Pakistan Crypto Value Converter

Convert PKR to Cryptocurrency

See how much your Pakistani Rupees would be worth in major cryptocurrencies based on current market data (2025 estimates).

Enter an amount in PKR and select a cryptocurrency to see the conversion.

Why Crypto Values Matter in Pakistan

The Pakistani Rupee has depreciated by over 30% against the US dollar since 2020, making cryptocurrencies attractive for both investment and payments. This converter uses 2025 market data where:

- Bitcoin accounts for approximately 60% of trading volume

- Ethereum accounts for approximately 20% of trading volume

- Stablecoins (like USDT) account for approximately 20% of trading volume

With over 18.2 million verified crypto accounts in Pakistan (up 5.4 million from 2024), this conversion tool helps you understand how your funds translate into digital assets.

Pakistan's cryptocurrency market is a rapidly expanding ecosystem that, according to 2025 industry reports, handles more than US$300billion in annual trading volume. The figure combines activity on international exchanges, local peer‑to‑peer (P2P) platforms, and emerging mobile‑money bridges that let users convert rupees into digital assets.

Breaking down the $300Billion claim

The $300billion number comes from a mix of on‑chain analytics, exchange‑provided trade data, and surveys of P2P operators. Roughly 55% of the volume is estimated to flow through offshore centralized exchanges such as Binance and Kraken, where Pakistani traders use fiat‑to‑crypto gateways that bypass the domestic banking system. The remaining 45% originates from local P2P marketplaces like LocalBitcoins and dedicated Pakistani platforms that match buyers with sellers via mobile wallets (Easypaisa, JazzCash).

Because many P2P deals are settled off‑chain, traditional volume trackers under‑report the true scale. Researchers compensate by aggregating transaction logs from mobile‑money APIs and by applying a multiplier derived from user‑survey data. The resulting adjusted figure lands close to the $300billion mark.

Who is trading? - User base and growth rates

CoinLaw’s 2025 report recorded 18.2million verified crypto accounts, a 5.4million surge over the previous year. Independent estimates, however, suggest that more than 40million Pakistanis hold some form of digital asset, reflecting the extensive use of informal wallets and family‑shared accounts. The discrepancy highlights the challenge of counting a market that operates heavily outside regulated channels.

Key demographics:

- Age 18‑35: 68% of active traders, driven by high smartphone penetration.

- Urban centres (Karachi, Lahore, Islamabad): 75% of volume, owing to better internet infrastructure.

- Freelancers and gig workers: 22% of total trades, using crypto for cross‑border payments.

Why the explosive adoption?

The Pakistani rupee has depreciated by over 30% against the US dollar since 2020, pushing investors to seek hedges. Bitcoin (BTC) accounts for roughly 60% of trade pairs, while Ethereum (ETH) captures 20% and stablecoins-mainly USDT-cover the remaining 20% for short‑term hedging. Mobile money services have become de‑facto fiat gateways, allowing users to top‑up their crypto wallets directly from Easypaisa or JazzCash accounts.

Other growth catalysts include:

- Limited domestic investment products, making crypto a perceived alternative portfolio asset.

- A youthful, tech‑savvy population; the Pakistan Bureau of Statistics reports that 62% of internet users are under 30.

- Increasing awareness of blockchain through university courses and local meet‑ups.

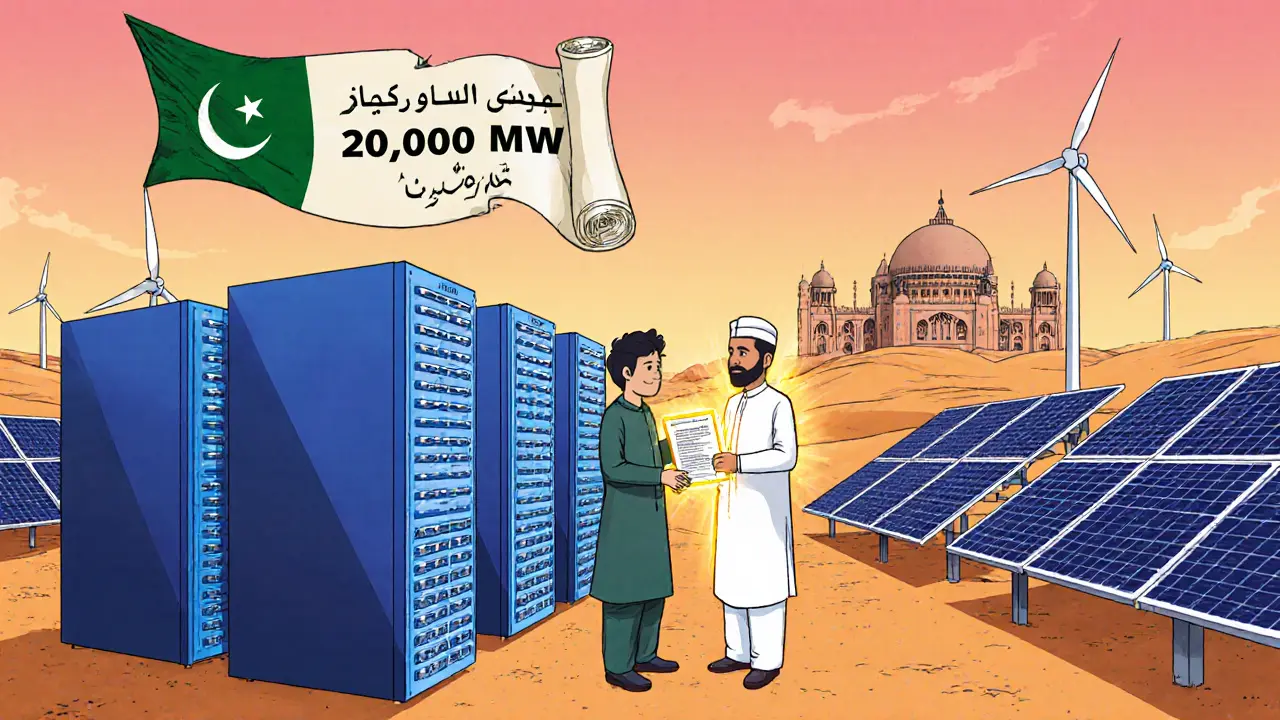

Infrastructure and mining - State involvement

In early 2025 the government earmarked 2,000MW of surplus electricity for Bitcoin mining, signaling a strategic shift from outright prohibition (the 2018 State Bank ban) to a more nuanced approach. Pilot mining farms in the Thar Desert have begun operating with renewable‑energy blends, aiming to lower the carbon intensity of hash power.

These initiatives have attracted foreign investors who see Pakistan as a low‑cost, high‑potential mining location. Estimated hash‑rate growth of 35% YoY places the country among the top ten global mining hubs, according to the Global Crypto Mining Index.

Regulatory outlook - From bans to potential frameworks

The State Bank of Pakistan (SBP) initially declared all crypto activities illegal in 2018, crippling formal banking integration. Over the past two years, however, SBP has opened a dialogue with industry groups, and a draft “Virtual Asset Regulation” is slated for parliamentary review in early 2026.

Key regulatory signals:

- Licensing proposals for crypto exchanges that partner with local banks for AML/KYC compliance.

- Tax guidance treating capital gains from crypto as taxable income, aligning with global best practices.

- Potential creation of a national Bitcoin reserve, which could lock up a portion of mined coins for sovereign wealth purposes.

Until the framework is finalized, most activity will remain in the gray zone, meaning investors should monitor policy updates closely.

Pakistan versus the world - Comparative snapshot

| Country | Annual Trading Volume (USDbn) | Adoption Index (0‑1) | Key Drivers |

|---|---|---|---|

| Pakistan | 300 | 0.62 | Rupee volatility, mobile money, gig economy |

| India | 420 | 0.68 | Large population, fintech boom, regulatory clarity |

| United States | 410 | 0.66 | Institutional investors, crypto‑friendly states |

| Vietnam | 110 | 0.55 | Young tech adopters, supportive policy |

Pakistan’s volume punches above its weight when you consider its GDP and per‑capita income. The adoption index places it third globally, a striking leap from its 2020 position outside the top ten.

Risks, opportunities and practical takeaways

Risks

- Regulatory uncertainty - potential retroactive penalties if future laws tighten.

- Infrastructure gaps in rural areas limit market depth.

- Price volatility of major assets; hedging with stablecoins is common but not foolproof.

Opportunities

- Early‑stage mining projects benefiting from cheap electricity.

- Fintech startups building compliant fiat‑to‑crypto bridges.

- Investment funds targeting emerging‑market crypto exposure.

For a newcomer, start with a reputable international exchange that supports Pakistani users, use a trusted mobile‑money gateway for fiat deposits, and keep a close eye on SBP announcements. Diversifying between BTC, ETH, and stablecoins can smooth out rupee‑driven swings.

Frequently Asked Questions

Is the $300billion volume figure reliable?

The number is an adjusted estimate that combines on‑chain data, exchange reports, and P2P transaction logs. Because a large share of trades occurs off‑chain, the figure is best viewed as a close approximation rather than an exact accounting.

Which cryptocurrencies dominate Pakistani trading?

Bitcoin leads with about 60% of pairings, followed by Ethereum at roughly 20%. Stablecoins, especially USDT, make up the remaining 20% and are popular for short‑term hedging against rupee depreciation.

Can I trade crypto through a Pakistani bank?

Direct bank‑to‑exchange links are still prohibited. Most traders use mobile‑money services (Easypaisa, JazzCash) or offshore exchanges that accept local debit cards.

What does the government’s energy allocation mean for miners?

The earmarked 2,000MW signals official tolerance for mining and may lead to subsidised power rates for licensed farms, boosting profitability for large‑scale operators.

When is a formal crypto regulatory framework expected?

A draft law is slated for parliamentary debate in early 2026. Final rules could roll out later that year, but interim guidance may appear sooner.

People Comments

Wow, the converter looks super handy for anyone trying to gauge crypto exposure in PKR. It pulls 2025 market rates, so the numbers feel fresh. The breakdown of Bitcoin, Ethereum and stablecoins helps visualize where most volume sits. If you’re new to crypto, this gives you a quick sense of buying power without digging through exchanges. Happy to see tools like this popping up in emerging markets 😊

It is a profound illustration of how monetary distress can catalyze digital asset adoption, a phenomenon not merely economic but sociocultural in its ramifications. The staggering $300 billion figure transcends mere statistics; it epitomises a collective yearning for financial sovereignty. One cannot help but feel the weight of history pressing upon each transaction, as if the very fabric of Pakistani commerce is being rewoven. Such a tableau inevitably summons both awe and apprehension, for the future remains a nebulous horizon.

In light of the presented data, one must acknowledge the profound shift towards decentralized finance within the region. The prevalence of Bitcoin at sixty percent underscores a decisive preference for assets perceived as stores of value. While the numbers are compelling, it is essential to consider regulatory frameworks that gonn shape future trajectories. A balanced approach, melding innovation with prudence, will ensure sustainable growth.

The crypto ecosystem in Pakistan is basically exploding-think of it as a liquidity tsunami powered by devaluation and youthful optimism. With Bitcoin hogging roughly 60% of the trade volume, it’s the market’s alpha‑dog, while ETH and stablecoins act as the reliable sidekicks. This conversion tool is the perfect sandbox for anyone looking to map fiat to digital assets without the usual hassle. It’s like having a mini‑exchange in your browser, complete with real‑time rate smarts. Bottom line: the nation’s digital appetite is undeniable, and this UI captures it beautifully.

Contemplating the surge in crypto activity invites a deeper reflection on the nature of value itself. When fiat falters, trust migrates to code, suggesting that belief in abstract mathematics can replace confidence in governmental institutions. This transition is not merely transactional; it is emblematic of a societal shift toward self‑sovereignty. As more Pakistanis engage with these platforms, they partake in a collective experiment whose outcomes remain uncertain. Yet, the very act of conversion signals a yearning for agency beyond conventional borders.

Crypto’s rise in Pakistan is a clear sign of changing financial habits.

Got to say, this tool makes it way easier to see how much crypto you could actually afford with your paycheck. It’s pretty neat seeing the numbers line up with the market data.

Sure, because what we all needed was another slick calculator to make crypto sound even more legit.

Seeing those 18.2 million verified accounts is both inspiring and a call to action for newcomers. It tells you that the community is already massive, yet there’s still room for education and safe practices. If you’re just starting out, use this converter as a stepping stone-not a finish line. Remember, knowledge is the best shield against volatility. Let’s keep the conversation going and help each other navigate this space responsibly.

The numbers are a wake‑up call for anyone still skeptical about crypto’s relevance in everyday life. With such a huge trading volume, the momentum is clearly on the side of digital assets. Harness that energy, explore the markets, and maybe discover new opportunities you hadn’t considered before.

While the dramatic prose of the preceding observation captures imagination, one must also scrutinize the underlying macroeconomic variables with scholarly rigor. The correlation between rupee depreciation and crypto influx warrants a methodical econometric analysis, lest we fall prey to sensationalism. Moreover, regulatory elasticity plays a pivotal role, influencing both capital flow and investor confidence. A nuanced discourse, therefore, should balance emotive narrative with empirical substantiation.

The tool is useful, but it also masks the reality that many are turning to crypto out of desperation rather than choice. Our policies need to address the root causes of fiat instability before we celebrate these numbers.

Philosophy aside, people are just trying to protect their wealth. Stop overthinking it.

One could argue that the pursuit of alternative assets reflects a deeper quest for autonomy in an unpredictable world. Yet, such shifts also expose participants to novel risks. Balance, therefore, remains the prudent path.

It is heartening to observe such widespread adoption, as it may empower individuals previously excluded from traditional banking. Nonetheless, the volatility inherent in these markets cannot be ignored. Prudence and informed decision‑making are essential.

Statistically speaking, a $300 billion volume is impressive, yet the underlying distribution reveals a heavy concentration in a handful of exchanges. This centralization could pose systemic risks if any platform experiences a breach. Investors should diversify their exposure accordingly.

Let’s unpack the implications of a $300 billion crypto turnover in Pakistan, a figure that dwarfs many traditional financial metrics in the region. First, the sheer scale signals a profound loss of confidence in the national currency, driving citizens toward assets perceived as hedge mechanisms. Second, this migration injects liquidity into an ecosystem still grappling with regulatory ambiguity, creating a paradox of opportunity and uncertainty. Third, the dominance of Bitcoin, commanding around sixty percent of trade, reflects a collective gravitation toward the most established digital store of value, while Ethereum and stablecoins fill complementary roles in utility and stability. Fourth, the rapid expansion of verified accounts-now exceeding eighteen million-underscores a demographic shift, especially among younger, tech‑savvy populations eager to bypass legacy banking channels. Fifth, this surge could catalyze infrastructure development, prompting exchanges, custodians, and ancillary services to proliferate, thereby generating employment and fostering innovation. Sixth, however, the volatility inherent in cryptocurrency markets poses significant risks to individuals lacking sophisticated risk‑management strategies. Seventh, the potential for illicit activity cannot be dismissed; cash‑in‑hand economies may find new avenues for money‑laundering, compelling regulators to tighten oversight. Eighth, education becomes paramount: without comprehensive financial literacy initiatives, many may fall prey to scams or make irreversible mistakes. Ninth, the macroeconomic impact may ripple outward, influencing foreign exchange reserves as capital flows reorient. Tenth, this phenomenon invites a broader discussion about monetary sovereignty and the role of the state in safeguarding economic stability. Eleventh, policymakers must weigh the benefits of embracing fintech advancements against the necessity of protecting consumers. Twelfth, strategic partnerships with global crypto firms could accelerate technology transfer, yet they also risk ceding regulatory control. Thirteenth, the social fabric may evolve as digital assets become commonplace, redefining notions of wealth and status. Fourteenth, as the ecosystem matures, we anticipate the emergence of hybrid financial products that blend traditional banking with decentralized finance. Finally, the trajectory of Pakistan’s crypto landscape will hinge on a delicate balance between innovation, regulation, and education, determining whether this surge becomes a catalyst for sustainable economic empowerment or a fleeting speculative bubble.

Sounds epic, but most folks just want to keep their money safe, not write dissertations.

Don’t let the hype blind you-use this converter to make concrete decisions, then double‑check your numbers before committing. It’s a powerful habit that separates the savvy from the speculative.

The rise of crypto invites contemplation about the evolving definition of money. Yet, practical considerations must remain at the forefront.

Another crypto tool, same old hype.

It’s great to see such resources becoming accessible; they help demystify complex concepts for newcomers and seasoned traders alike. Sharing knowledge builds a stronger, more resilient community.

Just a heads up – the rates update hourly, so keep an eye out for any sudden market moves. This tool’s pretty handy for quick checks.