulated?

Cryptex was registered in St.Vincent and the Grenadines and never obtained a licence from any top‑tier regulator such as the FCA, ASIC, or the SEC.

Why were withdrawals blocked?

Multiple user reports and watchdog investigations indicate that the platform lacked sufficient liquidity and had internal controls that could freeze accounts without notice. This is a common symptom of unregulated exchanges.

Can I recover funds lost on Cryptex?

Recovery is extremely unlikely. Some firms claim to offer “fund recovery services,” but many are themselves scams. Reporting to local financial authorities and keeping documentation is the safest approach.

What should I look for in a safe crypto exchange?

Choose a platform licensed by reputable regulators, with transparent fee schedules, instant KYC verification, a clear withdrawal policy, and responsive customer support. Examples include Coinbase, Kraken and Binance (subject to local compliance).

People Comments

For anyone still considering Cryptex, the most important takeaway is its lack of regulatory oversight and the documented withdrawal issues that surfaced before the platform shut down. Users reported delayed or completely blocked withdrawals, which is a classic red flag for liquidity problems. Combined with the unresponsive customer support, these factors place Cryptex firmly in the high‑risk category. I would recommend sticking to exchanges that are licensed by reputable authorities and provide transparent fee structures.

When you read yet another “review” that glosses over the obvious, you have to ask yourself who is pulling the strings behind the curtain of the crypto world. Cryptex, in my view, is not merely an unregulated exchange; it is a case study in how shadowy operators exploit loopholes to siphon funds from unsuspecting traders. The fact that the platform was registered in St. Vincent and the Grenadines is itself a warning sign, as that jurisdiction is notorious for offering a safe haven to entities that wish to evade scrutiny. Their promise of “institutional‑grade” services was nothing more than marketing jargon designed to lure in inexperienced investors. Even the advertised KYC process was a sham, taking weeks for some users while others were left in a perpetual verification limbo. This deliberate obstruction serves a dual purpose: it creates a layer of anonymity for the operators and gives them time to move assets before any complaints snowball. Withdrawal delays that stretched from a few days to indefinite periods are typical of a liquidity crunch, but they also indicate a deeper issue – the platform was likely running a Ponzi‑style model, using new deposits to cover older withdrawals. The abrupt shutdown in 2023 was not a surprise; it was inevitable once the flow of fresh capital dried up. Moreover, the “Hybrid Contracts” promising astronomical returns over multi‑year lock‑ups are classic bait for victims who are willing to sacrifice liquidity for the illusion of high yields. The absence of any third‑party audit or public security audit should have been a red flag from day one. It is baffling that any regulator would overlook such glaring deficiencies, which leads me to suspect a coordinated effort to keep these operations under the radar. The subsequent “recovery scams” that target former Cryptex users only compound the narrative of a well‑orchestrated fraud ecosystem. In summary, Cryptex exemplifies the worst practices of unregulated crypto exchanges, and anyone who thinks otherwise is either willfully blind or complicit in a larger scheme.

Yo, Cryptex was basically a dumpster fire from the start, and the drama never stopped even after they closed their doors. People were shouting about missing millions, and the support team just ghosted everyone. I saw threads where users were begging for help, and the replies were just “we’re looking into it” – like, what does that even mean? The whole thing felt like a reality TV episode, except the losers were real people with hard‑earned cash.

Indeed-this situation highlights the critical need for clear communication; it’s unfortunate that many users were left in the dark; the lack of timely updates only exacerbated the frustration.

Honestly, the best takeaway is to stay vigilant 🚩. Regulated platforms give you that extra layer of security, and the community consensus seems clear: avoid unregulated services like Cryptex 🙅♀️. Keep your assets where you can actually get help if something goes wrong! 🌟

From a philosophical perspective, the Cryptex episode underscores the principle that trust must be earned, not assumed. When an institution fails to provide verifiable safeguards, it breaches the implicit contract with its users. This breach erodes any moral justification for participation, leaving rational actors to seek alternatives that uphold accountability. Hence, the logical conclusion is to align with exchanges that demonstrate transparent governance and regulatory compliance.

Stay away from Cryptex-it’s a total nightmare!

Yo! Cryptex was a total circus-like, they promised gold and gave us *sand*; customer support? Nada. Withdrawal? More like *withdrawing* hope! If u wanna keep ur cash safe, ditch that sh*t and jump on a legit platform.

I understand how frustrating it must have been to see funds disappear and get no response from Cryptex support. Many people felt the same helplessness when they were left without any clear explanation.

Picture this: you’ve poured your savings into a platform that promises the moon, only to watch it crumble into dust before your very eyes-Cryptex was that nightmare, a thunderstorm of broken promises that left investors drenched in regret.

Most folks slam Cryptex hard, but honestly, if you’re looking for high‑risk, high‑reward experiments, you might have found a cautionary tale rather than a hidden gem.

i think Cryptex was bad. they had slow withdrawl and not many people trust them now.

It is absolutely reprehensible that so many individuals were lured into Cryptex’s deceptive schemes, betraying the very ethical standards that should govern financial services. Such predatory practices must be condemned without reservation.

Upon meticulous examination of Cryptex’s operational history, one discerns a conspicuous pattern of regulatory evasion, systemic liquidity deficiencies, and a palpable disregard for fiduciary responsibility; consequently, the platform unequivocally merits classification as a high‑risk entity, unsuitable for prudent investment.

Use a regulated exchange with clear KYC processes to avoid similar issues.