There’s no getting around it: if you’re looking for a solid review of IncrementSwap, you’re hitting a wall. After digging through dozens of trusted sources - from industry analysts to user forums - there’s simply not enough public data to give you a real, honest breakdown of this platform. That’s not a minor gap. It’s a red flag.

What Is IncrementSwap Supposed to Be?

IncrementSwap claims to be a decentralized crypto exchange. That means, in theory, it lets users trade cryptocurrencies directly from their wallets without handing over control to a central authority. No KYC, no deposit holdups, no middleman. Sounds familiar? It should. That’s the same promise Uniswap, PancakeSwap, and dozens of other DeFi platforms made years ago. But here’s the difference: those platforms have years of transaction history, public smart contract audits, and thousands of active users. IncrementSwap? There’s no verified trading volume. No public team. No whitepaper you can download. No GitHub repo showing code updates. No community Discord with more than a handful of members.Why This Matters

In crypto, trust isn’t built on marketing slogans. It’s built on transparency. When a platform doesn’t publish its smart contract addresses, you can’t verify if your funds are safe. If it doesn’t list which blockchains it supports - Ethereum, Solana, Polygon? - you can’t even tell if it’s compatible with your wallet. If there’s no record of audits by firms like CertiK or Hacken, you’re trading blind. Real exchanges don’t hide. They show their work. Kraken publishes its reserve proofs. Uniswap’s code is open on GitHub with over 10,000 commits. Even newer players like dYdX release quarterly security reports. IncrementSwap? Zero public footprint.

Who Might Be Behind It?

There are two likely scenarios here. One: IncrementSwap is a brand-new project still in stealth mode. That’s possible. But if that’s true, why are people already trying to trade on it? You can’t build trust overnight in DeFi. The second scenario is far more common - and far more dangerous. IncrementSwap could be a rug pull in disguise. These projects pop up with flashy websites, fake testimonials, and promises of high APYs. They attract small deposits. Then, when the volume hits a certain point, the devs drain the liquidity pool and vanish. The site goes dark. The Telegram group disappears. The Twitter account gets suspended. We’ve seen this play out hundreds of times. In 2023 alone, over $400 million was lost to similar anonymous DeFi platforms. No one got their money back. No regulators stepped in. No one even knew who to sue.What You Should Do Right Now

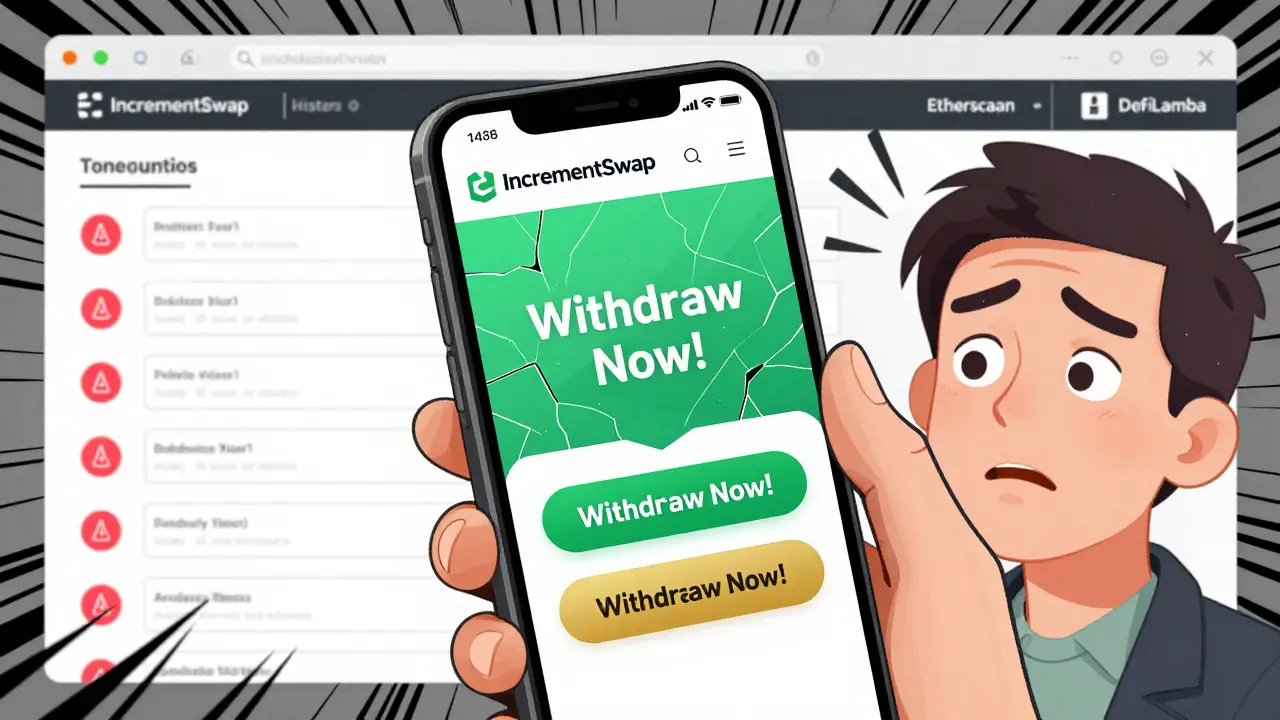

If you’ve already deposited funds into IncrementSwap, stop trading. Do not add more. Try to withdraw everything immediately. If the withdrawal button is grayed out or says "processing," that’s a classic sign of a liquidity lock - often a trap. If you’re thinking about signing up, don’t. Not until you can answer these five questions:- Can you find the official smart contract address on Etherscan or another blockchain explorer?

- Has a reputable firm like CertiK, SlowMist, or PeckShield audited the code?

- Is there a public team with LinkedIn profiles and real names?

- Does the platform have real trading volume on DEXTools or DeFiLlama?

- Are there at least 500 active users on their official Discord or Telegram?

Alternatives That Actually Work

You don’t need to gamble on unknown platforms to get good crypto trading. Here are three solid, verified alternatives:- Uniswap: The OG decentralized exchange. Supports 10,000+ tokens. Audited. Over $1 billion in daily volume.

- PancakeSwap: Built on BNB Chain. Low fees. Strong community. Regularly updated.

- Bybit: If you want centralized security with advanced tools, Bybit offers spot, futures, and options with full KYC, insurance fund, and cold storage.

The Bottom Line

IncrementSwap isn’t just unreviewed - it’s unverifiable. In crypto, that’s the same as dangerous. There’s no such thing as a "too good to be true" trade. If something looks like a shortcut to profits, it’s usually a trap. Stick to platforms with transparency. Stick to platforms with history. Stick to platforms that don’t make you guess whether your money is safe. If you can’t find real proof about IncrementSwap, then you already know the answer: don’t use it.Is IncrementSwap a legitimate crypto exchange?

There is no verifiable evidence that IncrementSwap is legitimate. No public smart contract addresses, no audits, no team information, and no trading volume data exist on reputable blockchain explorers or DeFi analytics platforms. Without these basics, it cannot be considered a trustworthy exchange. Most likely, it’s either a brand-new project still in development - or a scam.

Can I withdraw my funds from IncrementSwap?

If you’ve deposited funds, try withdrawing immediately. If the withdrawal button is disabled, says "processing," or asks for additional fees, do not proceed. These are classic signs of a liquidity lock or rug pull. Once funds are trapped, recovery is nearly impossible. Do not add more money.

Why don’t major crypto sites review IncrementSwap?

Reputable review sites like Koinly, NerdWallet, and InvestingHaven only cover exchanges with verifiable data: public audits, transparent teams, real trading volume, and regulatory compliance. IncrementSwap lacks all of these. Without data, there’s nothing to review. Silence from trusted sources is a warning, not an oversight.

What’s the difference between IncrementSwap and Uniswap?

Uniswap is a well-established decentralized exchange with publicly audited smart contracts, over $1 billion in daily trading volume, and a team with verifiable history. IncrementSwap has none of these. Uniswap’s code is open on GitHub. IncrementSwap’s code is hidden. Uniswap has been live since 2020. IncrementSwap appears to have launched without any public trail.

Should I use IncrementSwap if it offers higher rewards than other exchanges?

No. In crypto, unusually high rewards on unverified platforms are almost always a trap. These are often designed to lure small deposits quickly before the operators drain the liquidity pool. Real exchanges don’t need to promise 50% APYs - they earn trust through transparency and reliability. If it sounds too good to be true, it is.