CPDAX Review – All You Need to Know

When evaluating CPDAX, a cryptocurrency exchange that markets high‑leverage contracts and zero‑fee trading. Also known as CPDAX Exchange, it aims to attract active traders looking for low costs and fast order execution., the first step is to understand the crypto exchange, a platform that lets users buy, sell, and swap digital assets ecosystem it lives in. CPDAX review focuses on how the platform balances affordability with safety, and why that balance matters for anyone trading volatile assets. This tag page pulls together articles that break down fees, security measures, and the leverage options that many traders chase.

Key Aspects Covered in This Review

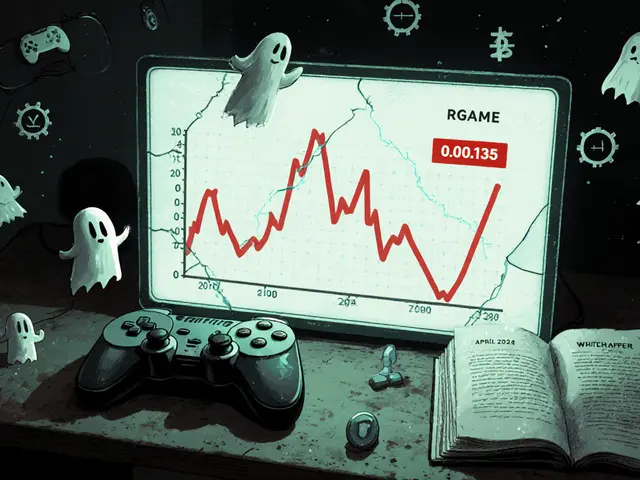

One of the biggest draws of CPDAX is its leverage trading, offering up to 100x exposure on select crypto pairs. While high leverage can amplify profits, it also raises the risk of rapid liquidations. The posts in this collection explain how margin calls work, what liquidation thresholds look like, and which risk‑management tools the exchange provides. At the same time, the platform touts “zero fees” on spot trades, but the fine print reveals hidden costs such as spread widening and funding rates on perpetual contracts. Understanding these nuances helps you avoid surprise expenses that could eat into potential gains.

Security is another non‑negotiable factor. CPDAX claims to implement multi‑factor authentication, cold‑storage wallets, and regular audits. The exchange security, the set of technical and procedural safeguards protecting user funds measures are dissected across several of the listed reviews, highlighting real‑world incidents, past withdrawal delays, and the platform’s response to regulatory inquiries. By comparing CPDAX’s security posture with industry benchmarks, you can gauge whether the exchange’s protections meet your comfort level.

KYC (Know Your Customer) requirements often determine how quickly you can start trading. CPDAX offers a tiered verification system: basic account creation is instant, but higher withdrawal limits and access to certain leveraged products demand ID verification and source‑of‑funds documentation. The articles explore how CPDAX’s KYC process stacks up against global standards, what data is stored, and how privacy‑focused users can navigate the trade‑off between anonymity and higher trading privileges.

Beyond the technical specs, the collection also touches on user experience, customer support responsiveness, and the community vibe surrounding CPDAX. Some reviews note a lively Telegram group that shares trading tips, while others point out occasional latency spikes during market surges. By reading through the curated posts, you’ll get a well‑rounded picture of both the strengths and the pain points of the platform.

Now that you’ve seen how CPDAX fits into the broader crypto exchange landscape, the impact of its security choices, and the real cost of its leverage offerings, you’re ready to dive deeper. Below you’ll find detailed articles that unpack each of these topics, give you actionable steps, and help you decide if CPDAX matches your trading style.