Blockchain Gaming Comparison Tool

Blockchain Gaming

Incorporates distributed ledger technology for true asset ownership, interoperable NFTs, and decentralized governance.

NFTs • Smart Contracts • DAOsTraditional Gaming

Centralized assets stored on developer servers with limited transferability and no direct economic return.

Licensing • Central Servers • Fixed Economy| Aspect | Traditional Gaming | Blockchain Gaming |

|---|---|---|

| Asset Ownership | Licensed, stored on central servers; lost if game shuts down. | Player-controlled NFTs/tokens on a public ledger; transferable. |

| Economic Model | Spend on cosmetics, DLCs; no direct monetary return. | Play-to-earn tokens, secondary market sales, staking rewards. |

| Governance | Developer-centric decisions. | Community-driven DAO voting on updates. |

| Interoperability | Items locked to a single title. | Cross-game asset use via shared standards (ERC-1155, etc.). |

| Scalability & Speed | High TPS, low latency. | Dependent on blockchain; often hybrid solutions. |

Benefits of Blockchain Gaming

- True ownership of in-game assets

- Cross-game asset interoperability

- Economic incentives through play-to-earn

- Decentralized governance via DAOs

- Transparent transaction records

Challenges in Blockchain Gaming

- Scalability limitations

- Complex user experience

- Cross-chain compatibility issues

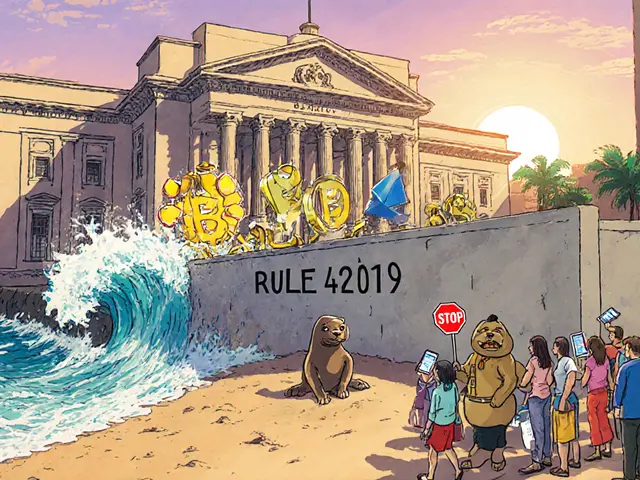

- Regulatory uncertainties

- Potential game quality trade-offs

Understanding the Shift

Blockchain gaming represents a fundamental shift from centralized asset management to decentralized ownership. While challenges remain, the technology offers new opportunities for player empowerment and economic participation in digital worlds.

Quick Take

- Blockchain gaming lets players truly own in‑game items as NFTs or tokens.

- Smart contracts automate game logic and asset transfers without a central server.

- Play‑to‑earn models reward gamers with tradable crypto that can be sold for real money.

- Hybrid architectures combine on‑chain security with off‑chain speed.

- Challenges include scalability, user‑experience polish, and cross‑chain compatibility.

Ever wondered why some games let you buy a skin that you can sell later for cash? That shift is driven by blockchain gaming. Below we break down the tech, the economics, and what it means for the future of play.

What Is Blockchain Gaming?

Blockchain gaming is a type of video game that incorporates distributed ledger technology to manage assets, currencies, and sometimes core gameplay mechanics. By storing key data on a blockchain, developers can guarantee that items, characters, and even game rules are immutable and transparently owned by the player. These games show up under many names-crypto games, NFT games, Web3 games, GameFi, or metaverse games-depending on the focus of the project.

Core Technologies That Power the Revolution

Three pillars keep blockchain games running:

-

Smart contracts are self‑executing code stored on a blockchain. They automatically enforce rules like "if a player defeats a boss, mint a unique weapon NFT" without needing a central authority. This trust‑less execution is what gives games their “decentralized” feel.

-

Crypto wallets act as the universal login for blockchain games. Instead of a username/password, a wallet address securely identifies a player and holds all their tokens and NFTs. Popular wallets include MetaMask, Trust Wallet, and Coinbase Wallet.

-

Non‑fungible tokens (NFTs) are unique digital certificates that prove ownership of a specific in‑game asset, such as a rare sword, a character skin, or a piece of virtual land. Because NFTs live on the blockchain, they can be traded on open marketplaces like OpenSea or Rarible.

How a Typical Blockchain Game Works

Most modern titles use a hybrid architecture that blends on‑chain and off‑chain components. The flow looks roughly like this:

- Player launches the game and connects a crypto wallet.

- Off‑chain servers handle graphics, physics, and real‑time matchmaking for speed.

- When a tradable item is earned, a smart contract mints an NFT on the blockchain.

- The NFT appears instantly in the player’s wallet; they can keep it, sell it, or use it in another compatible game.

- In‑game token economies (often called play‑to‑earn tokens) reward actions like completing quests, staking NFTs, or providing liquidity to in‑game markets.

Why It Matters: Benefits Over Traditional Gaming

Traditional games store items on central servers owned by the developer. If the company shuts down, players lose everything. Blockchain gaming flips that script:

- True ownership: NFTs give players a provable claim to assets that persists beyond any single game.

- Interoperability: Tokens and NFTs can move between compatible games, creating cross‑title economies.

- Economic incentives: Play‑to‑earn lets gamers monetize their time, turning hobby into potential income.

- Decentralized governance: Many projects are managed by DAOs (Decentralized Autonomous Organizations), giving players a say in future updates and policy changes.

- Transparency: All transactions are recorded on a public ledger, reducing fraud and enabling clear royalty distribution for creators.

Challenges That Keep Some Players on the Sidelines

Despite the hype, several hurdles hinder mass adoption:

- Scalability: Blockchains like Ethereum can process only ~15 transactions per second, leading to high fees and lag. Layer‑2 solutions (e.g., Polygon, Arbitrum) are helping but aren’t universal yet.

- User experience: Managing wallets, gas fees, and private keys feels daunting compared to a simple Steam login.

- Cross‑chain fragmentation: Assets on one blockchain often can’t be used on another without bridges, which add security risk.

- Regulatory uncertainty: Some jurisdictions treat NFTs as securities, creating legal gray zones for developers and players.

- Game quality: Early blockchain titles sometimes sacrifice polish for novelty, making them less appealing to mainstream gamers.

Future Outlook: From Niche to Mainstream?

Industry analysts expect three trends to push blockchain gaming forward:

- Improved scalability: New Layer‑1 blockchains (e.g., Solana, Avalanche) and roll‑up technologies aim to deliver sub‑second finality at low cost.

- Seamless wallet integration: SDKs that embed wallet creation directly into games will lower the entry barrier for non‑crypto players.

- Meta‑game ecosystems: Projects like The Sandbox, Decentraland, and Axie Infinity are building shared virtual worlds where NFTs act as land, avatars, and items that persist across multiple experiences.

When these pieces click, we could see a shift from “play‑for‑fun” to a blended model where entertainment and income coexist. That doesn’t mean every gamer will become a trader, but the option to cash out could reshape how developers design reward systems.

Traditional Gaming vs. Blockchain Gaming: A Quick Comparison

| Aspect | Traditional Gaming | Blockchain Gaming |

|---|---|---|

| Asset Ownership | Licensed, stored on central servers; lost if game shuts down. | Player‑controlled NFTs/tokens on a public ledger; transferable. |

| Economic Model | Spend on cosmetics, DLCs; no direct monetary return. | Play‑to‑earn tokens, secondary market sales, staking rewards. |

| Governance | Developer‑centric decisions. | Community‑driven DAO voting on updates. |

| Interoperability | Items locked to a single title. | Cross‑game asset use via shared standards (ERC‑1155, etc.). |

| Scalability & Speed | High TPS, low latency. | Dependent on blockchain; often hybrid solutions. |

Getting Started: Your First Steps Into Blockchain Gaming

- Choose a reputable wallet (MetaMask is a common starter).

- Fund it with a small amount of the blockchain’s native token (e.g., ETH for Ethereum).

- Pick a beginner‑friendly game: Axie Infinity, Gods Unchained, or Illuvium.

- Connect your wallet, claim any free starter assets, and explore the marketplace.

- Play, earn, and experiment with buying/selling NFTs on a marketplace like OpenSea.

Remember to keep your private key safe-losing it means losing all your in‑game assets.

Frequently Asked Questions

Do I need to be a crypto expert to play blockchain games?

No. Many games now bundle wallet creation and guide users through the basics. A small amount of crypto to cover transaction fees is all that’s required.

Can I trade my game NFTs for real money?

Yes. Most NFTs can be listed on open marketplaces and sold for fiat‑equivalent stablecoins, which you can then withdraw to a bank account.

What’s the biggest risk when investing time in a blockchain game?

Market volatility. Token values can swing wildly, and a game’s user base might shrink, reducing demand for its assets.

Are blockchain games safer from hacks than traditional games?

The on‑chain logic is immutable, but wallets and bridges can be targeted. Using hardware wallets and reputable platforms mitigates most risks.

Will traditional game studios adopt blockchain tech?

Some already are (e.g., Ubisoft’s Quartz platform). As scalability improves, we’ll likely see more mainstream titles experiment with NFTs and token economies.

People Comments

Blockchain gaming reshapes ownership by moving assets onto a public ledger. This shift means players keep their items even if the studio disappears. The article correctly points out the DAO governance angle, which can democratize updates. However, scalability remains a bottleneck, especially on congested chains. In practice, hybrid solutions that keep gameplay off‑chain while minting NFTs on‑chain are the most viable today.

Great rundown! 👍

If you want real value, stick to games that actually let you sell NFTs, otherwise it’s just hype. Anything else is just a marketing trick.

The article provides a comprehensive taxonomy of blockchain gaming architectures, delineating pure on‑chain, hybrid, and off‑chain models. Pure on‑chain games execute all logic within smart contracts, guaranteeing immutability but suffering from latency and gas constraints. Hybrid designs delegate intensive computations to traditional servers while anchoring asset provenance on the ledger, thereby achieving a balance between performance and trustlessness. Off‑chain titles, by contrast, merely adopt tokenized economies without leveraging decentralized asset custody. This classification mirrors the broader Web3 spectrum, where trade‑offs between scalability, security, and user experience are pivotal. From a cryptoeconomic perspective, token emission curves must be calibrated to avoid hyperinflation that would erode NFT valuation. Staking mechanisms, when integrated, can incentivize holders to secure the network, yet they also introduce complexity that may deter casual gamers. The article correctly highlights DAO governance as a democratizing force, though voting power often remains proportional to token holdings, raising concerns of plutocratic dominance. Interoperability standards such as ERC‑1155 enable cross‑title asset migration, but bridge vulnerabilities have precipitated high‑profile exploits. Layer‑2 solutions like Polygon and Arbitrum aim to alleviate Ethereum’s throughput limitations, offering sub‑second finality and negligible fees. Nonetheless, the nascent state of these roll‑ups poses risks related to contract incompatibility and centralization of sequencers. Regulatory scrutiny, especially regarding utility versus security token classification, continues to evolve and may impact token distribution models. Moreover, the environmental impact of proof‑of‑work chains has spurred migration toward proof‑of‑stake protocols, aligning with sustainability goals. From a developer’s standpoint, integrating wallet SDKs streamlines onboarding, yet user education remains a barrier to mass adoption. Lastly, community‑driven content creation, exemplified by player‑minted NFTs, fosters a vibrant ecosystem that blurs the line between developer and consumer. In sum, while the article captures the present landscape adeptly, future iterations must monitor advances in scalability, governance, and regulatory frameworks to remain salient.

Blockchain gaming isn’t just a gimmick; it’s an evolution of player agency that aligns with the philosophical notion of digital self‑ownership. By tokenizing assets, developers hand over true control, which can empower communities to shape the game’s direction. The article’s breakdown of DAO voting underscores this shift, yet many projects still centralize decision‑making behind a few big wallets. That’s where we as players need to stay vigilant and demand transparent governance. If the ecosystem learns from early missteps, the payoff could be massive for both creators and gamers 🚀. Keep an eye on emerging layer‑2 solutions-they’ll be the backbone of scalable play‑to‑earn models.

When you watch an NFT sword materialize on‑chain after a boss fight, the adrenaline surge feels like a backstage pass to the future of gaming! 🎮💥 The article nails that moment, but the real drama lies in the hidden gas fees that can turn triumph into frustration. Imagine a world where latency disappears and every loot drop is instant, immutable, and tradable. That vision drives the hype and the heartbeats of developers worldwide. Until then, we’re stuck in a hybrid reality, half‑digital, half‑blockchain, always yearning for the next epic drop.

America’s gaming giants should lead the charge, not hand over IP to fringe crypto labs. The play‑to‑earn model sounds flashy, but unless we own the servers and the code, we’re just feeding a foreign token economy. The article’s optimism is nice, yet the real power stays where the data centers are built. Let’s push for home‑grown blockchain solutions that keep profits onshore. Only then will the industry truly benefit the nation’s players.

Most of these so‑called “blockchain games” are just cash grabs with a veneer of tech. The article glosses over the fact that 90% of NFTs never see a secondary market sale. If you’re not willing to gamble on volatile tokens, stay away. This space is riddled with hype and low‑effort titles that barely pass muster.

I appreciate the balanced overview; the pros and cons are laid out clearly. It’s encouraging to see that developers are experimenting with hybrid models to keep gameplay smooth while preserving ownership. As the technology matures, I’m hopeful we’ll see more polished experiences that don’t sacrifice fun for finance. The community’s role in governance could also lead to richer, player‑driven content. Let’s keep the conversation constructive and supportive.

From a global perspective, blockchain gaming opens doors for creators in regions where traditional publishing pipelines are limited. The ability to mint NFTs means indie devs can monetize without a big publisher, which diversifies the cultural output of games. However, accessibility remains a challenge; not everyone has reliable internet or knows how to handle crypto wallets. Bridging these gaps with user‑friendly onboarding will be key to worldwide adoption. I’m excited to watch how different cultures shape the next wave of play‑to‑earn ecosystems. 🌍

Nice summary, the article hits the main points without getting too techy. Looking forward to more examples.

Wow, the article paints a vivid picture of a future where our in‑game heroes wear digital crowns that we can actually own! 🌟 The blend of art and finance is like watching a sunrise over a pixelated meadow – beautiful and full of promise. I love how it emphasizes community‑driven governance; it feels like we’re all co‑authors of the story. Still, the “scalability” dragon looms large, but I’m confident the tech wizards will tame it soon. Keep the creative sparks flying, and maybe toss in a few more case studies for extra flavor!

Honestly, most of this hype is just a way for some overseas devs to cash‑out on unsuspecting players. The article sounds like it’s buying into the dream, but the reality is that many of these games are riddled with bugs and pay‑walls. If you’re not careful, you’ll end up losing money instead of earning it. Keep your eyes open and don’t get blinded by fancy NFTs.

I don’t see why anyone needs to own a pixel sword when you can just enjoy the game.

The discourse surrounding blockchain integration in interactive entertainment necessitates a rigorous examination of both technical feasibility and socioeconomic impact. While the article provides a commendable overview, further empirical data on player retention and token velocity would bolster its arguments. Moreover, an analysis of cross‑chain interoperability standards could elucidate potential pathways for broader ecosystem cohesion. In sum, the dialogue must evolve beyond speculative enthusiasm toward substantiated research.

Sounds like a fad to me, but hey, each to their own.

I think u should try a game like Axie Infinity first – it’s a good intro. Just make sure u have some eth for gas, otherwise u’ll get stuck.

Those emojis really capture the excitement! If you’re new, start with a wallet that has a built‑in faucet so you don’t pay gas right away.

Indeed; the taxonomy presented is exhaustive, yet one might argue that the delineation between hybrid and off‑chain models could be further refined-especially concerning state synchronization mechanisms! Additionally, the article could benefit from a deeper dive into consensus algorithms that underlie token issuance, as these directly influence economic stability.

While the exposition is thorough, the treatment of regulatory considerations appears cursory; a more granular analysis of jurisdictional variance would enhance the piece’s applicability. Furthermore, the impact of network fees on user onboarding deserves amplified attention.

A balanced perspective is essential; acknowledging both the innovative potential and the inherent risks fosters a more nuanced community dialogue. Emphasizing education initiatives could mitigate many of the entry barriers highlighted.

Oh great, another 16‑sentence manifesto about how “blockchain will save gaming.” Sure, if we ignore the fact that most players just want fun, not spreadsheets.