Crypto Lending Liquidation Risk Calculator

When you borrow against crypto, the biggest nightmare is seeing your collateral vanish in a flash. That’s the essence of crypto lending liquidation - the forced sale of assets when a loan’s safety margin collapses. In the wild world of DeFi and centralized crypto lenders, this risk can turn a savvy move into a costly mistake within minutes.

How Liquidation Mechanics Work

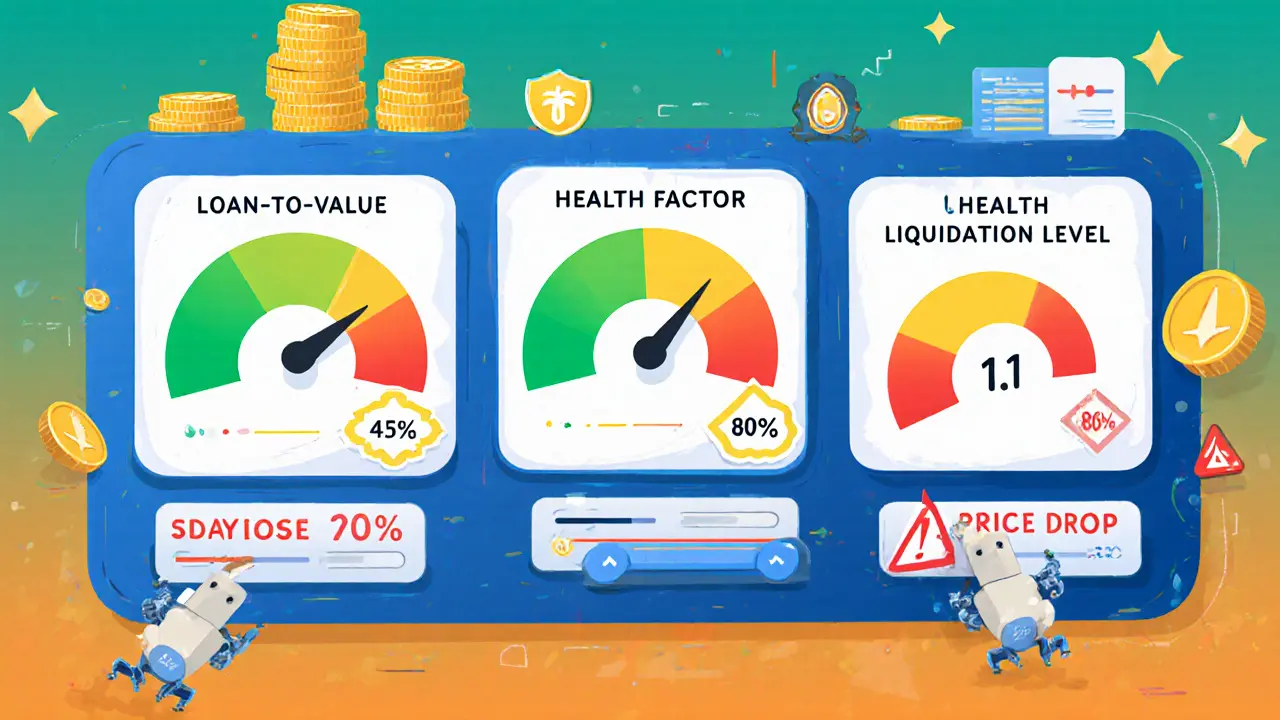

Every lending platform sets a safety buffer called the Loan‑to‑Value (LTV) ratio. If you take a $10,000 USDT loan backed by $20,000 worth of Bitcoin, your initial LTV is 50%. The protocol constantly watches the market price of your Bitcoin. Two thresholds matter:

- Margin call level - often around 70% LTV. The system flags you and may send a warning.

- Liquidation level - typically 80% LTV. If the price drops further, the smart contract automatically sells enough collateral to repay the loan.

DeFi protocols add a twist with the Health factor. Aave, for example, calculates health factor as the ratio of collateral value to debt, adjusted for each asset’s risk parameters. When the health factor slips below1, liquidation kicks in instantly.

Key Metrics You Need to Track

Understanding the numbers lets you stay ahead of the trigger.

| Metric | Description | Typical Range |

|---|---|---|

| LTV | Loan amount ÷ collateral value | 30‑50% |

| Health factor | Collateral value ÷ (Debt × liquidation multiplier) | >1.0 (safe), =1.0 (liquidation) |

| Collateralization ratio | Inverse of LTV, shows how much collateral backs each dollar borrowed | 200‑300% |

| Liquidation bonus | Extra reward paid to the actor who triggers liquidation | 3‑15% |

| Oracle update frequency | How often price feeds refresh | Every 30‑60seconds for major feeds |

Major Platforms and Their Liquidation Rules

Not all lenders play by the same rules. Below is a quick side‑by‑side look at three of the biggest players.

| Protocol | Max LTV | Liquidation Threshold | Bonus | Oracle Provider |

|---|---|---|---|---|

| Aave | 50% | 80% | 5% | Chainlink (updated 2023) |

| Compound | 45% | 75% | 8% | Compound Price Oracle (internal) |

| Nexo | 55% | 85% | 3% | Chainlink + proprietary feeds |

Notice how Aave and Nexo both rely on Chainlink for price data. Accurate oracles are the backbone of any liquidation system - a stale feed can trigger unnecessary liquidations, while a manipulated feed can leave the protocol exposed.

Why Liquidation Risk Stalls Mainstream Adoption

Studies from Ledger Academy (2023) and Binance Academy repeatedly point out that volatility creates “an increased chance of loans going into liquidation”. In practice, this means:

- Investors hesitate to lock up assets they might need quickly.

- Institutions demand insurance or hedging tools before entering DeFi lending.

- Regulators scrutinize liquidation contracts for consumer‑protection gaps.

When a large position liquidates, the market impact can cascade. A rapid sell‑off pushes prices lower, triggering more liquidations in a feedback loop - a phenomenon witnessed during the March2020 crash and the May2022 TerraLuna implosion.

Practical Ways to Manage Your Liquidation Risk

Surviving the volatility curve boils down to three habits:

- Borrow conservatively. Keep your LTV well below the platform’s limit - most experienced users aim for 30‑40%.

- Set up real‑time alerts. Use Discord bots, Telegram notifications, or dedicated portfolio trackers that ping you when the health factor approaches 1.2.

- Maintain a buffer fund. Keep a separate stash of stablecoins ready to top‑up collateral during sudden dips.

Some advanced users employ automated scripts that call a smart contract to add collateral the moment a price feed crosses a pre‑defined line. While powerful, this approach requires solid coding skills and continuous monitoring.

User Stories: Wins and Woes

Reddit threads from 2022‑2024 paint a vivid picture. One borrower, “Dean”, took a $10,000 USDT loan against $20,000 BTC at 50% LTV. When Bitcoin dipped 22% in a single day, his LTV spiked to 78%. The protocol issued a margin call, but Dean missed the notification. Within minutes, his BTC was sold, and he lost $4,500 worth of collateral.

Conversely, a veteran DeFi trader kept his LTV at 35% and used a custom alert bot. When the market slumped 15% in an hour, the bot added $2,000 worth of USDC collateral automatically, averting liquidation and preserving his position.

These anecdotes highlight two takeaways: monitoring is non‑negotiable, and maintaining a safety cushion pays off.

Emerging Trends: Making Liquidations Less Brutal

Protocol designers are listening. Recent upgrades include:

- Partial liquidations. Instead of wiping out an entire position, the system sells just enough collateral to bring the health factor back above 1.

- Grace periods. Aave’s 2023 update introduced a 5‑minute buffer after a health factor breach, giving borrowers a chance to top‑up.

- Insurance wrappers. Platforms like Nexus Mutual now offer policies that reimburse part of the collateral lost to liquidation.

- AI‑driven risk dashboards. Start‑ups are rolling out machine‑learning models that predict imminent liquidation events based on cross‑chain data.

These changes aim to soften the blow while preserving the core safety net that protects lenders.

Regulatory Outlook

Globally, regulators are probing whether liquidations constitute “unfair contract terms”. The EU’s MiCA framework, still being refined in 2025, proposes mandatory disclosure of liquidation thresholds and a minimum notice period. In the U.S., the SEC has hinted at requiring “consumer‑friendly” liquidation processes for platforms that serve retail users.

For now, most protocols operate independently, but expect tighter compliance requirements to emerge over the next couple of years.

Bottom‑Line Checklist

- Know your platform’s LTV and liquidation thresholds.

- Monitor health factor in real time.

- Keep a collateral buffer ready for quick top‑ups.

- Consider partial‑liquidation‑friendly protocols.

- Stay aware of upcoming regulatory changes.

Frequently Asked Questions

What triggers a crypto lending liquidation?

A liquidation occurs when the collateral’s value falls enough to push the loan’s LTV above the protocol’s liquidation threshold or when the health factor drops below1. The trigger is automatic and relies on price feeds from oracles.

How can I avoid being liquidated?

Borrow conservatively (keep LTV <40%), set up instant price alerts, maintain a separate stablecoin reserve for collateral top‑ups, and consider protocols that offer partial liquidations or grace periods.

What is a liquidation bonus?

It’s a reward paid to the actor (often a bot or third‑party trader) who executes the liquidation. Bonuses typically range from 3% to 15% of the liquidated collateral’s value.

Are there insurance options for liquidation risk?

Yes. Protocols like Nexus Mutual and InsurAce have started offering policies that reimburse a portion of collateral lost during a liquidation, though premiums can be high.

Will new regulations make liquidations less harsh?

Regulators are pushing for clearer disclosures and minimum notice periods. While rules won’t eliminate liquidations, they should give borrowers more transparency and potentially longer grace windows.

People Comments

Wow, the whole liquidation thing feels like watching a drama unfold on a razor‑edge. One minute your collateral is safe, the next it’s ripped apart by a price dip. The numbers in the health‑factor table look like a script for a thriller, and the margin‑call alerts are the ominous drum rolls. If you love living on the edge, this is the perfect playground. Otherwise, keep a massive buffer, because the system is unforgiving.

While the preceding exposition attempts to dramatize the mechanics, it is essential to observe that the liquidation process is fundamentally a deterministic function of collateral valuation and pre‑established thresholds. The protocol employs oracle feeds, which, notwithstanding occasional latency, provide objective price data. Consequently, any perceived ‘nightmare’ is merely the logical outcome of a borrower’s over‑leveraged position. One must therefore adhere to disciplined risk‑management practices, irrespective of narrative embellishments.

It’s really important, you know, to keep an eye on the LTV ratio, especially when the market shows volatility, because a sudden swing can push the health factor below the safe threshold, and that’s when the protocol steps in, automatically selling collateral. Also, setting up real‑time alerts, perhaps via Discord or Telegram, can give you that extra minute to react, which can be the difference between a minor adjustment and a full‑blown liquidation event.

Liquidations are just a fancy way of saying “you didn’t read the fine print.”

From a philosophical standpoint, the risk of liquidation mirrors life’s impermanence; assets fluctuate, and we must adapt. In practice, maintaining a LTV well below the ceiling-say 30‑40%-offers a cushion against sudden dips. Remember, the oracle is only as good as its update frequency, so occasional stale data can catch you off guard.

Keep your LTV under 40% and set a Discord alert for a health factor of 1.2. 🙌 You’ll thank yourself when the market drops.

If you keep borrowing at the max LTV, you’re just begging for a liquidation. Stay conservative and protect your capital.

Regarding the prior observation on oracle latency, it is pertinent to note that the mean time between feed updates for major providers such as Chainlink typically resides within the 30‑60 second window. This cadence, however, does not fully mitigate the risk of price slippage during high‑frequency market turbulence. Accordingly, incorporating a safety margin-preferably a 10‑15% buffer above the calculated liquidation threshold-constitutes an optimal risk‑mitigation stratagem.

Think of the health factor as your personal safety net; when it drops below 1, the protocol pulls the plug. A modest buffer of 0.2‑0.3 above that line can give you the time needed to add collateral manually or trigger an automated bot. 🛡️ Keep the buffer, stay chill.

The mechanics of liquidation in crypto lending are more than mere numbers; they embody a cascade of systemic safeguards designed to preserve the solvency of the platform while simultaneously exposing borrowers to acute market risk. When a borrower initiates a loan, the protocol immediately calculates the Loan‑to‑Value ratio, anchoring it against a predefined threshold that reflects the volatility profile of the underlying collateral. Should the market price of that collateral decline, the LTV ratio inflates, eroding the cushion that the health factor measures. The health factor itself is a ratio of collateral value to debt, adjusted for any liquidation multiplier that may be present on the specific asset. Once this factor falls below the critical value of one, the smart contract automatically initiates liquidation, selling just enough collateral to restore equilibrium. This automated response is powered by price oracles, which feed real‑time market data into the protocol; any latency or manipulation in these feeds can precipitate premature or delayed liquidations. Moreover, platforms differ in their implementation of partial versus full liquidations, with some opting to liquidate a fraction of the collateral to bring the health factor back above the safe zone, thereby preserving the borrower’s remaining position. The inclusion of a liquidation bonus further incentivizes external actors-often called liquidators-to execute the sale, compensating them for the risk and effort involved. Users can mitigate these risks by maintaining a conservative LTV, typically well under 40%, and by setting up real‑time alerts that notify them when the health factor approaches a predefined safety margin such as 1.2. Additionally, keeping a reserve of stablecoins ready for rapid collateral top‑ups can thwart an imminent liquidation. Advanced users may script automated collateral additions that trigger upon reaching a certain price threshold, but this approach demands rigorous testing to avoid unintended consequences. Finally, the broader ecosystem is evolving, with emerging designs that incorporate grace periods, partial liquidation mechanisms, and insurance wrappers to soften the blow of forced sales. As regulatory scrutiny intensifies, we can expect further refinements aimed at protecting retail participants while preserving the fundamental security of lending protocols.

This whole “grace period” idea is just a way for the platforms to look like they care while still taking your assets. If you want real protection, you need to stay below 30% LTV and keep a solid USDC stash ready. No amount of UI polish will save you from a 20% market crash.

Honestly, the post glosses over the fact that many users simply ignore the health factor until it’s too late, resulting in massive collateral loss. The narrative seems to romanticize “advanced scripts” without acknowledging the steep learning curve and potential bugs that can exacerbate risk. It also underestimates the danger of oracle manipulation, which remains a critical vulnerability.

Let’s keep the focus on constructive steps: maintain a lower LTV, use reliable alert services, and consider diversified collateral to reduce single‑asset exposure. Small, consistent habits outweigh occasional dramatic maneuvers.

Interesting how different platforms choose varying liquidation bonuses. Does anyone have experience with the newer insurance wrappers on Nexus Mutual? 🤔 Looking to compare the actual payout percentages after a liquidation event.