Collector Crypt Fee Comparison Calculator

Tokenization Cost Calculator

Fee Comparison

Collector Crypt (CARDS) isn’t just another crypto coin. It’s a bridge between your childhood Pokémon cards and the blockchain. If you’ve ever bought a rare trading card on eBay, only to worry if it was real or overpay for shipping and fees, Collector Crypt was built to fix that. Launched in August 2025, the CARDS token powers a platform that turns physical trading cards into digital NFTs you can trade, earn from, or even redeem for the real thing.

How Collector Crypt Turns Physical Cards Into Digital Assets

Here’s how it works: You send a physical Pokémon, Magic: The Gathering, or other trading card to one of Collector Crypt’s certified grading partners-like PSA or Beckett. They authenticate it, grade its condition (say, PSA 10 Gem Mint), seal it in a protective case, and store it in a secure, climate-controlled vault. Then, they create a unique NFT on Solana that’s tied directly to that exact card.

This isn’t just a picture of the card. It’s a digital proof of ownership with a redemption guarantee. Want your original Charizard back? You can ‘burn’ the NFT and the physical card gets shipped to your door. No middlemen. No scams. Just blockchain-backed trust.

That’s the core innovation. Unlike OpenSea or Magic Eden, where NFTs are purely digital, Collector Crypt’s tokens are backed by real-world objects. This makes it part of a growing trend called Real-World Asset (RWA) tokenization-and it’s working. By September 2025, the platform had processed $150 million in trading volume, with users spending $5.7 million per week on digital card packs and NFT trades.

The CARDS Token: Utility, Supply, and Volatility

The CARDS token is the engine of the platform. It’s an SPL token built on Solana, with a total supply of 1 billion. But here’s the catch: only 125 million (12.5%) were in circulation at launch. The rest are locked and will be released over time.

This thin float created massive early volatility. After hitting a $450 million fully diluted valuation in its first week, the price dropped sharply as early buyers sold off. On Reddit, users reported losing money because they bought at $0.45 and watched it fall to $0.12. Why? Because the market couldn’t absorb the supply when unlocks started.

But it’s not all speculation. CARDS is used for:

- Paying transaction fees (4% vs. eBay’s 15%)

- Staking for rewards (8.2% APY as of September 2025)

- Buying digital card packs (Gacha system)

- Accessing exclusive drops and events

By late September, 37.5 million CARDS tokens (30% of circulating supply) were already staked. That’s a sign users believe in the long-term value-not just short-term flips.

Why Solana? Speed, Cost, and Scalability

Collector Crypt doesn’t run on Ethereum. It runs on Solana-and for good reason.

On Ethereum, sending an NFT can cost $1.20 or more. On Solana, it’s $0.00025. Transactions confirm in 400 milliseconds. That’s critical when you’re buying digital card packs or flipping NFTs in seconds.

It also means the platform can handle high volume without breaking. In September 2025, Collector Crypt processed over 800,000 NFT trades in a single month. Try doing that on Ethereum without paying a fortune in gas fees.

All you need to get started is a Solana wallet-Phantom or Backpack. No hardware. No coding. Just connect, fund it with SOL, and start trading.

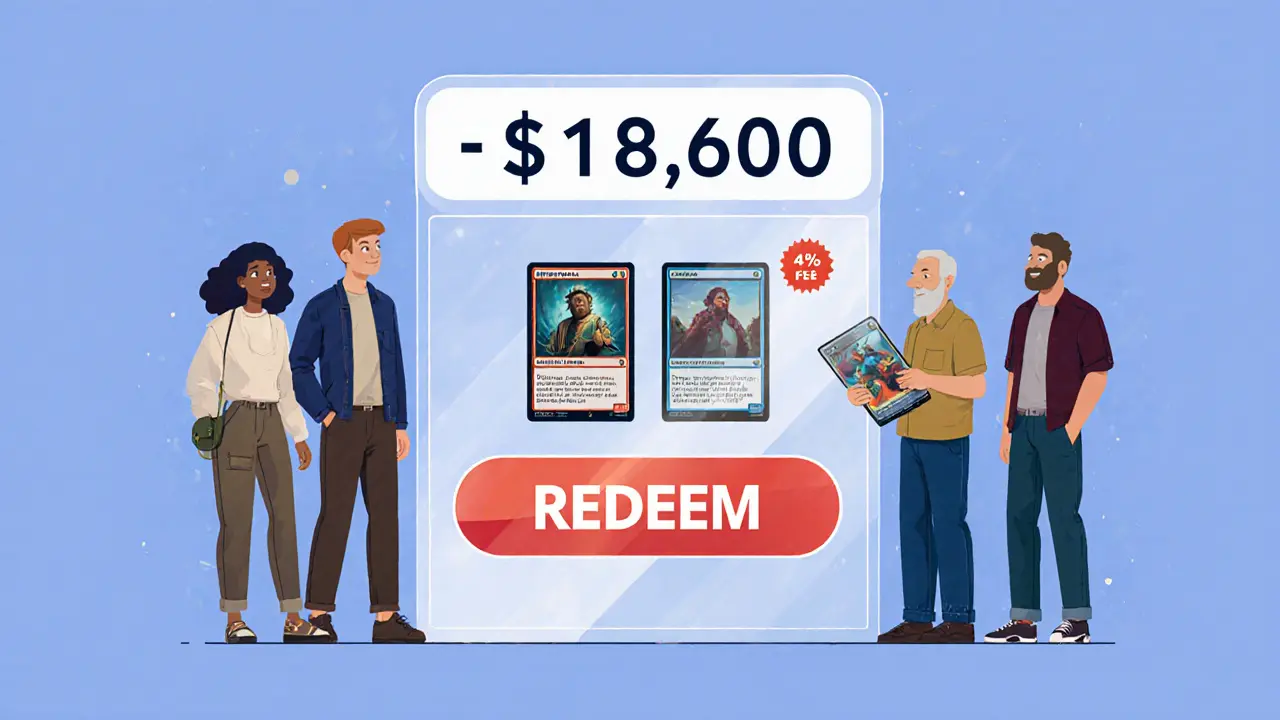

How It Compares to Traditional Collectibles Markets

Before Collector Crypt, buying high-value cards meant eBay, Heritage Auctions, or local dealers. Fees were brutal: eBay took 15%, Heritage charged up to 19.5%. Buyers paid extra for insurance, shipping, and grading.

Collector Crypt cuts that down to 4% total fees. And you get more:

- Guaranteed authenticity (graded by PSA/Beckett)

- 24/7 trading (no auction end times)

- Instant liquidity (sell anytime, not just during auctions)

- Lower entry point (you can buy a $20 NFT instead of a $2,000 card)

Users aren’t just saving money-they’re spending more. The average transaction on Collector Crypt is $18,600. On eBay, it’s $499. This isn’t casual collectors. It’s serious investors who trust blockchain more than paper certificates.

Market Position and Competition

Collector Crypt isn’t the only player in tokenized collectibles. NBA Top Shot leads with $2.1 billion in lifetime volume. Sorare, with soccer player NFTs, sits at $1.3 billion. But Collector Crypt is the leader in physical trading cards.

As of September 2025, it held 16.5% of the $756 million global market for tokenized physical collectibles. Only Topps, with its authenticated baseball cards, had higher monthly volume ($142 million vs. Collector Crypt’s $124.5 million).

What sets it apart? Redemption. NBA Top Shot NFTs can’t be turned into real jerseys. Sorare NFTs don’t come with real player contracts. But Collector Crypt’s NFTs? You can get the card in your hand. That’s why users call it ‘the only NFT platform that doesn’t feel like a game.’

Regulatory Risks and Expert Opinions

Not everyone is bullish. The SEC has been watching. In September 2025, it released a draft framework calling redeemable NFTs tied to physical assets ‘a gray area’-potentially securities if marketed as investments.

Caitlin Long of Custodia Bank warned that if the SEC classifies CARDS as a security, Collector Crypt could face $45 million in retroactive compliance costs. That’s 62% of its projected annual revenue.

But others see opportunity. Ryan Wyatt of a16z called it ‘a breakthrough in trust infrastructure.’ Delphi Digital analyst Ben Carter estimated the token was undervalued by 300%, citing a revenue multiple of 0.26x-compared to eBay’s 15x.

The truth? It’s a high-risk, high-reward play. If regulation stays light, Collector Crypt could become the dominant force in collectibles. If the SEC cracks down, it could be forced to shut down redemption or go through a costly legal overhaul.

What Users Are Saying

On Trustpilot, Collector Crypt has a 4.3/5 rating from 87 verified users. Positive reviews praise the grading process: ‘I got my PSA 10 Charizard in perfect condition. Peace of mind I never had on eBay.’

Negative reviews? Almost all point to CARDS token volatility. ‘I bought to invest, but the price swings made it impossible to plan,’ said one user. Others complained about slow support for token questions-response times averaged over 3 hours.

But the redemption stories are powerful. One Reddit user, CardKing88, shared: ‘I redeemed my NFT. Got the card in 5 days. Paid 3.8% fees. Saved $2,850 on a $15k card.’ That’s the kind of story that keeps users coming back.

What’s Next for Collector Crypt?

The roadmap is ambitious:

- Q4 2025: Integration with Solana Pay for instant physical redemptions

- Q1 2026: Support for Magic: The Gathering cards

- Q1 2026: Expansion into sports memorabilia (Upper Deck already partnered)

- 2026: Potential expansion into autographed items and rare coins

Industry analysts at Galaxy Digital predict the tokenized collectibles market will hit $12.7 billion by 2028. Collector Crypt is positioned to capture nearly 30% of that-if it survives regulation.

Should You Get Involved?

Here’s the bottom line:

- If you collect physical trading cards and want to trade them safely, Collector Crypt is the best option today.

- If you’re looking to invest in CARDS, understand the risks: thin float, regulatory uncertainty, and price swings are real.

- If you just want to play with digital card packs, the Gacha system is fun-and the fees are low.

Don’t buy CARDS because it’s going to 10x. Buy it because you want to own a rare card without the risk, the hassle, or the eBay markup. The token is just the key to the vault.

Collector Crypt doesn’t promise riches. It promises trust. And in the world of collectibles, that’s worth more than any price chart.

Is Collector Crypt (CARDS) a good investment?

It depends on your goal. If you want to trade or redeem physical trading cards, Collector Crypt offers real value with low fees and trusted authentication. But if you’re buying CARDS tokens hoping for quick profits, you’re taking on high risk. The token has a low circulating supply, extreme volatility, and regulatory uncertainty. Only invest what you can afford to lose.

Can I really get my physical card back from an NFT?

Yes. That’s the core feature. When you own a Collector Crypt NFT, it’s linked to a specific physical card stored in a secure, insured vault. You can ‘burn’ the NFT through the platform’s redemption system, and the exact card you own will be shipped to your address. The process is verified, tracked, and backed by grading partners like PSA and Beckett.

Do I need to be a crypto expert to use Collector Crypt?

No. You only need a Solana wallet like Phantom or Backpack. The platform guides you through submitting cards, paying fees, and trading NFTs. No coding, no complex setups. The learning curve is about 2.7 hours for a first-time user-much easier than traditional auction platforms.

What cards does Collector Crypt support?

Currently, Collector Crypt supports Pokémon Trading Card Game cards and is expanding to Magic: The Gathering in Q1 2026. The platform is focused exclusively on physical trading cards, not other types of collectibles. Partnerships with Upper Deck suggest hockey cards may be added soon.

How much does it cost to tokenize a card?

You pay a grading fee ($15-$50, depending on the card and speed) plus a 1% vaulting fee. There’s also a 4% transaction fee when you buy or sell the NFT. All fees are paid in SOL or CARDS. The total cost is still far lower than eBay or auction houses, especially for high-value cards.

Is CARDS token listed on major exchanges?

CARDS is available on major Solana-based exchanges like Raydium and Orca, and is listed on CoinGecko and CoinMarketCap. It’s not yet on centralized giants like Binance or Coinbase, likely due to its regulatory gray zone. Trading volume is highest on decentralized platforms.

What happens if Collector Crypt shuts down?

Your NFTs and physical cards remain yours. The platform doesn’t hold your assets-it just manages the redemption system. If the company disappears, the NFTs still represent ownership of the vaulted cards. However, you’d lose access to the redemption interface, making it harder to claim your physical card. This is a known risk, and users are advised to keep backups of their NFT metadata and vault IDs.

- Poplular Tags

- Collector Crypt

- CARDS coin

- Solana NFT

- tokenized trading cards

- CARDS token

People Comments

This is actually kinda cool 😊 I never thought I'd see my old Pokémon cards turn into NFTs and still get the real thing back. Feels like magic.

YESSSSS!!! This is the future!!! No more eBay scams, no more overpaying for shipping, no more fake PSA 10s!!! CARDS is the ONLY platform that actually delivers on its promise!!! If you're still buying cards on eBay you're literally throwing money into a black hole!!!

i like how they cut fees down to 4% but honestly the token price is wild. i bought at 0.35 and now it's at 0.11... i think i lost my lunch money

If you're new to this, don't panic about the price swings. The real value is in the redemption. I staked my CARDS and got my 1999 Charizard in 5 days. That's the win. The token is just the key. 🙌

man i just sent my mint condition blue eyes white dragon to them last week. took 3 days to get graded, now its in the vault. waiting for the nft to mint. so excited. this is way better than keeping it in a shoebox under my bed

Solana is the only chain that makes sense for this. Ethereum gas fees would’ve killed this model. $0.00025 per trade? That’s not a feature - it’s a revolution. And the 400ms confirmations? Perfect for gacha pulls. I’ve flipped three packs in 12 minutes. No lag. No drama.

Let me guess - the SEC is gonna shut this down in 6 months. They HATE anything that lets regular people own real assets without Wall Street’s permission. They’ll call CARDS a security, demand audits, force them to burn the redemption feature… and then Goldman Sachs will launch ‘NFTs Lite’ with 20% fees and no physical backing. Classic.

This is a classic pump-and-dump disguised as innovation. They’ve got a 12.5% circulating supply, zero revenue model, and a token that’s basically a lottery ticket. The ‘redemption’ feature? A gimmick to make it look like utility. They’re not selling cards - they’re selling FOMO. Mark my words: when the unlocks hit, this token will crater to $0.02.

I’ve been collecting for 25 years. I’ve bought cards on eBay, at conventions, from shady dealers. I’ve been scammed twice. Collector Crypt is the first thing that actually gives me peace of mind. The grading partners are legit. The vault is insured. The NFT is a digital notarization. It’s not magic - it’s just good, old-fashioned trust, built on blockchain. I’m not investing in CARDS. I’m investing in my collection.

I love how this brings together two worlds - the nostalgic joy of physical cards and the efficiency of crypto. My 8-year-old got her first NFT card and asked if she could ‘trade it for a real one.’ I said yes. She’s now saving her allowance to buy a PSA 9 Pikachu. This isn’t just tech - it’s generational. 💫

Funny how people call this ‘trust infrastructure’ when the entire model relies on trusting a private company to not vanish with your $15k Charizard. What happens if the CEO gets kidnapped? Or the vault burns down? The NFT still exists - but the card? Gone. And now you’ve got a digital ghost. Cool tech. Risky bet.

The operational efficiency is undeniable. The fee structure is superior to traditional markets. However, the regulatory ambiguity presents a non-trivial existential risk. The SEC’s draft framework is not inconsequential. One misclassification could trigger systemic collapse. One must consider the probability-weighted outcome.

You guys are missing the point. This is just another crypto scam. Real collectors don’t need blockchain. Real collectors know how to grade cards themselves. You’re just giving your money to a company so they can make an NFT and charge you 4%. I’ve been collecting since 1996 and I never needed this. You’re all being played.

I don’t care about the token. I care about the card. I sent in my 1996 Holo Shadowless Charizard. Got it back in 7 days. Perfect condition. No scratches. No fakes. No drama. That’s all I needed to know.

The staking APY is nice, but I’m holding CARDS just to buy digital packs. The Gacha system is surprisingly fun. I got a PSA 8 Pikachu for $12. It’s not rare, but it’s mine. And I didn’t have to drive to a store or risk a fake. That’s worth more than any ROI.

You think this is revolutionary? Wait till you see the next phase - autographed memorabilia. Imagine owning an NFT that unlocks a signed Michael Jordan jersey. But you know what? They’ll never do it. Too many lawyers. Too many lawsuits. This is just the appetizer. The main course is coming… and it’s gonna be a bloodbath.

I bought CARDS at $0.45. I watched it drop to $0.12. I didn’t sell. I staked it. Now I’m earning 8% APY while waiting for the next unlock. I’m not here to flip. I’m here to collect. The token’s just the key to the vault. If you’re trading it like a meme coin, you’re already losing.

I’m not a crypto guy. I’m just a dad who wanted to share my childhood with my kids. I bought them each a digital card pack. They got a Pikachu and a Blue-Eyes. We redeemed them last week. Got the real cards in the mail. We framed them. Best $40 I’ve ever spent.

i tried it. sent my mtg foil dark ritual. took 10 days. fees were fine. got the nft. staked it. got rewards. now i just chill. no stress. no ebay drama. honestly? it just works.

I just redeemed my NFT and got my card. The box it came in had a little thank you note from the vault team. I cried. Not because it was expensive. Because someone cared enough to write a note. That’s the difference.

this is so last year. everyone’s doing rwa now. why is this even a thing? i mean seriously. the real innovation is when you can tokenize your grandma’s wedding ring and cash it out on chain. this is just pokemon for rich kids

I’ve got 12 CARDS NFTs. All backed by real cards. I’ve never sold one. I don’t care about the price. I care about the stories. That PSA 10 Charizard? I got it the week my mom passed. It’s the last thing I bought with her. That’s why I keep it. Not for profit. For memory.

So… you’re telling me I can now pay $50 to have my 2003 Magic card graded, then pay $2 to trade it, then pay $2 to redeem it… and somehow this is cheaper than eBay? I did the math. You’re still paying more than a dealer in a mall. But hey - at least your card has a blockchain certificate. That’s… something.

I read your comment about the fees being higher than a mall dealer. That’s true - if you’re selling a $20 card. But if you’re selling a $15,000 card? eBay takes $2,250. Collector Crypt takes $600. That’s a $1,650 savings. And you don’t have to wait 14 days for payment. Or risk a chargeback. Or deal with a buyer who claims it’s ‘not as described.’ This isn’t for casual sellers. It’s for serious collectors. And they’re saving tens of thousands.