VEUR Gold Value Calculator

VEUR Calculator

Calculate the actual gold value of your VNX Euro tokens based on current gold prices.

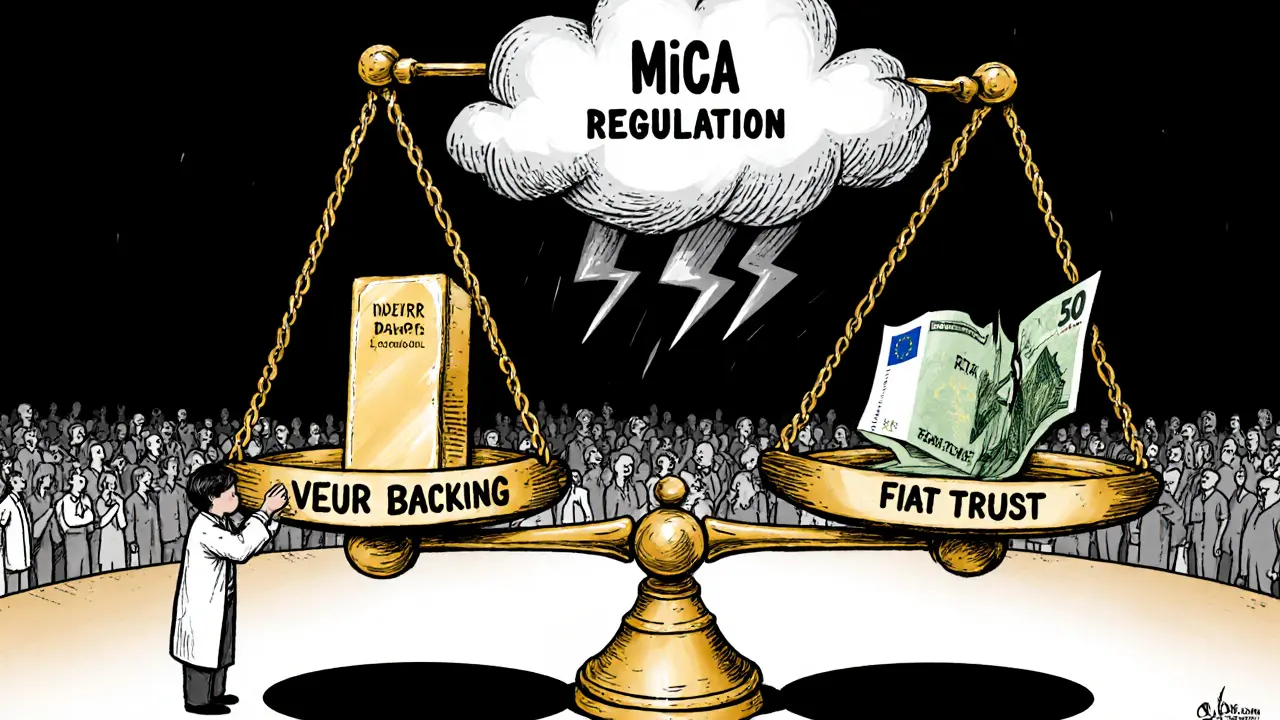

How VEUR Works

VEUR is not backed by euros but by physical gold. Each VEUR represents a claim on gold stored in Liechtenstein vaults, with a value intended to track the euro. However, the actual value depends on the gold price, which can cause the token to trade above or below €1.00.

Results

* Based on the gold price entered and VEUR's actual value. The peg to the euro is not always maintained due to liquidity and market factors.

VNX Euro (VEUR) isn’t another stablecoin trying to mimic the euro. It’s something different: a digital token that tracks the euro’s value but is backed by physical gold, not cash or government bonds. If you’re looking for a stable euro-denominated asset in crypto, most people reach for EUROC or EURS. But VEUR offers a twist - it ties your euro exposure to gold stored in Liechtenstein vaults. That means you’re not just holding a digital euro. You’re holding a digital claim on real gold, with the euro as your pricing anchor.

How VNX Euro Works (It’s Not What You Think)

VEUR is created by VNX Commodities, a company licensed under Liechtenstein’s Blockchain Act and registered with the country’s Financial Market Authority (FMA). That’s important. Unlike many crypto projects that operate in legal gray zones, VNX is regulated. This gives it credibility in Europe, especially as the EU’s MiCA regulations roll out in 2024.

Here’s the catch: VEUR isn’t backed by euros. It’s backed by VNXAU, a separate token that represents physical gold. Each gram of gold held in Liechtenstein vaults corresponds to a value in VNXAU, which then backs VEUR. So if you hold 1 VEUR, you’re not holding €1 in a bank account. You’re holding a claim on gold that’s valued at approximately €1 at any given moment.

This two-step collateral system is unusual. Most stablecoins like USDC or EUROC hold cash or short-term U.S. Treasuries. VEUR holds gold. That’s a big deal. Gold doesn’t lose value to inflation like fiat currency can. But it also moves in price. If gold spikes 5% in a week, VEUR’s value could drift from €1.00 to €1.05 - even though it’s supposed to be stable. That’s why VNX has to constantly rebalance its reserves. And that’s also why VEUR doesn’t always trade at exactly €1.

Current Market Data (November 2025)

As of November 2025, VEUR is trading at around $1.16 USD. That’s above the current euro exchange rate of $1.06. That gap isn’t random. It’s a sign of low liquidity and limited demand. The market cap sits at $3.18 million with just 2.76 million tokens in circulation. That’s tiny. Compare that to EUROC, which has a $1.2 billion market cap and is listed on Coinbase, Binance, and Kraken. VEUR is on Bitstamp, LBank, and a few smaller exchanges. You won’t find it on most major platforms.

Trading volume is under $150,000 in 24 hours. That’s 0.0001% of the entire stablecoin market. The top 10 wallet addresses hold 68% of all VEUR. That’s a red flag. It means a handful of players control the price. If one of them sells, the token could crash.

Why It Exists: The Gold Advantage

Why would anyone build a euro stablecoin backed by gold? Two reasons: trust and diversification.

First, gold has been trusted for thousands of years. Unlike banks or governments, gold doesn’t print more of itself. When you hold VEUR, you’re not relying on a central bank’s balance sheet. You’re relying on physical bars in a vault under Liechtenstein’s strict financial oversight. VNX offers a public tool to verify gold allocation - something no other euro stablecoin does.

Second, gold can act as a hedge. If the euro weakens against the dollar, but gold rises, VEUR might hold its value better than EUROC. That’s the theory. But in practice, the gold price is volatile. And VEUR’s peg to the euro requires constant adjustment. If gold falls sharply, VNX must either add more gold or buy back VEUR to keep the peg. That’s expensive and complex.

How It Compares to Other Euro Stablecoins

| Stablecoin | Backing | Market Cap | Exchanges | Regulation |

|---|---|---|---|---|

| VEUR | Physical gold (via VNXAU) | $3.18M | Bitstamp, LBank, few others | Regulated in Liechtenstein |

| EUROC | US dollars, cash, Treasuries | $1.2B | Coinbase, Kraken, Binance | Circle, regulated in U.S. |

| EURS | Euros, cash equivalents | $247M | Binance, OKX, Kraken | STASIS, regulated in EU |

| EURE | Euros, cash reserves | $45M | Bitfinex, KuCoin | Regulated in EU |

VEUR is the only one backed by gold. That’s its unique selling point. But it’s also the smallest. EUROC and EURS have deep liquidity, institutional adoption, and easy on-ramps. You can buy EUROC with a credit card on Coinbase. You can’t do that with VEUR. You need to go through VNX’s platform, complete KYC, and transfer crypto to their bridge.

How to Use VEUR

Using VEUR isn’t simple. Here’s what you need to do:

- Complete VNX’s KYC/AML process. This takes 2-5 business days. You’ll need ID, proof of address, and sometimes a selfie.

- Deposit crypto (ETH, BTC, USDT, etc.) into your VNX wallet.

- Use VNX’s chain bridge to convert your crypto to VEUR. It works across 15 blockchains, including Ethereum, Polygon, and BSC.

- Store VEUR in any wallet that supports ERC-20 tokens.

Redeeming VEUR for gold or euros is even harder. You need at least 1,000 VEUR to start the process. The redemption takes 5 business days. And you can’t get euros directly - you get the value in gold or fiat, but only after VNX processes your request. Most users report slow customer support. Email is the only channel. Response times average 48 hours.

Who Is VEUR For?

VEUR isn’t for beginners. It’s not for casual traders. It’s for a very specific group:

- Investors who believe gold is a better long-term store of value than cash.

- People who want exposure to the euro without relying on traditional banking.

- Those who trust Liechtenstein’s regulatory system more than U.S. or EU banking systems.

- Developers building DeFi apps that need a euro-pegged asset with gold backing.

If you’re just trying to send money cheaply or trade without volatility, stick with EUROC or EURS. They’re cheaper, faster, and more liquid. VEUR adds complexity for a benefit that hasn’t proven itself in real-world use.

The Risks

VEUR has several serious risks:

- Price drift: It trades at $1.16, not $1.06 (euro rate). That gap suggests the peg isn’t working well.

- Liquidity crunch: With $150k daily volume, even small trades can move the price.

- Centralization: 68% of supply is held by 10 wallets. That’s a single point of failure.

- Redemption barriers: You can’t easily turn VEUR back into cash or gold. It’s locked in VNX’s system.

- Regulatory uncertainty: MiCA may require stablecoins to hold only high-quality liquid assets. Gold doesn’t qualify under that definition yet.

Analysts at JPMorgan rate VEUR’s future as “low.” Others think it could grow if gold prices surge and VNX expands listings. But so far, adoption is stagnant. Its market rank dropped from #1420 in January 2023 to #1578 in October 2023 - while the whole crypto market grew.

Final Verdict

VEUR is an interesting experiment. It’s one of the few stablecoins trying to blend gold’s stability with blockchain speed. But it’s not a practical tool for most people. The liquidity is too low, the redemption process too slow, and the price too unstable. If you’re curious about gold-backed digital assets, VEUR is worth watching. But don’t treat it like a euro. Treat it like a speculative bet on gold + blockchain regulation.

For now, if you need a euro stablecoin, go with EUROC or EURS. They’re proven. VEUR is still a prototype - clever, but not ready for the mainstream.

Is VNX Euro (VEUR) backed by euros?

No. VEUR is not backed by euros. It’s backed by VNXAU, a token representing physical gold stored in Liechtenstein vaults. Each VEUR is designed to track the euro’s value, but the underlying asset is gold, not cash or bonds.

Can I redeem VEUR for physical gold?

Yes, but only through VNX’s platform and only for verified customers. You need a minimum of 1,000 VEUR to start the redemption process. The process takes 5 business days, and you can receive either the equivalent value in gold or fiat currency, depending on VNX’s terms at the time.

Why is VEUR trading at $1.16 when the euro is at $1.06?

The price difference reflects low liquidity and limited market demand. VEUR isn’t widely traded, so small buy or sell orders can push the price away from its intended €1 peg. This suggests the mechanism to maintain the peg isn’t strong enough yet to handle market pressure.

Is VEUR regulated?

Yes. VNX Commodities is licensed under Liechtenstein’s Blockchain Act and registered with the country’s Financial Market Authority (FMA). This makes VEUR one of the few euro-linked crypto assets with formal regulatory oversight in Europe.

Can I use VEUR on Coinbase or Binance?

No. VEUR is not listed on Coinbase, Binance, Kraken, or other major exchanges. It’s only available on a few smaller platforms like Bitstamp and LBank. This limits its accessibility and liquidity compared to EUROC or EURS.

Is VEUR safe to hold long-term?

It depends on your risk tolerance. VEUR has strong regulatory backing and transparent gold reserves, which is rare. But its low liquidity, price instability, and centralized control make it risky for long-term holding. It’s better suited as a speculative or experimental asset, not a core part of your portfolio.

- Poplular Tags

- VNX Euro

- VEUR crypto

- gold-backed stablecoin

- VNX Commodities

- euro stablecoin

People Comments

VEUR is gold. Not euros. Not promises. Just gold.

Love the idea of gold-backed stablecoins. Feels like crypto finally growing up. Not every coin needs to be a speculative rollercoaster. Sometimes, you just want something that won’t vanish when the next meme coin drops.

Still, the liquidity is wild. $150k daily volume? That’s a bathtub compared to the ocean of EUROC. You’re not trading-you’re babysitting.

Gold + blockchain = ancient wisdom meets digital future 🌟

VEUR feels like the quiet genius in the room who never shouts but always has the right answer. Sure, it’s not on Binance-but that’s not the point. The point is: someone built something real, not just hype.

And yes, the peg drifts. But gold itself drifts too. The fact that VNX even tries to rebalance? Respect. Most stablecoins just pray their reserves don’t melt.

If you’re into decentralization with a soul, this is it. Not perfect. But profoundly thoughtful.

Interesting concept but too niche for real use. If I need euro exposure, I use EURS. Simpler, faster, regulated. Why complicate with gold?

The structural integrity of VEUR is a marvel of financial engineering-yet it remains tragically underappreciated. Gold, as a non-sovereign, non-printable, non-inflationary asset, provides a metaphysical anchor that fiat-backed stablecoins can never replicate. The regulatory oversight from Liechtenstein’s FMA is not merely compliance-it is a covenant of trust.

That said, the liquidity crisis is not a bug-it is a feature of nascent innovation. To demand mass adoption before the infrastructure matures is to misunderstand the evolution of money itself. VEUR is not a payment tool. It is a monetary experiment in the tradition of the gold standard-reimagined for the blockchain age.

Those who dismiss it as ‘unusable’ are the same people who once called Bitcoin ‘a fad for drug dealers.’ History rarely favors the impatient.

i just dont get why anyone would use this?? like, i get the gold thing but its sooo hard to cash out?? and why is it at 1.16 when euro is 1.06?? like… what even is happening??

also why does it take 5 days to redeem?? i just wanna buy coffee with crypto not go through a 5-day audit 😭

VEUR is a prime example of a DeFi primitive that’s not optimized for velocity but for sovereignty. The gold-backing introduces a non-correlated asset class into the stablecoin ecosystem-critical for macro hedging. Think of it as a yield-less, anti-inflationary collateral layer.

Low liquidity? Of course. It’s not meant for retail arbitrage. It’s meant for institutional treasury diversification. Once MiCA gets serious about asset-backed tokens, VNX will be the first mover with auditable, on-chain gold reserves. That’s not speculation-that’s infrastructure.

So if gold goes up, VEUR goes up? But it’s supposed to be pegged to the euro… so does that mean it’s not really stable? Or is it just… unstable on purpose? I’m confused.

So many people are quick to call VEUR ‘useless’-but have you ever thought about what it represents? It’s not about buying coffee. It’s about trust. In a world where banks collapse and currencies get devalued overnight, having a digital claim on physical gold stored under strict European law? That’s not niche. That’s insurance.

I know it’s not liquid. I know it’s slow. But sometimes, the most valuable things aren’t the fastest. They’re the ones that survive when everything else burns.

gold-backed stablecoin?? lol. so its like… crypto but with extra steps?? why not just buy gold on coinbase??

also why does it say ‘veur’ like it’s a dragon from a fantasy game 😴

It’s fascinating how VEUR turns the entire stablecoin paradigm on its head. Most are trying to mimic fiat. This one says: ‘What if we anchored to the original store of value?’

Yes, it’s illiquid. Yes, redemption is slow. But the transparency-public gold audits, Liechtenstein regulation, multi-chain bridging-is unmatched. This isn’t a currency. It’s a statement.

I get why people are skeptical. But look at it this way: if the euro crashes tomorrow, EUROC crashes with it. But VEUR? Gold might go up. That’s the hedge. It’s not perfect-but it’s the only euro stablecoin that doesn’t tie you to the fate of a central bank.

It’s like owning a house with a basement full of gold bars. It’s not convenient. But if the city burns down, you’re still standing.

1.16 USD for 1 VEUR? Bro… that’s not stable. That’s just… broken. 🤡

also why do i need to do KYC just to hold a ‘stablecoin’? sounds like a bank with extra steps.

Let me be blunt: VEUR is the only euro stablecoin that doesn’t rely on the integrity of a central bank. That’s not a feature-it’s a revolution. While EUROC and EURS are merely digital IOUs from corporations and governments, VEUR is a claim on tangible, measurable, unprintable wealth. The fact that it trades above parity isn’t a failure-it’s a market signal. People are paying a premium for the illusion of safety. And guess what? In today’s world, that illusion is worth more than the reality.

Yes, the redemption process is slow. Yes, the liquidity is laughable. But that’s because this isn’t for the crowd. It’s for those who remember that money was once backed by something that couldn’t be deleted, inflated, or seized. Gold. Not data. Not promises. Gold.

If you think this is ‘niche,’ ask yourself: who held value during hyperinflation? Who held value during banking collapses? Who held value when the dollar was taken off gold in 1971? Not banks. Not bonds. Gold.

VEUR is the first attempt to digitize that truth. It’s clumsy. It’s imperfect. But it’s the only one trying. The rest are just playing dress-up with fiat.

^ This. Finn just said everything I’ve been thinking but couldn’t articulate. VEUR isn’t trying to be the next USDC. It’s trying to be the next gold standard. And honestly? I’m rooting for it.