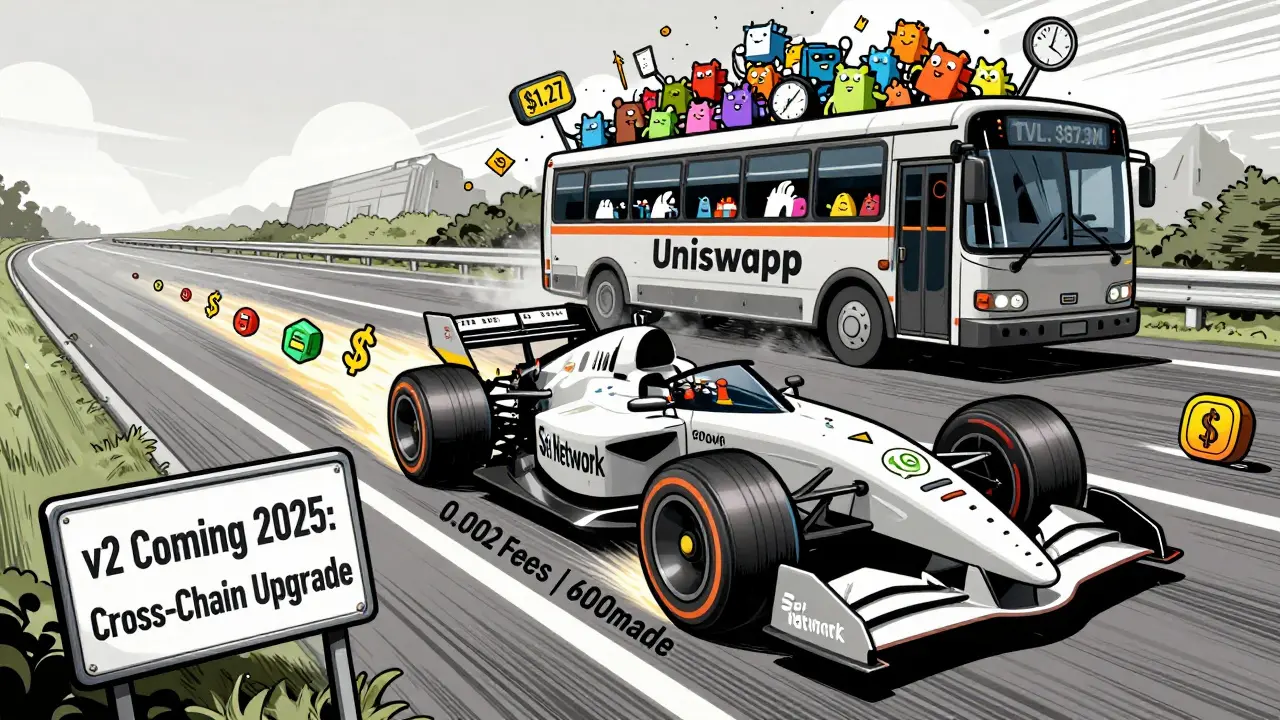

Most crypto exchanges are slow. Even the ones you think are fast-like Uniswap or PancakeSwap-take 10 to 15 seconds just to confirm a trade. If you’re trading during a market spike, that’s enough time for your order to slip 2%, 5%, even 10% before it executes. But what if you could swap tokens in under a second-with fees under a penny? That’s not a dream. It’s DragonSwap v1.

What DragonSwap v1 Actually Is

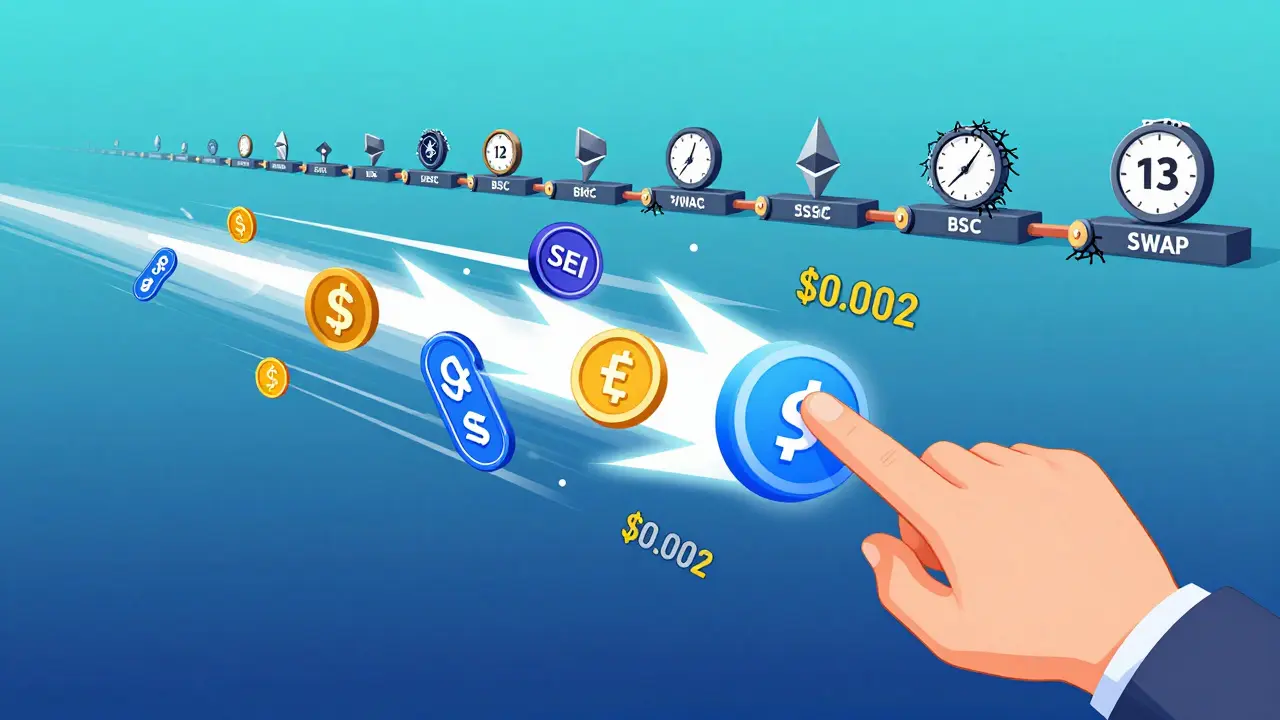

DragonSwap v1 isn’t just another decentralized exchange. It’s the native DEX built specifically for the Sei Network, a blockchain designed from the ground up to handle high-speed trading. Unlike Uniswap, which runs on Ethereum, or PancakeSwap on BNB Chain, DragonSwap only works on Sei. That’s not a bug-it’s the whole point. Sei’s parallelized EVM architecture lets it process trades faster than any major blockchain today. DragonSwap v1 taps into that speed directly.It’s not a simple swap interface. DragonSwap uses a binary smart contract system: one master contract that creates and tracks every token pair, and then a separate contract for each pair. This keeps the code lean, reduces bugs, and makes it harder for attackers to exploit. Each trade costs 0.3% in fees. Of that, 0.25% goes straight to liquidity providers, and 0.05% goes to the protocol treasury. That’s standard, but here’s the kicker: the average transaction fee on DragonSwap is $0.002. On Ethereum? Around $1.27. That’s 635 times cheaper.

Why Speed Matters More Than You Think

Speed isn’t just about convenience. It’s about survival in volatile markets. During a sharp price move, slippage kills profits. Nansen’s data shows DragonSwap can handle 14,000 transactions per hour without breaking a sweat. During a recent market spike, a trader on Twitter recorded 47 arbitrage trades completed in 28 seconds. On Uniswap v3, the same trader would’ve managed maybe 9.DragonSwap’s secret? It doesn’t wait for blocks to fill. Sei’s parallel processing means multiple trades can happen at the same time, not one after another. That’s why DragonSwap confirms trades in 400-600 milliseconds. Compare that to Ethereum’s average of 13,000 milliseconds. That’s 21 times faster.

This isn’t theoretical. Alpha Sei’s testing found DragonSwap could handle 120 simultaneous swaps without slippage exceeding 0.15%. SushiSwap on Ethereum started showing over 1% slippage at just 15 concurrent trades. For anyone doing high-frequency trading, arbitrage, or even just buying a token before it pumps, that difference is life-changing.

Concentrated Liquidity: Making Every Dollar Work Harder

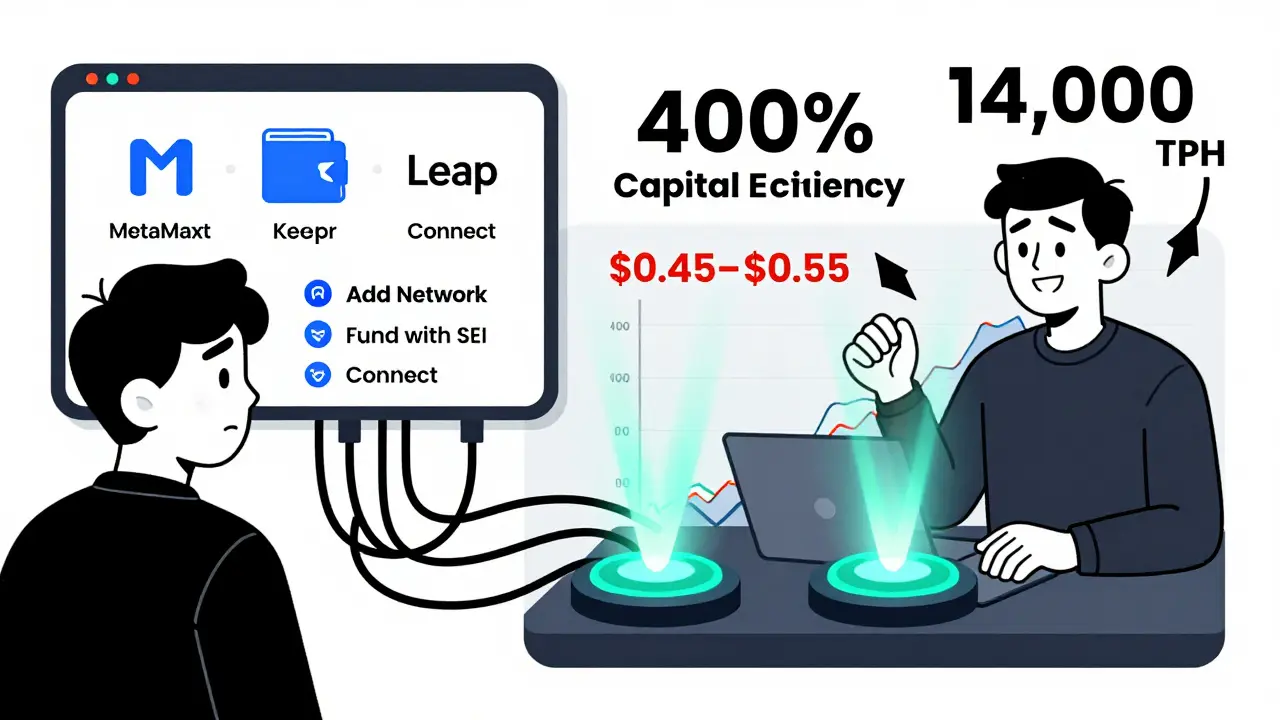

DragonSwap v1 uses concentrated liquidity-the same model Uniswap V3 introduced-but it does it better on Sei. Instead of spreading your tokens across the entire price range, you choose where to put your capital. If you think SEI will trade between $0.45 and $0.55, you lock your liquidity there. That means your capital is 3-4 times more efficient than on traditional AMMs.ICOholder’s analysis found this boosts capital efficiency by up to 400%. For liquidity providers, that means higher yields with less capital. But it also means more risk. If the price moves outside your range, your tokens stop earning fees until it comes back. That’s fine for experienced traders. For beginners? It’s confusing.

What DragonSwap v1 Doesn’t Do

Speed and low fees are great, but DragonSwap v1 has serious limits. It only works on Sei Network. No Ethereum. No BSC. No Polygon. If you want to trade a token not listed on Sei, you’re out of luck. That’s why its total value locked (TVL) is $87.3 million-impressive for Sei, but tiny next to Uniswap’s $12 billion.Over 78% of that TVL is in SEI-USD stablecoin pairs. That’s not diversification-it’s concentration. If SEI’s price drops hard, liquidity dries up fast. Most other DEXs have hundreds of tokens with real trading volume. DragonSwap has about 150, but 80% of volume comes from the top 10.

It also lacks cross-chain bridging. You can’t deposit ETH or SOL and swap them directly. You need to bridge your assets to Sei first-using a third-party bridge like Gravity Bridge or Sei’s own portal. That adds steps, risk, and delays. If you’re used to swapping across chains with a single click, DragonSwap feels restrictive.

Real User Experience: Fast, But Frustrating at First

Users love the speed. On Trustpilot, 4.1 out of 5 stars. Comments like “lowest fees I’ve ever seen” and “swaps feel instant” are everywhere. But the onboarding? Messy.Most complaints are about wallet setup. DragonSwap only works with Sei-compatible wallets: Keplr, Leap, and Front. If you’re using MetaMask, you’re stuck. You have to switch wallets, add Sei Network manually, fund it with SEI for gas, and then connect. That’s an 8-12 minute process for new users. Reddit threads are full of people giving up after the third failed connection attempt.

Another issue: slippage settings don’t save between sessions. You set it to 0.5%, swap once, then come back later-and it’s reset to 1%. That’s a bug. DragonSwap’s own analytics show it affects 12% of first-time users. And it’s still open as of October 2024.

There’s also almost no educational content. Concentrated liquidity? Impermanent loss? Slippage mechanics? The docs assume you already know. New users are left guessing. One user wrote: “I lost $180 because I didn’t know my liquidity would stop earning if the price moved.” That shouldn’t happen.

Security and Reliability

CertiK audited DragonSwap v1 in March 2024 and found three medium-severity issues. All were fixed in the v1.1 update. No exploits since. That’s good. But it’s not a full audit like what Uniswap got. The code is simple, which helps, but it’s still a new protocol.Uptime? 87% for the API, according to independent monitoring. That’s okay for a DeFi app, but not great. If you’re running a bot or automated strategy, you’ll hit downtime. Discord support responds in 22 minutes during business hours. On weekends? Over three hours. That’s slow for crypto.

Who Is DragonSwap v1 For?

DragonSwap v1 isn’t for everyone. It’s not for casual investors. It’s not for people who want to trade Bitcoin or Ethereum directly. It’s not for those who hate learning new wallets.It’s for three types of people:

- Sei Network users-If you’re already holding SEI or trading Sei-based tokens, this is your only fast, cheap option.

- High-frequency traders-Arbitrageurs, market makers, scalpers. If you’re doing dozens of trades a day, the 600ms speed and $0.002 fees save you thousands.

- DeFi veterans-If you understand concentrated liquidity, impermanent loss, and gas optimization, you’ll appreciate the efficiency.

It’s not for beginners. Not for long-term holders. Not for people who want to swap BTC to ETH in one click.

The Future: DragonSwap v2 Is Coming

DragonSwap’s roadmap is clear: v2 is coming in Q1 2025. It’ll add cross-chain support through Sei’s interchain accounts. That means you could trade tokens from Ethereum, Solana, or Cosmos directly-without bridges. That’s huge. It’s also why the Kaia Foundation gave them $2.5 million in funding.Right now, DragonSwap controls 43.7% of Sei’s entire DeFi liquidity. That’s dominant. But if Sei Network fails to grow, DragonSwap fails with it. That’s the risk. Messari predicts 22% quarterly growth if Sei’s mobile wallet launches as planned. But if adoption stalls? DragonSwap becomes a niche tool for a fading chain.

For now, v1 is the best DEX on Sei. It’s fast, cheap, and technically solid. But it’s also fragile. It’s a high-performance engine in a car that only runs on one kind of fuel. If that fuel runs out, the engine doesn’t matter.

Final Verdict

DragonSwap v1 is a technical marvel. It’s the fastest, cheapest DEX you can use today-if you’re on Sei Network. The speed is real. The fees are unreal. The concentrated liquidity model works better here than anywhere else.But it’s also a gamble. You’re betting on Sei Network’s future. You’re betting that enough traders will stick around to keep liquidity deep. You’re betting that the team will fix the UX issues before more users get frustrated and leave.

If you’re already on Sei, use DragonSwap. It’s the best option. If you’re not? Don’t bother switching just for it. Wait for v2. Or stick with Uniswap or PancakeSwap. DragonSwap v1 isn’t a universal solution. It’s a precision tool for a very specific job.

People Comments

DragonSwap is just a glorified toy for Sei cultists. Real DeFi runs on Ethereum. This whole thing feels like a vanity project for a chain that’ll be dead in 18 months.

The assertion that DragonSwap’s speed is ‘life-changing’ is hyperbolic at best. The market doesn’t move in 600ms increments. It moves in macroeconomic shifts. This is optimization porn.

600ms? More like 600ms of waiting for your wallet to stop crashing. Tried it twice. Gave up. Still using Uniswap.

For beginners, the wallet setup is brutal. But once you get Keplr set up with Sei, it’s smooth. I’ve done 40+ swaps in a week. Fees are literally pennies. The concentrated liquidity is genius if you know what you’re doing.

THIS IS THE FUTURE 🚀 I did 12 arb trades in 45 seconds last week. My profit? $870. On Uniswap? 3 trades, $200. The math doesn’t lie. Sei is the new Solana. Get in now.

Only 150 tokens? 80% volume concentrated? This isn’t a DEX. It’s a liquidity trap disguised as innovation. You’re not a trader-you’re a speculator betting on a sinking ship.

i tried it once. i thought it was gonna be easy. then i had to add a new network, buy sei, switch wallets… i just gave up. why is everything so complicated now??

It’s fast but the UX is garbage. Slippage resets every time. That’s not a feature. That’s negligence. Why is this even live?

Y’all act like this is the first time someone built a high-speed DEX. We had this on Algorand in 2021. Sei is just late to the party. The real win is the interchain accounts in v2-if they deliver.

If you’re already in the Sei ecosystem, DragonSwap is a no-brainer. The speed is unreal. The fees are insane. But if you’re not? Don’t force it. Wait for v2. Or just stick with what works. No shame in that.

The concentrated liquidity model here is like giving a Ferrari a manual transmission-brilliant if you know how to drive it, disastrous if you don’t. I love how it forces you to think like a market maker. But yeah, that $180 loss story? That’s real. We need better onboarding.

It’s funny how we call this ‘innovation’ but really it’s just removing friction for a narrow group of people. The rest of us? We’re left holding the bag of complexity. Is efficiency worth alienating 95% of users? Maybe not. But I’ll admit-I’d use it if I had SEI.

so dragonswap is like… the crypto version of a sports car that only works on premium gas? and the gas station is run by a guy who doesn’t speak english? yeah. i get it. but also… why??

Technically impressive, yes. But DeFi should be accessible, not a gated club for algorithmic traders. The fact that this is being hailed as ‘the future’ while ignoring UX and education is deeply concerning.

Let’s talk about what’s not being said here: DragonSwap’s architecture is actually elegant. The binary contract system? Brilliant. It reduces attack surface, cuts gas waste, and makes debugging cleaner. Most DEXs are spaghetti code with 5000 lines per pair. DragonSwap? Maybe 800. That’s not just fast-it’s thoughtful engineering. And yes, the wallet setup is a pain, but it’s a one-time cost. Once you’ve got Keplr configured, you never look back. The real bottleneck isn’t the tech-it’s the education gap. People don’t understand concentrated liquidity because no one bothered to explain it in plain language. That’s on the team, not the users. And the slippage reset? That’s a bug, not a feature. Fix it, and this becomes the gold standard for speed-focused DEXes. Until then? It’s a diamond in the rough.

Low fees? Sure. But at what cost? You’re centralizing liquidity around a single token. That’s not decentralization. That’s monoculture. And you call this innovation?

Look-I’m not a trader. I just hold and HODL. But I tried DragonSwap because I’m curious. Took me 10 minutes to get Keplr working. Felt like setting up a satellite dish. But once I did? I swapped SEI for a new memecoin in under a second. Felt like magic. And I paid $0.0017 in fees. I cried a little. Not because I made money-but because it just worked. That’s rare. If they fix the slippage bug and make a one-click tutorial? This could be the gateway drug for millions who think DeFi is too hard. Don’t write it off because it’s niche. Sometimes niche is where the future starts.

While the technical merits are undeniable, I must emphasize the importance of sustainability. A DEX that relies on a single-chain ecosystem is inherently fragile. The real test will be whether DragonSwap can evolve beyond its current constraints-or whether it becomes a monument to a chain that never achieved mass adoption.

It’s not about being the fastest. It’s about being the most resilient. DragonSwap v1 is like a sprinter with no endurance. v2 is where the real race begins-if they can bridge the gap, literally and figuratively. I’m watching. Not because I’m excited. Because I’m skeptical. And skepticism is the last honest currency in crypto.

Wait-so you’re telling me I can’t use this with MetaMask?? And I have to buy SEI just to swap? And then I have to manually set my slippage every single time?? And the docs assume I know what impermanent loss is?? And you think this is user-friendly?? What planet are you on??

Speed is nice. But when your entire ecosystem is built on one token, you’re not building a DEX-you’re building a Ponzi with better UI. The fact that 78% of TVL is SEI-USD? That’s not efficiency. That’s desperation.

DragonSwap? More like DragonTrap. I lost $200 because my liquidity got stuck outside the range. And the support? Silence. This isn’t DeFi. It’s a casino with a 600ms timer.

Let’s be real-DragonSwap isn’t for you. It’s for the 0.1% of traders who can time the market down to the millisecond. The rest of us? We’re just collateral damage in their algorithmic war. The team knows this. They don’t care. They’re not building for users. They’re building for backtesting results. The fact that they’re charging 0.05% to the treasury while users lose money to slippage and misconfigured liquidity? That’s not innovation. That’s extraction dressed in Rust code. And don’t get me started on the ‘audit’-CertiK found three medium issues and they called it a day? Please. Uniswap’s audit was a 300-page novel. This was a Post-it note. If you’re investing in this, you’re not trading crypto-you’re betting on hype. And I’m not here to cheer you on. I’m here to warn you.