Liquid Staking Risk Calculator

Assess your potential losses from liquid staking risks based on real market events. Enter your staked amount and select your protocol to see potential de-pegging, slashing, and centralization risks.

When you stake your ETH or SOL, you lock it up to help secure the network and earn rewards. Simple, right? But what if you could earn those rewards without locking anything up? That’s the promise of liquid staking. Protocols like Lido and Rocket Pool let you turn your staked ETH into a token-like stETH-that you can trade, lend, or use in DeFi, all while still earning staking rewards. It sounds too good to be true. And in many ways, it is.

As of late 2025, over $14 billion is locked in liquid staking protocols. That’s not small change. But behind that growth is a web of hidden risks that most beginners don’t see until it’s too late. You’re not just trusting the blockchain anymore. You’re trusting smart contracts, centralized exchanges, validator operators, and market liquidity-all at once.

De-pegging: When Your stETH Isn’t Worth 1 ETH

The whole idea of liquid staking is that 1 stETH = 1 ETH. Always. But that’s not how markets work.

In June 2022, during the collapse of Celsius and the FTX meltdown, stETH dropped to as low as 0.94 ETH on major exchanges. Not 0.99. Not 0.97. 0.94. That’s a 6% loss overnight-not from a hack, not from a rug pull, but from a liquidity crunch. Users couldn’t swap stETH for ETH because the Curve Finance pool ran dry. People were stuck with tokens that looked like ETH but couldn’t be redeemed at face value.

It happened again in early 2023. CoinGecko data shows stETH traded below 0.99 ETH over 15 times in six months. That’s not a glitch. That’s a structural flaw. Liquid staking tokens aren’t stablecoins. They’re speculative assets with volatile demand. If everyone tries to exit at once, the price cracks.

And it’s not just stETH. stSOL, rETH, and stMATIC have all seen similar dips during market stress. The peg isn’t guaranteed. It’s maintained by liquidity providers, arbitrage bots, and market confidence-all of which vanish when panic hits.

Smart Contract Bugs: The Silent Killer

You’re not holding your ETH anymore. You’re trusting a smart contract to hold it for you. And smart contracts are code. Code has bugs.

Ankr’s 2023 risk analysis bluntly states: “Smart contracts that hold the original unstaked assets will have bugs which makes them susceptible to hacking.” That’s not speculation. It’s a fact of life in DeFi. In 2022, the Poly Network hack stole $600 million. In 2021, the bZx exploit drained $50 million. Liquid staking protocols are no different.

Even protocols with multiple audits-like Lido and Rocket Pool-aren’t immune. Community forums in 2023 showed users questioning whether audits were thorough enough. One user on Reddit pointed out that a critical function in Lido’s contract had only been audited by one firm, and that firm had missed a similar flaw in another protocol the year before.

Worst case? A bug lets someone drain the entire staking pool. No warning. No refund. Just gone. And because these contracts are immutable, there’s no rollback. No customer support. Just silence.

Slashing: You Pay for Someone Else’s Mistake

When you stake directly, you know the risks. If your validator goes offline or signs two conflicting blocks, you lose part of your stake. That’s slashing. But with liquid staking, you’re outsourcing that risk.

Galaxy Research confirmed in 2023 that slashing can cost up to 1 ETH per incident. That’s not theoretical. Ethereum validators have been slashed multiple times since the Merge. But here’s the catch: when you use Lido or Rocket Pool, you don’t know which validator you’re paired with. You don’t control it. And if that validator gets slashed, your stETH or rETH loses value.

Some protocols, like Rocket Pool, try to mitigate this by requiring operators to put up collateral (RPL tokens). But that doesn’t fully protect you. If the collateral is undercollateralized-or if multiple validators get slashed at once-the entire system gets strained. And you, the user, absorb the loss.

It’s like buying car insurance from a company that doesn’t actually own any cars. You pay for protection, but the protection depends on someone else doing their job right. And if they don’t? You’re on your own.

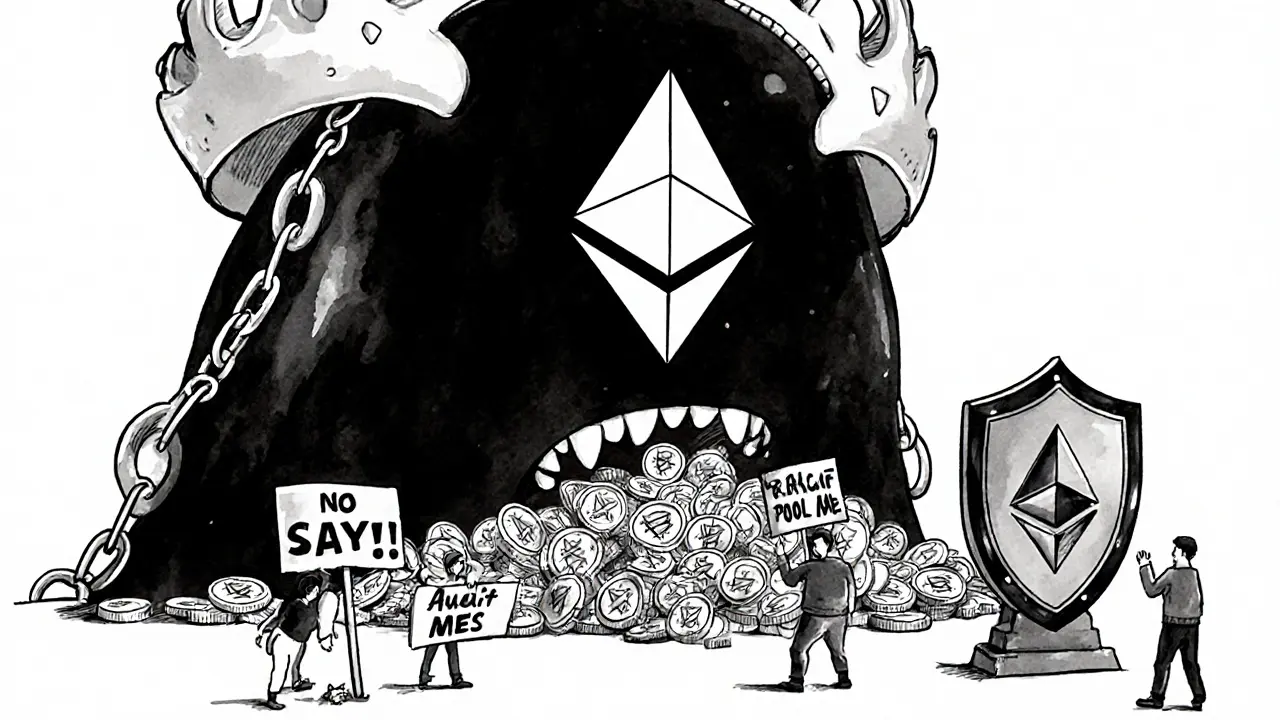

Centralization: One Protocol, Too Much Power

Lido controls roughly 32% of all staked ETH on Ethereum. That’s more than the next five largest staking providers combined. That’s not decentralization. That’s a single point of failure.

Ethereum’s security relies on distributed validators. If one entity controls a third of the network, it could theoretically manipulate consensus, delay transactions, or even censor addresses. That’s not a conspiracy theory-it’s a documented threat model from Ethereum Foundation researchers.

Lido’s governance is run by LDO token holders. But most LDO is held by a handful of large wallets. In September 2023, Lido DAO voted to expand into Solana and Polygon. Many users were furious. They didn’t want their ETH staking risk spread to less secure chains. But they had no say. The vote was decided by a few big holders.

Compare that to Rocket Pool, where anyone can run a minipool by staking 8 ETH plus 2.4 ETH in RPL. It’s harder. It’s slower. But it’s more distributed. The trade-off? Higher barrier to entry. Lower rewards. Less convenience.

When you choose Lido, you’re choosing convenience over decentralization. And that’s a risk you can’t undo.

Regulatory Risk: The SEC Is Watching

On August 5, 2025, the U.S. Securities and Exchange Commission issued a formal statement on “Certain Liquid Staking Activities.” It didn’t ban anything. But it didn’t need to.

The SEC signaled that LSTs like stETH and rETH could be classified as securities. Why? Because they’re sold as investment contracts-promising returns from the efforts of others (the protocol operators). That’s the Howey Test.

If that happens, exchanges like Coinbase and Binance will have to delist them. DeFi platforms will have to block U.S. users. Liquidity will dry up. Prices will crash.

And it’s not just the U.S. The EU’s MiCA regulation, which takes full effect in 2026, will also target staking services. Liquid staking is no longer a niche DeFi experiment. It’s a financial product under regulatory scrutiny.

What You Can Do to Protect Yourself

Don’t panic. But don’t sleepwalk into this either.

- Diversify your LSTs. Don’t put all your ETH into stETH. Split it between stETH, rETH, and maybe even OETH (Origin Ether). Each has different risk profiles. OETH, for example, has built-in slashing protection and deeper liquidity.

- Check liquidity depth. Before staking, look at the trading volume on Uniswap, Curve, or SushiSwap. If the pool has less than $100 million in liquidity, avoid it. Low liquidity = high de-peg risk.

- Verify audits. Don’t trust marketing. Go to the protocol’s GitHub or documentation. Look for audits from OpenZeppelin, Trail of Bits, or Quantstamp. If they only have one audit from an unknown firm, walk away.

- Understand your token type. Is it rebasing (supply changes) or reward-bearing (token price increases)? Rebasing tokens can complicate taxes. Reward-bearing tokens are easier to track but harder to price.

- Never stake more than you can afford to lose. Liquid staking isn’t savings. It’s high-risk DeFi. Treat it like leveraged trading.

Is Liquid Staking Worth It?

Yes-if you know what you’re doing. No-if you think it’s just “stake and earn.”

It’s not about whether liquid staking is good or bad. It’s about whether you understand the trade-offs. You’re trading control for convenience. You’re trusting strangers with your assets. You’re betting on market stability in a volatile ecosystem.

For many, the rewards are worth it. The flexibility to use your staked ETH in DeFi is powerful. But that power comes with responsibility. The biggest risk isn’t a hack. It’s ignorance.

Know the risks. Monitor your positions. Don’t assume the peg will hold. And never, ever treat a liquid staking token like cash.

Can you lose money with liquid staking even if the blockchain is secure?

Yes. Even if Ethereum or Solana runs perfectly, you can still lose money. Liquid staking tokens can de-peg due to low liquidity, smart contract exploits, or validator slashing. Your loss isn’t from the blockchain failing-it’s from the financial layer built on top of it.

Is stETH safer than rETH?

It depends. stETH has more liquidity and is easier to trade, but it’s controlled by Lido, which holds 32% of all staked ETH. That’s a centralization risk. rETH is more decentralized because users run their own validators with collateral, but it’s harder to trade and has lower liquidity. If you care about security over convenience, rETH is safer. If you care about ease of use, stETH wins-but with higher systemic risk.

What happened to stETH during the 2022 crypto crash?

During the Celsius and FTX collapses, stETH dropped to 0.94 ETH on major exchanges. The Curve Finance pool that allowed swaps between stETH and ETH ran out of liquidity. Users couldn’t redeem their tokens at 1:1. Many lost 5-6% of their value overnight. It wasn’t a hack-it was a liquidity crisis triggered by mass panic.

Are liquid staking tokens considered securities?

The U.S. SEC has signaled that they may be. In August 2025, the SEC issued a statement calling out “certain liquid staking activities” as potential securities offerings. If classified as such, exchanges may be forced to delist them, and U.S. users could be blocked from using them. This could drastically reduce liquidity and increase volatility.

Should I avoid liquid staking entirely?

No-but only if you understand the risks. Liquid staking offers real benefits: liquidity, DeFi access, and passive income. But it’s not risk-free. Treat it like a high-risk investment. Diversify across protocols, monitor liquidity, verify audits, and never stake more than you can afford to lose. If you want true safety, stake directly or use a regulated custodian like Coinbase.

![What is Sheesha Finance [ERC20] (SHEESHA) crypto coin? Token details, risks, and real-world performance](/uploads/2025/11/thumbnail-what-is-sheesha-finance-erc20-sheesha-crypto-coin-token-details-risks-and-real-world-performance.webp)

People Comments

I just lost 5% on stETH last year and still haven't forgiven myself. No one warned me it wasn't actually ETH. Just a fancy IOU that disappears when the market sneezes.

This is why I only use rETH. Yeah, the liquidity is thinner and the interface is clunkier, but at least I know I'm not putting all my eggs in one centralized basket. Lido's 32% share is a red flag bigger than a whale in a bathtub.

I read this article three times. I checked the Curve pool data. I looked up the audit reports. I verified the validator distribution. And I still think it's worth it, as long as you diversify. Don't just pick one. Split between rETH, stETH, and OETH. And never stake more than you're willing to lose. Period.

We think we're owning ETH when we hold stETH. But really we're trusting a chain of strangers. A contract. A bot. A vote. A CEO. A regulator. We've built a house of cards made of faith. And now we're surprised when the wind blows.

The tragedy of liquid staking is not its risk-it's its seduction. It promises freedom: trade, lend, yield, repeat. But freedom without responsibility is just another kind of bondage. We traded control for convenience, then acted shocked when convenience betrayed us. The blockchain didn't fail us. We failed to understand what we were truly buying.

Lido's DAO is controlled by 7 wallets. The SEC is already drafting a subpoena. And you think the smart contract audits are legit? Please. The same firm that missed the Parity bug audited Lido. They're not doing due diligence-they're doing PR. This whole thing is a Ponzi dressed in DeFi clothes.

I appreciate the thoroughness of this breakdown. The regulatory risk alone should be enough to make any prudent investor pause. If stETH becomes classified as a security, the implications ripple across every DeFi protocol that uses it as collateral. This isn't speculation. It's imminent.

i just use coinbase staking now. no drama. no weird tokens. no panic selling. just earn. simple.

In India we call this khaali kaatna-selling air. You think you own something but you're just holding a promise. The real asset is locked away. The token is just a receipt. And receipts can be torn

I spent 18 months researching this. I built a spreadsheet tracking every de-peg event since 2021. I analyzed liquidity ratios, audit firm reputations, validator uptime stats, and even the Twitter sentiment of Lido’s core team. The data is clear: stETH is a time bomb. rETH is the safer bet. OETH is the dark horse. And if you’re holding anything else? You’re gambling.

Oh wow so you mean to tell me putting your money in a smart contract run by people you've never met and trusting a token that might not be worth what you paid for it is risky? Shocking. Next you'll tell me buying NFTs of apes is not retirement planning.

I still use stETH. Not because I think it's safe. But because it's the most liquid. I treat it like a volatile stock. I don't sleep on it. I monitor it daily. I take profits when it pumps. And I never let it sit longer than 3 months. It's not savings. It's trading.

This is why America is doomed. You people trust corporations, then call it decentralization. The SEC is coming. The banks are watching. The whole thing is a controlled demolition. And you're still buying stETH like it's gold? Wake up. This isn't finance. It's a propaganda campaign run by venture capitalists.

i use stETH and i'm chill 😌 the peg always comes back. just don't panic sell. also i like that i can use it in aave and curve. it's like having your cake and eating it too 🍰

I love how this post breaks down the risks without fearmongering. The liquidity point is critical. I check Curve pool depth before every stake now. If it's under $200M, I skip it. Simple rule. Saves headaches.

You think the real risk is the protocol? Nah. It's you. You're the one who thinks stETH is cash. You're the one who bought it because your cousin said it was 'easy money'. You're the one who didn't read the docs. The system isn't broken. You are.

This is exactly why I told my clients to avoid liquid staking entirely. You're not earning passive income-you're enabling a systemic risk cascade. And if you're using it as collateral in DeFi? You're playing Russian roulette with your entire portfolio. The fact that people still do this is terrifying.

Meh. I just stake on Coinbase. It's easier.

Diversify. Monitor. Don't assume. That's it.

I got slashed 0.3 ETH last year because my validator on Lido went offline. I didn't even know I was assigned to them. No warning. No refund. Just gone. That's the hidden cost of convenience. I switched to rETH after that. Worth the extra steps.

Let me be clear: liquid staking is not a savings account. It is not a CD. It is not a bond. It is a high-leverage, multi-layered financial instrument built on top of a decentralized ledger. If you treat it as anything less, you are not an investor-you are a liability. The rewards are real. But so are the consequences of ignorance. Do your homework. Or get out.