There is no such thing as a 'Minter Ethereum crypto exchange.' If you're searching for one, you're chasing a myth. The term 'Minter' is either a misunderstanding of Ethereum's old mining system - which died in 2022 - or confusion with Minter Network, a completely different blockchain that lets you create your own tokens. Neither has anything to do with trading Ethereum today. And if a website, app, or YouTube video is selling you on 'mining Ethereum' or a 'Minter exchange,' you're being misled. This isn't just outdated advice - it's dangerous.

Ethereum Mining Is Dead. Here's Why.

Ethereum stopped being mined in September 2022. That’s not a rumor. It’s not a future plan. It’s done. The network switched from Proof-of-Work to Proof-of-Stake in an event called The Merge. Every GPU, ASIC rig, and mining farm that once ran on Ethereum became useless overnight. The software won’t connect. The hardware won’t earn ETH. The network doesn’t allow it. As of 2026, mining Ethereum is as possible as using a fax machine to send a tweet.

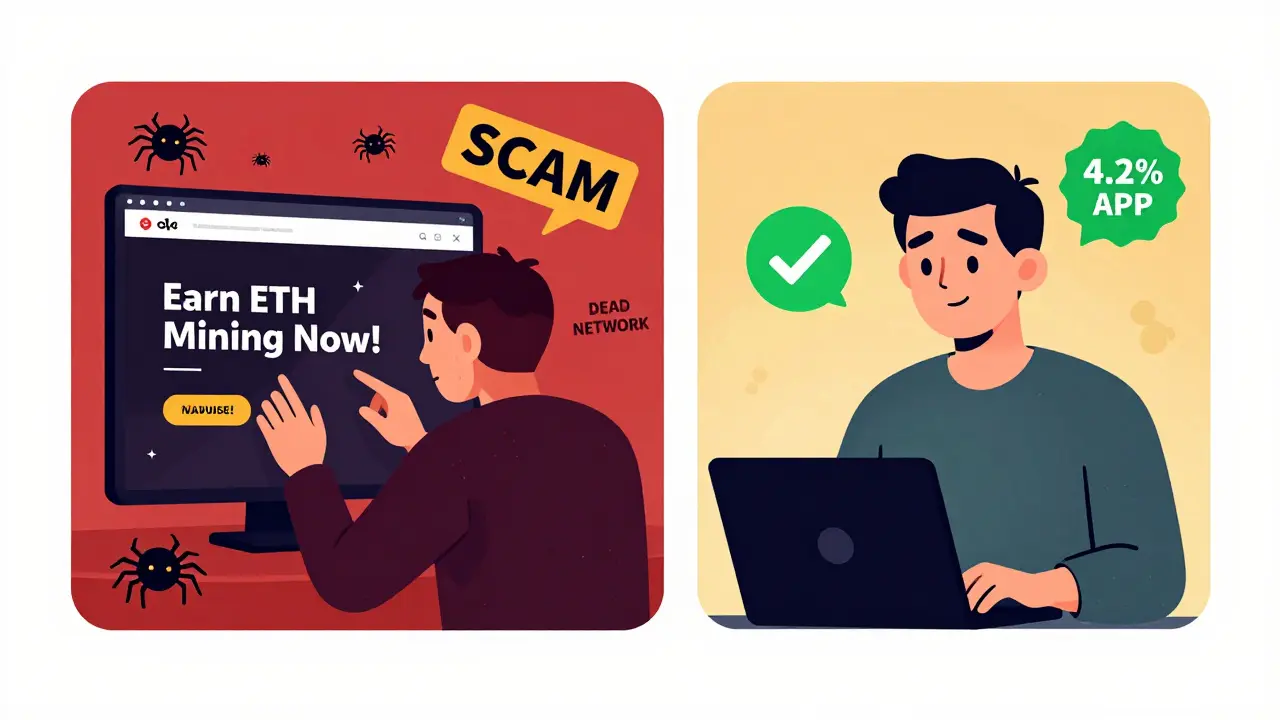

What you’ll find online now are scams. Sites claiming to offer 'Ethereum mining software' are either malware distributors or pay-to-click traps. Even some YouTube tutorials still show people plugging in GPUs and bragging about ETH rewards - those videos were made before 2022 and haven’t been updated. The Ethereum Foundation, CoinDesk, and Cambridge University all confirm: mining Ethereum is extinct. The energy savings from this change were massive - 99.95% less power used. That’s why the network is faster, cheaper, and more sustainable now.

What Is Minter Network? (And Why It’s Not for Ethereum)

There is a real project called Minter Network. Launched in 2018 by Russian developer Alexander Minin, it’s a separate blockchain that lets users create custom tokens - like your own meme coin or loyalty points - without needing to code. In 2023, it rebranded to Bip Network. It has its own coin (BIP), its own wallet, and its own community. But it’s not connected to Ethereum. You can’t trade ETH on it. You can’t stake ETH on it. You can’t even send ETH to a Bip Network address. If someone tells you 'Minter is the best place to trade Ethereum,' they’re mixing up two totally different systems.

Think of it like this: Minter/Bip is a custom t-shirt printer. Ethereum is a global bank. One lets you make your own currency. The other lets you trade the world’s second-largest cryptocurrency. They don’t overlap. Confusing them is like asking if a pizza oven can run Windows 11.

Where to Actually Trade Ethereum in 2026

If you want to buy, sell, or hold Ethereum, you need a real crypto exchange. Here are the top four trusted platforms that support ETH trading today:

- Coinbase: Best for beginners. Charges 0.5%-4% per trade, but offers simple UI, $250M insurance, and SOC 2 compliance. Supports instant USD buys via bank transfer. Used by over 100 million people worldwide.

- Kraken: Best for security. Requires mandatory two-factor authentication and withdrawal whitelisting. Processes $42.7 billion monthly. KYC can take up to 58 hours, but once approved, it’s rock-solid. Only exchange with 100% proof-of-reserves audited monthly.

- Binance: Best for volume and low fees. Charges 0.1%-0.2% per trade, supports 600+ coins. But it’s banned in 23 countries, including the U.S. for spot trading. If you’re outside the U.S., it’s powerful - but don’t trust it with your life savings.

- Gemini: Best for U.S. users. Fully licensed in all 50 states. Charges a flat 0.35% fee. Offers institutional-grade custody and regular audits. Ideal if you want to sleep well at night.

Uphold stands out too. It lets you trade ETH alongside gold, silver, and other metals in real time. Its reserves are updated every 30 seconds - something no other major exchange does. Nic Carter of Castle Island Ventures says exchanges without this level of transparency will face regulatory crackdowns in 2026.

Staking Ethereum: The Real Way to Earn ETH

Since mining is gone, staking is the only way to earn passive income from Ethereum. You lock up 32 ETH to run a validator node. Right now, that’s about $86,400. But the upcoming Prague upgrade in Q2 2026 will reduce that to just 1 ETH. That’s a game-changer.

Right now, staking rewards range from 3.5% to 5.2% annually. That’s not mining. It’s earning interest for helping secure the network. You can stake directly through exchanges like Coinbase or Kraken - they handle the technical side for you. Or use a non-custodial wallet like Lido or Rocket Pool if you want full control.

But be warned: some platforms promise '9% returns' on Ethereum. That’s not staking. That’s a yield farm - and those are high-risk. Meltem Demirors of CoinShares warns that centralized exchanges offering unstaked yield programs are a systemic risk. If they go under, your ETH could vanish.

Decentralized Exchanges Are Growing Fast

You don’t need a centralized exchange to trade ETH. Decentralized exchanges (DEXs) like Uniswap, Curve, and Balancer let you trade directly from your wallet. They don’t hold your funds. No KYC. No account. Just smart contracts.

In Q3 2025, DEXs handled 28.4% of all Ethereum trading volume - up from 12% in 2023. Uniswap alone processes over $10 billion daily. But DEXs aren’t perfect. Slippage can eat your profits. Front-running bots are real. And if you mess up a transaction, there’s no customer service to call.

For most people, a mix works best: buy ETH on Coinbase, then move it to a wallet and swap on Uniswap. That gives you safety and control.

Regulation Is Changing Everything

In 2025, the EU’s MiCA law forced all exchanges to verify user identities for trades over €1,000. The U.S. is still confused. The SEC says ETH is a security. The CFTC says it’s a commodity. That legal gray zone is why some exchanges left the U.S. market entirely.

Only Coinbase, Kraken, and Gemini have full proof-of-reserves with third-party audits. Binance only verifies 89.3% of its assets. That’s not enough. If an exchange can’t prove it holds your ETH, it’s just a digital IOU. And IOUs don’t pay out when the system crashes.

By 2027, Messari predicts 40% of crypto exchanges will shut down because they can’t afford compliance. The survivors? The ones that are transparent, regulated, and secure.

What to Do Right Now

Forget 'Minter.' Forget mining. Ethereum doesn’t work that way anymore.

- Use a trusted exchange like Coinbase, Kraken, or Gemini to buy ETH.

- Store it in a non-custodial wallet (MetaMask, Ledger) if you’re holding long-term.

- Stake your ETH through the exchange or a verified provider like Lido.

- Ignore anyone selling 'Ethereum mining rigs' or 'Minter exchange apps.' They’re scams.

- Watch for the Prague upgrade in mid-2026 - staking will become affordable for regular people.

The crypto world moves fast. But the rules are clear now: if it sounds too good to be true, it is. If it promises mining on Ethereum, it’s lying. If it calls itself 'Minter' and claims to trade ETH, it’s confused or dishonest. Stick to the facts. Stick to the real platforms. And protect your money.

People Comments

Finally someone lays it out straight. I spent three weeks trying to find this 'Minter exchange' before realizing it was a scam. The mining stuff? Total ghost town since The Merge. Glad the post called it out.

Just bought my first ETH on Coinbase last week. Staking via Lido now. Feels way better than chasing dead tech.

mining eth? lol. still see ppl on youtube with their 3080s running lol. they dont even know the network changed. its like using a rotary phone to order uber. absolute chaos.

Ugh I hate how everyone still talks about mining like its 2020. Its not just outdated its embarrassing. People are still selling GPU rigs on eBay as 'ETH miners' like its a vintage collectible. The energy waste alone makes me want to scream. This post is the only thing keeping me from quitting crypto entirely

USA made this happen. We dont need some foreign blockchain project confusing people. Minter Network? Sounds like a Russian scam. Real Americans trade on Coinbase or Gemini. No excuses. If you're still mining you're part of the problem.

It's critical to distinguish between Layer 1 protocols and token-creation platforms. Minter/Bip operates as a sovereign L1 with a custom consensus mechanism and native asset (BIP), whereas Ethereum is a general-purpose smart contract platform with native token (ETH). The architectural divergence is non-trivial - conflating them is akin to equating a blockchain-based DNS registry with a decentralized exchange. This is foundational knowledge for anyone entering Web3.

YES YES YES. I literally had a friend try to send me ETH to a Bip Network address last week 😭 I had to screenshot this whole post and send it to her. Staking on Coinbase was my first win. 4.2% APY and I didn’t even have to learn how to run a node. 🙌

They're not just lying - they're watching you. Every 'Minter mining software' download is a keylogger. Every YouTube video with a GPU rig? Paid ad. The Ethereum Foundation has publicly warned about this. And yet, the scammers just rebrand every 3 months. I think the government is in on it. Why else would these sites still rank on Google?

Man I wish I’d read this a year ago. I bought a used ASIC rig off Craigslist thinking I’d get rich. Ended up using it as a space heater. Now I just stake 1.5 ETH on Kraken. Easy. No noise. No heat. No regrets. Thanks for the clarity.

Who even cares about Coinbase? Real crypto happens on DEXs. You think they’re safe? They’re just centralized middlemen with a fancy UI. The Prague upgrade won’t change that. The real power is in self-custody. Also, why is everyone ignoring that BIP network is actually more scalable than Ethereum? You’re all sheep following the hype

Thank you for writing this. I’ve been trying to explain this to my uncle for months. He still thinks he can mine ETH on his laptop. I printed this out and gave it to him with a cup of coffee. He actually read it. Progress. 🥹