When you hear that crypto trading in Bangladesh can land you in jail for 12 years, it sounds like a hard stop. But here’s the truth: no one has been sentenced to 12 years for simply buying or selling Bitcoin in Bangladesh - not even close.

The 12-Year Myth That Won’t Die

The number 12 keeps popping up in headlines. You see it in news articles, YouTube videos, Reddit threads. It’s cited like a law. But if you dig into Bangladesh’s actual statutes, you won’t find it. The source? A 2014 statement from Bangladesh Bank, the country’s central bank. They warned that crypto transactions could violate existing laws - and that violations might lead to prison time. Then came the number: 12 years. But where did it come from? It was never written into law. It was an extrapolation. Bangladesh Bank officials pointed to the Money Laundering Prevention Act 2012, which carries a maximum sentence of 10 years. They added two extra years, possibly referencing the Anti-Terrorism Act 2009, which can be applied in cases involving large-scale financial crime. But the law itself doesn’t say “crypto = 12 years.” The confusion grew in 2017 when Bangladesh Bank expanded its warning to include Ethereum, Ripple, and Litecoin. Media outlets around the world ran with “Bangladesh Bans Crypto - 12-Year Jail Term.” The headline stuck. But the legal reality? Far more complicated.What Laws Actually Apply

Bangladesh doesn’t have a law that says “crypto is illegal.” Instead, it uses three existing laws to block crypto activity:- Foreign Exchange Regulation Act 1947 (FERA): This law says all foreign currency transactions must go through authorized banks. If you use crypto to send money overseas, you’re bypassing that system - which is a violation.

- Money Laundering Prevention Act 2012: If crypto is used to hide the source of illegal money (like drug proceeds or corruption), you can be charged under this. Maximum penalty: 10 years.

- Anti-Terrorism Act 2009: If authorities believe crypto was used to fund terrorism, this law kicks in. It allows for harsher penalties, but only in extreme cases.

Enforcement? Rare. Harsh? Almost Never.

You might think with such strict warnings, Bangladesh would be locking up crypto users. But data tells a different story. According to the Anti-Money Laundering Department’s 2022 report, only 37 cases nationwide were filed under digital financial crimes. Not one was specifically for crypto trading. In 2024, the Cyber Security Division recorded 17 crypto-related cases. None resulted in sentences close to 12 years. The heaviest penalties handed down so far? Around 3 to 5 years - and even those were for people involved in large-scale fraud, not individual traders buying Bitcoin on Binance. The reality? Enforcement is selective. Authorities focus on:- Large P2P operators running unlicensed exchanges

- People moving millions in crypto to launder money

- Scammers running fake crypto investment schemes

People Are Still Trading - A Lot

Despite the warnings, crypto adoption in Bangladesh is growing. Chainalysis reported a 206% jump in crypto transaction volume between mid-2021 and mid-2022. By late 2024, about 2.1 million Bangladeshis - roughly 1.2% of the population - owned cryptocurrency. Why? Because the system is broken. The official exchange rate for the Bangladeshi taka is controlled, but the real market rate is much lower. People turn to crypto to protect their savings from inflation. Others use it to send money home from abroad - cheaper and faster than Western Union or bank wires. P2P trading on platforms like Binance and LocalBitcoins has surged 347% since the 2021 crackdown. Traders use mobile apps, cash deposits, and even QR codes to swap taka for Bitcoin. It’s underground, but it’s working.

The Government’s Conflicting Signals

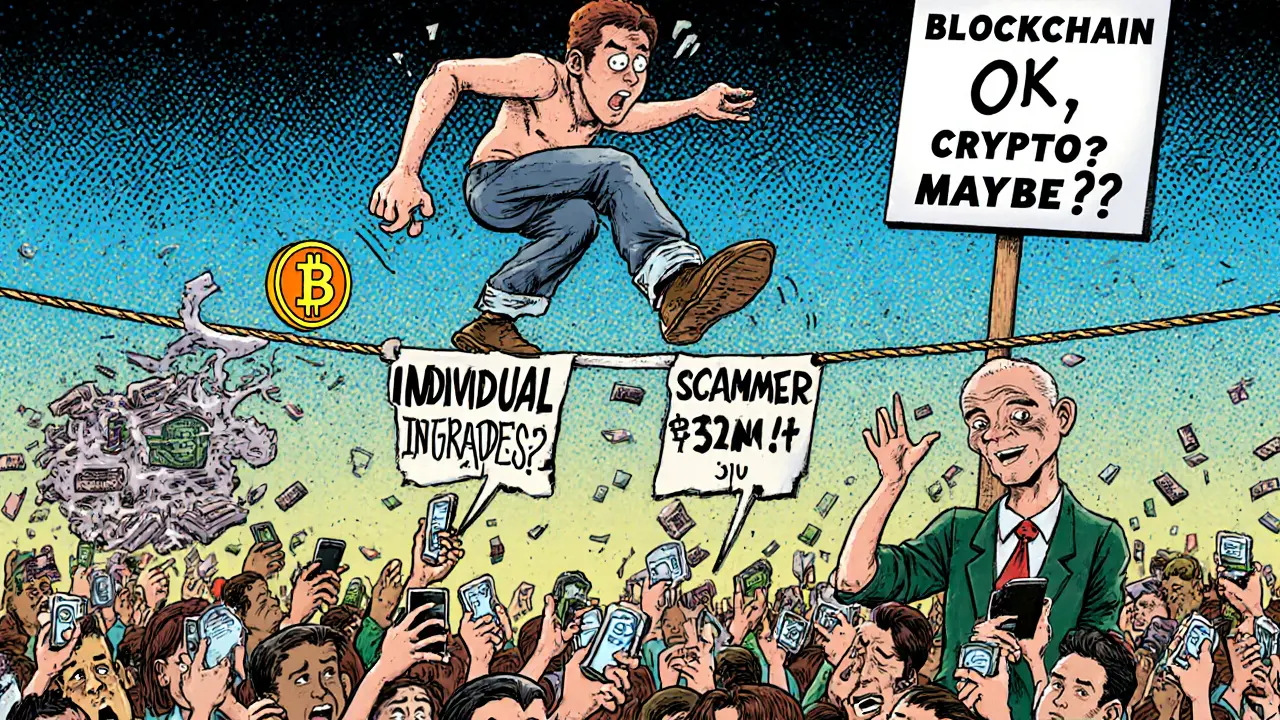

Here’s the strangest part: while Bangladesh Bank warns against crypto, other parts of the government are exploring blockchain. In 2020, Bangladesh published a National Blockchain Strategy. It talks about using blockchain for land records, supply chains, and public services. That’s not the behavior of a country that wants to erase a technology - it’s a country trying to separate the tech from the speculation. The Bangladesh Securities and Exchange Commission admitted in 2023 that “the absence of specific prohibitive legislation creates implementation challenges.” Translation: We don’t have a clear rulebook, so we’re winging it. Even the Financial Action Task Force - the global watchdog on money laundering - noted in 2023 that Bangladesh applies anti-money laundering rules inconsistently to crypto. That’s not enforcement. That’s confusion.What Happens If You Get Caught?

If you’re an individual trader, the risk is low - but not zero. Here’s what could happen:- Bank account frozen: If your bank detects crypto-related transfers, they might freeze your account for review.

- Police questioning: You might be called in for a conversation. No arrest, just a warning.

- Fine or short jail term: Only if you’re linked to a larger fraud or money laundering scheme.

What About Foreigners or Offshore Accounts?

Some blogs claim “owning Bitcoin is illegal in Bangladesh but permitted offshore.” That’s misleading. The law doesn’t distinguish where you hold crypto. It cares about what you do with it. If you’re a Bangladeshi citizen and you use crypto to move money out of the country without going through a licensed bank - you’re violating FERA, no matter if your wallet is on Binance or a hardware device in Dubai. The same goes for using a foreign broker. If you’re sending taka to a foreign exchange to buy crypto, and that exchange isn’t licensed by Bangladesh Bank, you’re still breaking the law.

The Real Risk: Uncertainty

The biggest danger isn’t jail. It’s the lack of clarity. There’s no official list of what’s allowed. No clear guidance for banks. No court rulings that set precedent. One day, a bank might freeze your account. The next, you’re trading without issue. Legal experts like Barrister Mahbubur Rahman say the law should treat crypto like cash: “If you use it to commit a crime, you’re punished for the crime - not for holding crypto.” That’s a reasonable view. But it’s not the official stance. Bangladesh Bank keeps issuing reminders. In March 2024, they told all commercial banks: “Do not process any crypto-related transactions.” But they didn’t say what happens if you do. No fine amount. No jail term. Just a warning.What Should You Do?

If you’re in Bangladesh and considering crypto:- Don’t assume you’re safe. The rules are vague, and enforcement can be sudden.

- Avoid large transfers. Small, occasional purchases are less likely to trigger alerts.

- Never use crypto to move money out of the country. That’s the biggest red flag.

- Don’t run a P2P exchange. That’s where enforcement is focused.

- Keep records. If you’re buying crypto to save, keep proof it’s personal use - not a business.

Is This Law Going to Change?

Probably. But not soon. India went from banning crypto to taxing it. Nigeria cracked down, then relaxed. Thailand is moving toward licensing. Bangladesh is stuck in the middle. The government needs revenue. The people need alternatives. Banks need clarity. And the central bank? It’s caught between pressure from global regulators and a population that’s already using crypto. Until there’s a new law - or a landmark court case - the 12-year threat will remain a scare tactic. But the real risk isn’t prison. It’s losing your money to a scam, freezing your bank account, or getting caught in a crackdown that nobody saw coming. The message isn’t “don’t trade.” The message is: “Be careful. You’re walking a legal tightrope.”Is it illegal to own Bitcoin in Bangladesh?

No, owning Bitcoin or any cryptocurrency is not explicitly illegal in Bangladesh. The law doesn’t ban holding crypto. But using it to send money overseas, launder funds, or bypass banking rules can lead to charges under existing laws like the Foreign Exchange Regulation Act or Money Laundering Prevention Act.

Can you really get 12 years in jail for trading crypto in Bangladesh?

The 12-year sentence is a myth. It was never written into law. It came from a 2014 Bangladesh Bank official’s comment linking crypto to money laundering penalties. The actual maximum under the Money Laundering Prevention Act is 10 years, and no one has been sentenced to anywhere near that for simple crypto trading. Enforcement has focused on fraud and large-scale operations, not individual users.

Are there any cases of people being jailed for crypto in Bangladesh?

As of 2025, there are no publicly documented cases of individuals receiving prison sentences specifically for buying or selling cryptocurrency. A few cases have involved fraud or money laundering using crypto, with sentences ranging from 2 to 5 years - far below the 12-year figure often cited. Enforcement targets organized crime, not everyday traders.

Can I use Binance or other crypto exchanges from Bangladesh?

You can access Binance or other platforms from Bangladesh, and many people do. But Bangladesh Bank has instructed banks to block transactions linked to crypto exchanges. Your bank account could be frozen if they detect transfers to these platforms. P2P trading (cash for crypto) is more common and harder to track, but still carries legal risk.

Is crypto taxed in Bangladesh?

No, Bangladesh does not have any tax laws for cryptocurrency. There is no capital gains tax, no reporting requirement, and no official guidance on how to declare crypto income. The government has not created a tax framework - which adds to the legal uncertainty around crypto use.

Can I send crypto to someone in Bangladesh?

Sending crypto to someone in Bangladesh doesn’t break the law by itself. But if they convert it to taka and withdraw it through an unlicensed channel, they could be violating foreign exchange rules. The person receiving the crypto may face consequences if they use it to move money out of the banking system. It’s safer to avoid sending crypto to Bangladesh unless you’re certain of how it will be used.

Why does Bangladesh Bank warn about crypto if it’s not fully banned?

Bangladesh Bank doesn’t have the legal authority to ban crypto outright. Instead, it uses existing laws to block its use in financial transactions. The warnings are a way to discourage adoption without passing new legislation. It’s a defensive move - protecting the banking system while avoiding political backlash from a growing user base.

Is blockchain legal in Bangladesh?

Yes, blockchain technology is not banned. In fact, Bangladesh published a National Blockchain Strategy in 2020 to explore using blockchain for land records, supply chain tracking, and government services. The government is trying to separate the underlying tech from cryptocurrency speculation - which is why blockchain is encouraged while crypto trading is discouraged.

People Comments

OMG this is wild 😱 I can't believe people are still falling for this '12-year jail' myth. It's like the internet turned a vague warning into a horror movie trailer. 🎥💸

Of course the media invented a 12-year sentence. Americans love a good scare tactic. Meanwhile, in Bangladesh, people are just trying to protect their savings from a currency that’s collapsing. 🤷♀️

This is exactly why the U.S. needs to stop pretending it’s not a global police force. You think Bangladesh’s central bank is just making this up? They’re terrified of losing control. Crypto isn’t just money-it’s sovereignty. And sovereignty scares the hell out of Western institutions.

Let’s be real-this whole article is a disinformation campaign disguised as journalism. If crypto were truly harmless, why are banks freezing accounts? Why are P2P traders getting harassed? The fact that no one’s been jailed yet doesn’t mean it’s legal-it means they’re waiting for a big enough fish to make an example of.

The car analogy is spot on. You don’t get jailed for owning a car. You get jailed for using it to rob a bank. Same with crypto. The law isn’t against Bitcoin-it’s against bypassing financial controls. Most people just want to send money home cheaply. They’re not criminals.

I’ve lived in Dhaka for five years. I’ve seen friends buy Bitcoin with cash from street vendors. No one’s arrested. No one’s even questioned. But if you try to transfer $50k in crypto to Dubai? Suddenly you’re on a list. It’s not about crypto-it’s about unregulated capital flight. The government isn’t anti-tech. It’s anti-chaos.

i think most people in bangladesh just want to survive. if crypto helps them send money home without paying 10% in fees, why punish them? the real criminals are the ones running fake exchanges. not the student buying $200 of btc

The 12-year myth is a distraction. The real agenda? The IMF and Western banks are terrified that Bangladesh’s youth will bypass the global financial system entirely. This isn’t about law-it’s about power. If people can trade crypto without banks, the entire dollar-based order starts to unravel. That’s why they keep screaming ‘jail’-because they know the truth: they can’t stop it.

you think this is the end? wait till they start tracking wallet addresses through mobile data. the government is already working with chinese tech firms to build a blockchain surveillance system. next thing you know, your phone will auto-flag your binance app. they’re not just warning you-they’re preparing to crush you.

I’ve read the original 2014 Bangladesh Bank memo. The 12-year figure was a speculative footnote. The media turned it into a headline because clicks > truth. Meanwhile, the actual law-FERA-is a 77-year-old colonial relic that shouldn’t even be applied to digital assets. This isn’t enforcement. It’s bureaucratic laziness dressed up as authority.

i just sent my cousin in dhaka 0.05 btc last week to help with rent. he cashed out via a local guy who paid him in cash. no one got arrested. no one got a call. just two people helping each other. if this is illegal, then so is giving someone a loan in cash. why are we pretending crypto is different?

The fact that you’re even debating this shows how naive you are. Bangladesh is not a democracy. It’s a military-backed autocracy with a central bank that answers to foreign interests. The ‘12-year’ threat is a psychological weapon. It’s designed to create fear, not enforce law. The real crime? You’re still trusting their narrative.

From a compliance standpoint: the FERA violation is the real risk. Crypto transactions bypassing authorized channels = unauthorized foreign exchange = criminal offense under Section 23. The 10-year MPA clause is only triggered if proceeds are illicit. Most users are clean. But banks don’t care about intent-they flag based on pattern. So yes, your account can freeze. That’s not punishment. That’s risk mitigation.

I’ve got family in Bangladesh. They use crypto to pay for medical bills overseas. No one’s been arrested. No one’s even heard of the 12-year thing. They just know it works. Maybe the law is broken, not the people.

I’m so proud of Bangladeshis for finding a way to outsmart a broken system. The central bank’s warnings are just noise. People are using tech to reclaim financial dignity. This isn’t rebellion-it’s evolution. And no amount of scare tactics will stop it. The future is decentralized, and it’s already here.

i think the real story here is how the same tech that’s being called illegal is also being used by the government to track land records. so it’s not that crypto is bad-it’s that the system doesn’t know how to handle it. we’re all just waiting for someone to figure it out.