Cross-Border Crypto Monitoring Framework Comparison

This tool compares key aspects of international crypto monitoring frameworks. Select a jurisdiction to see detailed compliance requirements.

Select Jurisdiction

Jurisdiction Overview

Select a jurisdiction above to view its regulatory framework details.

Key Compliance Requirements

Compliance requirements will appear here after selecting a jurisdiction.

When governments try to keep an eye on money that hops across borders on a blockchain, they rely on a patchwork of rules, data‑sharing agreements, and cutting‑edge tech. Cross‑border crypto monitoring refers to the coordinated effort by global regulators to track, verify, and, when necessary, block digital‑asset movements that cross national frontiers. The goal? Stop money‑laundering, terror financing, and sanctions evasion without choking legitimate innovation.

Quick Takeaways

- FinCEN’s Travel Rule forces VASPs to share sender‑ and receiver‑data for transfers over $3,000.

- The EU’s MiCA sets a risk‑averse, licensing‑first approach for crypto firms.

- The UK‑US Transatlantic Task Force is shaping a bilateral template for global oversight.

- Technical workarounds like mixers, VPNs, and non‑KYC services remain the biggest compliance blind spots.

- Future frameworks will blend blockchain analytics with traditional AML systems to improve traceability.

Why Cross‑Border Monitoring Matters Today

In 2025, central banks in 91% of economies are dabbling with digital‑currency projects, while illicit actors continue to exploit the anonymity of unhosted wallets. Regulators therefore treat crypto assets as financial institutions under the Bank Secrecy Act (BSA), obliging them to follow the same anti‑money‑laundering (AML) and counter‑terrorism financing (CFT) rules that apply to banks.

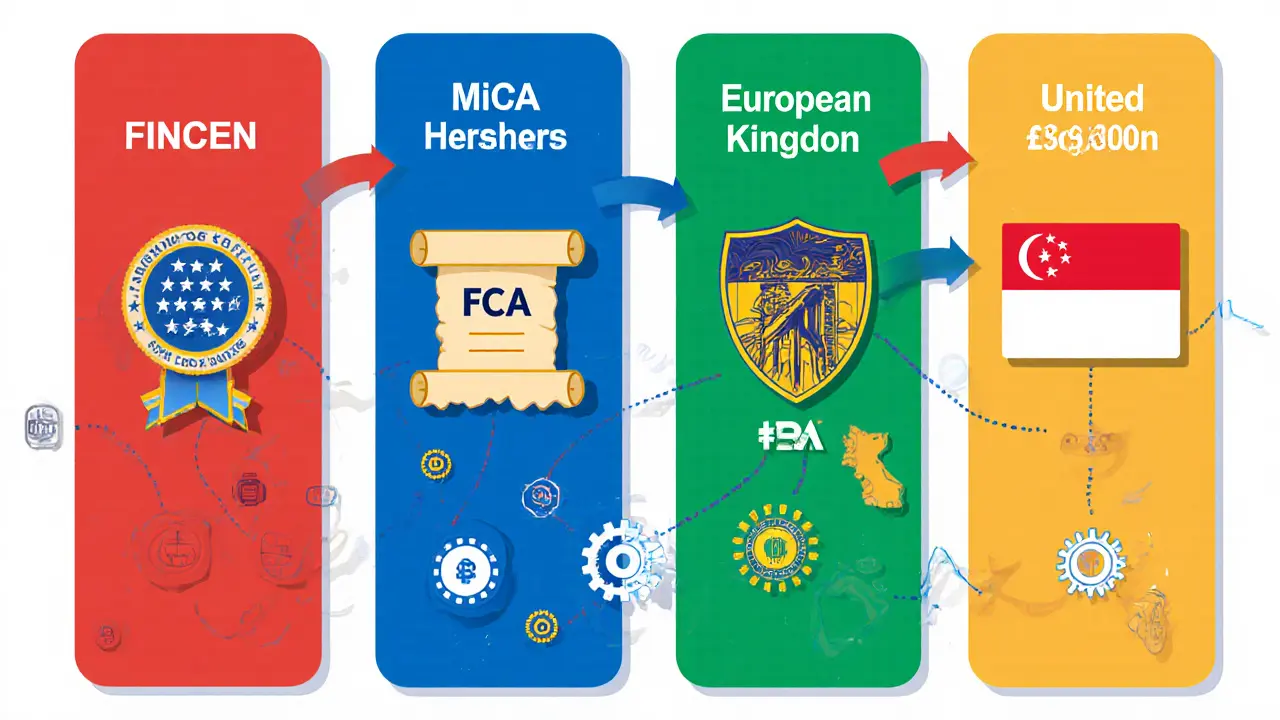

Core International Frameworks

The backbone of global oversight is the Financial Action Task Force (FATF). Its Recommendation 16 - the Travel Rule - requires crypto businesses to collect, store, and transmit five core data elements for every transaction above a set threshold. While FATF offers the template, individual jurisdictions add their own twists.

United States: FinCEN and the Travel Rule

In the U.S., the Financial Crimes Enforcement Network (FinCEN) enforces the Travel Rule under the BSA. Since 2023, all Virtual Asset Service Providers (VASPs) - exchanges, custodians, and wallet‑providers - must capture:

- Originator name and address

- Beneficiary name and address

- Originator’s financial institution (if any)

- Transaction amount, date, and currency

- Wallet addresses or transaction hashes

European Union: The MiCA Regime

The EU’s Markets in Crypto‑Assets (MiCA) regulation, fully operational since 2024, takes a licensing‑first stance. Crypto asset service providers must obtain a EU‑wide license, conduct enhanced due diligence, and file suspicious‑activity reports (SARs) with national financial‑intelligence units. MiCA’s AML obligations mirror the Travel Rule but set the reporting threshold at €5,000 (≈$5,400). Unlike the U.S., MiCA also imposes capital‑adequacy requirements and mandates a dedicated compliance officer for every crypto firm.

United Kingdom and the Transatlantic Task Force

Britain’s UK‑US Transatlantic Task Force was launched in late 2023 to sync policy on crypto licensing, stablecoin standards, and cross‑border data exchange. Both sides have agreed to share SARs in real time, align their Travel Rule data fields, and co‑develop a blockchain‑analytics sandbox for testing new monitoring tools. The task force’s charter makes the UK and U.S. de‑facto leaders for any country looking to adopt a harmonized approach.

Other Key Players

| Jurisdiction | Supervisory Authority | Travel Rule Threshold | Licensing Requirement | Key Compliance Tool |

|---|---|---|---|---|

| United States | FinCEN (BSA) | $3,000 | None for VASPs, but registration under Money Services Business (MSB) | Chainalysis, Elliptic |

| European Union | National FIUs under MiCA | €5,000 | EU‑wide crypto‑asset service provider license | Solidus Labs, Coinfirm |

| United Kingdom | FCA | £2,500 | FCA registration for crypto‑asset businesses | Open‑source AML‑API (UK‑FCA) |

| Singapore | MAS | S$3,000 | Digital token service provider licence | TRM Labs |

Implementation Challenges on the Ground

Even with clear rules, the technology itself creates friction.

- Anonymous wallets: Private keys can be generated offline, making ownership verification impossible without a KYC layer.

- Mixers and tumblers: These services blend multiple inputs, breaking the linear traceability that regulators rely on.

- Cross‑chain bridges: Moving assets from Ethereum to Solana or Binance Smart Chain bypasses a single blockchain’s monitoring tools.

- VPN and proxy usage: Criminals mask IP addresses, complicating geolocation checks required for jurisdiction‑based thresholds.

Regulators are responding by mandating “transaction‑level analytics” - software that tags each hash with risk scores and automatically flags patterns that match known laundering methods.

Practical Steps for Crypto Firms

- Register with the appropriate national authority (FinCEN, FCA, MAS, etc.) and obtain any required licenses.

- Integrate a Travel Rule API that captures the five FATF data elements for every qualifying transfer.

- Adopt a blockchain‑analytics platform that supports multi‑chain monitoring, such as Chainalysis Reactor or TRM Labs.

- Conduct enhanced due‑diligence on counterparties, especially if they operate in high‑risk jurisdictions flagged by the UK‑US Task Force.

- Maintain immutable logs of all transaction data for at least five years, as required by BSA and MiCA.

- Run regular SAR drills with your compliance team to ensure timely reporting of suspicious activity.

Following these steps can reduce the risk of enforcement actions that have, in 2024‑2025, led to fines ranging from $250,000 for minor reporting lapses to $12million for systemic breaches.

Looking Ahead: Standardization and Tech Fusion

The next wave will likely see a unified global data model for crypto transfers, driven by the UK‑US Transatlantic Task Force and the FATF’s “Crypto‑Data Exchange” pilot. Expect:

- Real‑time SAR sharing across borders via a secure API.

- AI‑driven risk scoring that adjusts thresholds based on geopolitical events.

- Mandatory support for decentralized identifiers (DIDs) that link wallet addresses to verified digital identities.

When regulators succeed in marrying blockchain’s transparency with traditional AML oversight, the ecosystem can keep growing without the shadow of illicit use.

Frequently Asked Questions

What is the Travel Rule and why does it matter for crypto?

The Travel Rule, a FATF standard, requires VASPs to collect and share sender‑ and receiver‑information for transactions above a set value (e.g., $3,000 in the U.S.). It lets regulators trace digital‑asset flows across borders, making money‑laundering and sanctions‑evasion harder.

How does MiCA differ from the U.S. approach?

MiCA is more risk‑averse: it forces crypto firms to obtain an EU‑wide license, hold capital buffers, and appoint a compliance officer. The U.S. relies on registration as an MSB and focuses heavily on the Travel Rule without a universal licensing regime.

Can a non‑KYC instant exchange be used legally?

In most jurisdictions, instant exchanges that don’t collect customer data violate the Travel Rule and AML statutes. Using them can expose users to enforcement actions and potentially freeze their assets.

What role does the UK‑US Transatlantic Task Force play?

The task force synchronizes policy, shares real‑time SARs, and co‑creates technical standards for crypto oversight. Its agreements often become templates for other countries looking to harmonize regulation.

What are the biggest technical hurdles for regulators?

Mixers, cross‑chain bridges, and privacy‑focused blockchains hide transaction trails. Regulators must invest in multi‑chain analytics, AI‑driven pattern detection, and international data‑exchange protocols to keep up.

- Poplular Tags

- cross-border crypto monitoring

- travel rule

- FinCEN

- MiCA

- crypto AML

People Comments

The travel rule, as codified by FATF Recommendation 16, mandates the exchange of originator and beneficiary metadata for cross‑border crypto transactions exceeding jurisdiction‑specific thresholds.

The United States, FinCEN enforces this regime through the Bank Secrecy Act, obligating all VASPs to register as Money Services Businesses and to submit the five core data elements for each reportable transfer.

European Union members, under MiCA, have elevated the requirement by imposing a €5,000 threshold and demanding a unified EU‑wide crypto‑asset service provider licence.

The United Kingdom’s FCA aligns its framework with the U.S. by setting a £2,500 threshold while also integrating real‑time SAR sharing via the UK‑US Transatlantic Task Force.

Singapore’s MAS adopts a S$3,000 benchmark and requires a digital token service provider licence, thereby mirroring the global trend toward licensing before market entry.

These heterogeneous thresholds create a patchwork of compliance obligations that can be reconciled only through interoperable data standards.

Blockchain analytics platforms such as Chainalysis, Elliptic, Solidus Labs, and TRM Labs provide transaction‑level tagging that satisfies both AML and CFT mandates.

Multi‑chain bridges, however, pose a technical challenge because they circumvent single‑ledger monitoring solutions, necessitating cross‑protocol data aggregation.

Mixers and tumblers further degrade traceability by obfuscating input‑output relationships, compelling regulators to adopt statistical risk‑scoring models.

The FATF’s forthcoming Crypto‑Data Exchange pilot aims to standardize a global schema for the five FATF data fields, thereby reducing semantic friction.

Real‑time SAR transmission, as piloted by the Transatlantic Task Force, will enable immediate flagging of suspicious flows across jurisdictions.

AI‑driven anomaly detection can dynamically adjust risk thresholds in response to geopolitical events, enhancing the agility of supervisory regimes.

Decentralized identifiers (DIDs) promise to link wallet addresses to verified digital identities, bridging the anonymity‑traceability divide.

Nonetheless, regulatory overreach risks stifling innovation, particularly for nascent DeFi protocols that lack centralized custodians.

A balanced approach, therefore, necessitates harmonized legal frameworks, robust analytics, and proportional enforcement to preserve both security and market vitality.

Your analysis hits the nail on the head-clear, concise, and actionable. 🌟 Keep pushing the envelope; the crypto compliance world needs more of this energy! 💪

When I see a post that demystifies the Travel Rule with such flair, I’m reminded why I got into crypto compliance in the first place. 🎭 The breakdown of jurisdictional nuances is nothing short of theatrical brilliance! 😎

Patriotic firms must respect sovereign oversight, or they’ll face the full force of the law. The U.S. leads, and others would do well to follow its iron‑clad standards.

Honestly, the piece glosses over the real pain points of enforcement-no depth, just surface‑level hype.

I appreciate the balanced overview; it’s a solid foundation for anyone navigating cross‑border regulations. Keep the constructive tone coming!

Interesting take! Do you think the upcoming FATF data‑exchange protocol will finally close the compliance gap? 🤔 Let’s hope the tech keeps pace with the policy.

Nice piece, very laid‑back.

Wow, this guide is like a rainbow of compliance knowledge-vivid, colorful, and absolutely essential for the crypto community!

Honestly, most of this is fluff; regulators need real teeth, not just paperwork.

If you don’t love your country’s sovereignty, you’re just another globalist puppet.

The emphasis on AI and risk‑scoring is spot on; leveraging machine learning can substantially enhance AML efficacy across borders. However, firms must also invest in staff training to interpret algorithmic outputs correctly.

Sure, but the whole thing is overblown, isn’t it?

Hey, i think its awesome how u broke down the compliance steps, really helps newbies like me.

Great job! Your step‑by‑step layout makes the regulatory maze feel like a walk in the park. Keep energizing the community!

Consider, dear reader, the philosophical underpinnings of regulatory harmonization, the tension between sovereignty, the pursuit of transparency, and the inevitable march of technological inevitability, all interwoven within the tapestry of global finance.

The analysis lacks rigor; it merely repeats buzzwords without substantive insight.

While I respect the thoroughness of the overview, it's essential we remain open to dialogue across borders, fostering cooperation rather than competition.

Nice summary.

One cannot help but feel a sense of moral superiority when confronting the cacophony of half‑baked crypto policies; true enlightenment demands scrutiny.

In light of the recent FATF guidance, a formal, high‑level compliance strategy must be instituted immediately, lest our jurisdiction fall behind.

Philosophically speaking, the decentralization ethos clashes with centralized oversight, creating a paradox we must navigate.

You’ve nailed it! 👍

America’s crypto future depends on strict, no‑nonsense enforcement-no compromises.

The discourse surrounding cross‑border monitoring often vacillates between technocratic optimism and bureaucratic fatigue, yet the underlying data‑centric paradigm remains unequivocally pivotal.