Polygon DEX: What It Is, How It Works, and Why It Matters

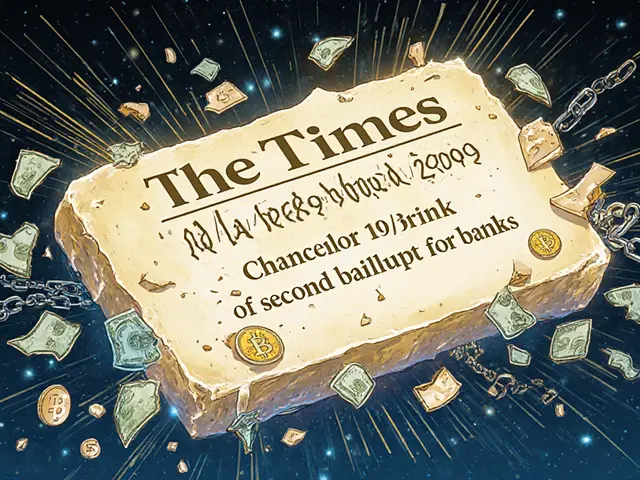

When you trade crypto on a Polygon DEX, a decentralized exchange built on the Polygon blockchain that lets users trade tokens directly without a central authority. Also known as a Polygon-based DEX, it’s one of the most popular ways to swap tokens with low fees and near-instant settlements. Unlike big centralized platforms, a Polygon DEX runs on smart contracts—so you keep control of your keys, and there’s no bank or company standing between you and your money.

What makes Polygon DEX special isn’t just that it’s decentralized—it’s how fast and cheap it is. Built on Ethereum but running its own sidechain, Polygon cuts gas fees by over 90% compared to the main Ethereum network. That’s why you see projects like Aave, Uniswap, and SushiSwap all offering versions of their platforms on Polygon. It’s not just a workaround—it’s become the go-to for everyday trading, especially for users who hate paying $20 to swap two tokens.

But a Polygon DEX isn’t just about speed and cost. It’s also tied to bigger ideas like DeFi trading, the system of open financial protocols that let you lend, borrow, and trade without traditional banks, and blockchain interoperability, how different networks like Ethereum, Solana, and Polygon connect to share data and assets. That’s why many of the posts here dive into cross-chain bridges, token swaps, and how liquidity moves between chains. You can’t talk about Polygon DEX without talking about how it fits into the larger puzzle of Web3 finance.

Some of the risks you’ll see covered here—like smart contract hacks, fake tokens, or liquidity traps—aren’t unique to Polygon. But because it’s so popular, it’s also a prime target. If you’re using a Polygon DEX, you need to know how to spot a scam token, what slippage really means, and why a token with no trading volume might look cheap but is actually worthless. The posts below break down real cases: from NFT-based trading platforms on Polygon, to how governance votes on DEXs affect your rewards, to why some airdrops turn out to be empty promises.

You’ll find guides here on how to use Uniswap V3 on Polygon, what to look for in a DEX’s liquidity pool, and why some tokens labeled as "Polygon-based" are just clones with no real team. You’ll also see how regulatory pressure in places like India and Vietnam is pushing traders toward decentralized options—and why that’s both a blessing and a risk. Whether you’re new to DeFi or you’ve been swapping tokens for years, the real value of a Polygon DEX isn’t just in the tech—it’s in knowing how to use it safely, smartly, and without getting ripped off.