It’s not a rumor. It’s not a scare tactic. If you’re hiding crypto gains from the IRS, you could go to jail for five years and pay a fine of up to $250,000. And it’s not just for millionaires. Even if you made $100 in profit from trading Bitcoin last year and didn’t report it, you’re breaking the law.

Why the IRS Treats Crypto Like Property

The IRS doesn’t treat Bitcoin, Ethereum, or Solana like cash. It treats them like stocks or real estate. That means every time you sell, trade, or spend crypto, you trigger a taxable event. If you bought 0.1 BTC for $3,000 and sold it later for $5,000? You made a $2,000 capital gain. That’s taxable income. If you mined 0.05 ETH and sold it for $150? That’s ordinary income. If you got paid in crypto for freelance work? That’s wages. All of it needs to be reported.There’s no minimum. No threshold. No "it’s too small to matter." The IRS says: all transactions must be reported. And since January 1, 2025, exchanges like Coinbase, Kraken, and Binance US are legally required to send you-and the IRS-a Form 1099-DA for every single trade, transfer, or staking reward. That means if you didn’t report it, they already did.

The Real Cost of Not Paying

The $250,000 fine is the criminal maximum. But that’s just the start. If you’re caught, you’ll also owe:- Back taxes on all unreported gains

- Interest that compounds daily since the original due date

- Failure-to-file penalty: 25% of what you owe

- Failure-to-pay penalty: another 25% of what you owe

- Combined penalties: up to 75% of your total tax debt

That’s not hypothetical. In 2024, the IRS collected $2.4 billion in crypto-related enforcement actions in the U.S. alone. About 15% of those cases were for tax evasion. One man in Texas got hit with a $187,000 penalty after failing to report $92,000 in crypto gains from 2019 to 2022. He didn’t go to jail-but he lost his savings, his home equity, and his credit score.

How the IRS Finds You

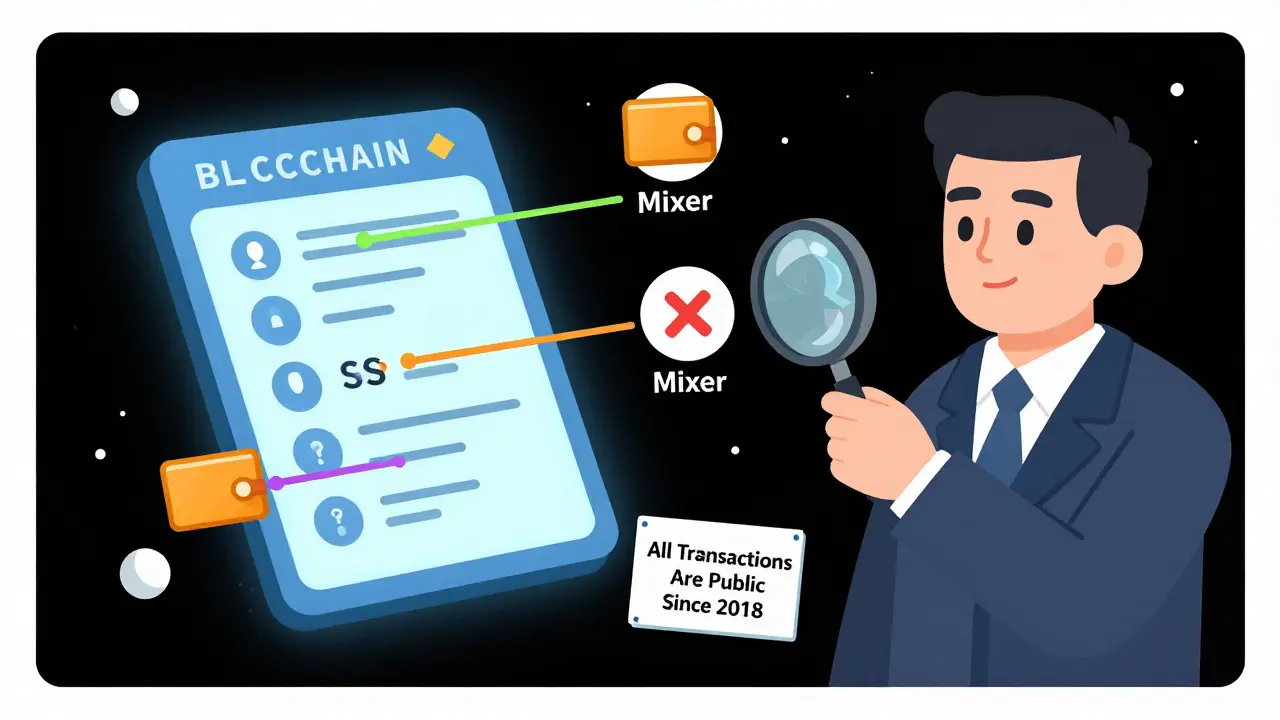

You might think you’re safe if you use a non-U.S. exchange or send crypto to a personal wallet. Think again.The IRS doesn’t need your password. They don’t need your phone. They just need blockchain data. Every Bitcoin transaction is permanently recorded on a public ledger. Every Ethereum transfer leaves a trace. The IRS uses tools like Chainalysis and Elliptic to track wallets across years. They can see:

- Which wallet sent you 0.5 ETH in 2021

- Which exchange you cashed out to in 2023

- Which bank account received the USD

They’ve been doing this since 2018. That means if you didn’t report crypto from 2020, 2021, or 2022, they still have the data. And with the new Form 1099-DA, they now have a direct line to your transaction history. No more hiding.

What’s Legal vs. What’s Illegal

There’s a big difference between avoiding taxes and evasing them.Legal tax avoidance: Holding crypto for over a year to get the lower long-term capital gains rate. Using tax-loss harvesting to offset gains with losses. Putting crypto into a Roth IRA. Donating crypto to charity for a tax deduction. These are all smart, legal moves.

Criminal tax evasion: Lying on your tax return. Not reporting a single trade. Faking records. Using a mixer to hide transactions. Transferring funds to offshore wallets to avoid detection. These are felonies. And yes-even if you only made $500 in profit.

The IRS doesn’t care how much you made. They care if you intentionally hid it. And intent is easy to prove when the records are public.

What You Should Do Right Now

If you’ve ever traded, mined, or received crypto and didn’t report it, here’s what to do:- Stop waiting. The window for quiet compliance is closing. The IRS has more data than ever.

- Get your records. Use tools like Koinly, CryptoTax, or CoinLedger to import all your wallet addresses and exchanges. These tools calculate your cost basis and gains automatically.

- File amended returns. If you missed reporting crypto for 2021, 2022, or 2023, file Form 1040-X. You’ll owe taxes, interest, and maybe a penalty-but you’ll avoid criminal charges.

- Keep better records going forward. Track every transaction: buys, sells, trades, staking rewards, airdrops, and even transfers between your own wallets. The 2025 rules require wallet-by-wallet accounting.

One investor in Florida filed amended returns for 2020-2023 after getting an IRS notice. He owed $12,000 in taxes but paid only $1,800 in penalties because he came forward voluntarily. The alternative? A criminal investigation, possible jail time, and a $250,000 fine.

What’s Next?

The IRS isn’t slowing down. In 2025, they hired over 1,200 new agents trained in blockchain forensics. They’re partnering with foreign tax agencies to share data. They’re scanning DeFi protocols, NFT marketplaces, and even crypto ATMs.And if you think political changes will help? Don’t count on it. Even if future administrations soften other crypto rules, tax enforcement is bipartisan. Both Democrats and Republicans agree: crypto isn’t a tax loophole. It’s a taxable asset.

The message is clear: report everything. Pay what you owe. Keep records. Or risk losing far more than just your crypto.

Can the IRS track crypto I sent to a non-U.S. exchange?

Yes. Even if you used a foreign exchange like Binance or Bybit, the IRS can still trace your transactions. If you ever cashed out to a U.S. bank account, linked your wallet to a U.S.-based service, or used a U.S. IP address, they have enough data to identify you. The blockchain doesn’t care about borders.

Do I have to report crypto I didn’t sell?

You only owe taxes on gains. But you still have to report transactions that trigger taxable events: trading one crypto for another, spending crypto for goods or services, or receiving crypto as payment. If you just held crypto and didn’t move it, you don’t owe taxes-but you still need to answer "yes" on Schedule 1 of your tax form if you had any transactions.

What happens if I accidentally forget to report crypto?

If it’s truly an honest mistake-like forgetting a small trade-the IRS will usually just send you a notice asking for the missing info. You’ll pay the tax plus interest and a small penalty. But if they see a pattern-multiple years, large amounts, wallet transfers to avoid tracking-they’ll treat it as intentional evasion, which can lead to criminal charges.

Can I go to jail for not reporting $500 in crypto gains?

Technically, yes. The law doesn’t set a minimum amount. But in practice, the IRS prioritizes cases involving $10,000+ in unreported gains. Still, even small cases can escalate if you ignore notices, lie on forms, or try to hide assets. The risk isn’t just about the money-it’s about intent.

Is using crypto tax software enough to stay compliant?

It’s a huge help, but not a guarantee. Software like Koinly or CoinTracker can calculate your gains, but it only works if you import all your wallets and exchanges. If you forget one wallet or don’t connect your DeFi interactions, you’ll still underreport. Always double-check your data. And never assume the software makes you immune to audits.